Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Stud 1. Interest on a A when the nu B. as of the enc C. when princips O. when the inten magazine publis ses

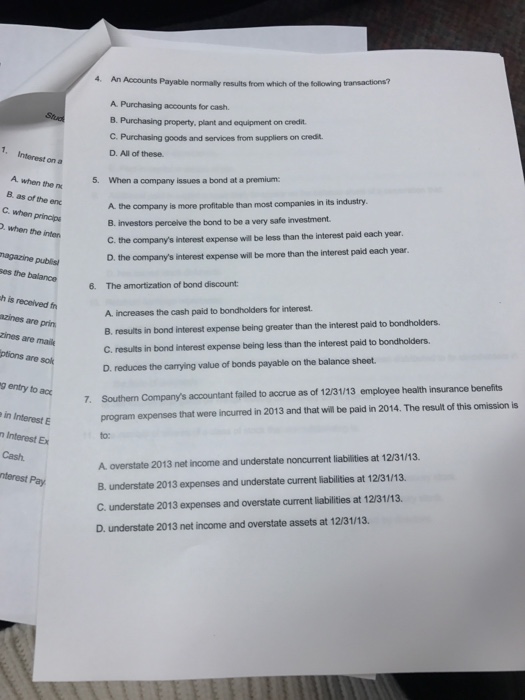

Stud 1. Interest on a A when the nu B. as of the enc C. when princips O. when the inten magazine publis ses the balance ch is received fr azines are prin zines are maik ptions are sok ng entry to act ein Interest E n Interest Ex Cash. interest Pay 4. An Accounts Payable normally results from which of the following transactions? A. Purchasing accounts for cash. B. Purchasing property, plant and equipment on credit. C. Purchasing goods and services from suppliers on credit. D. All of these. 5. When a company issues a bond at a premium: A. the company is more profitable than most companies in its industry. B. investors perceive the bond to be a very safe investment. C. the company's interest expense will be less than the interest paid each year. D. the company's interest expense will be more than the interest paid each year. 6. The amortization of bond discount: A. increases the cash paid to bondholders for interest. B. results in bond interest expense being greater than the interest paid to bondholders. C. results in bond interest expense being less than the interest paid to bondholders. D. reduces the carrying value of bonds payable on the balance sheet. 7. Southern Company's accountant failed to accrue as of 12/31/13 employee health insurance benefits program expenses that were incurred in 2013 and that will be paid in 2014. The result of this omission is 11. to: A overstate 2013 net income and understate noncurrent liabilities at 12/31/13. B. understate 2013 expenses and understate current liabilities at 12/31/13. C. understate 2013 expenses and overstate current liabilities at 12/31/13. D. understate 2013 net income and overstate assets at 12/31/13.

Step by Step Solution

★★★★★

3.52 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

QUESTION 4 an accounts payable normally results from which of the following transactions C Purchasin...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started