Student ID is 505

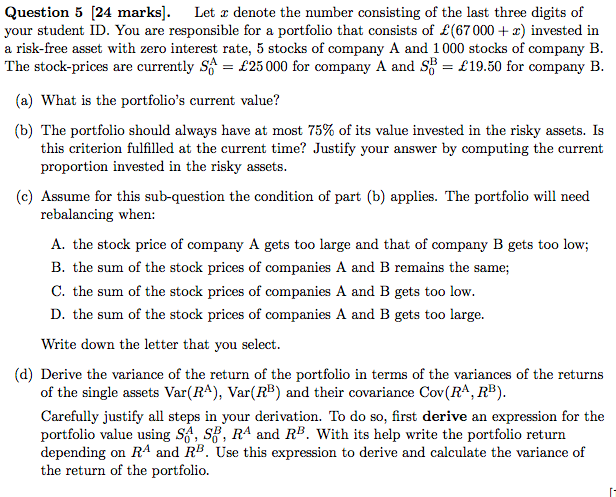

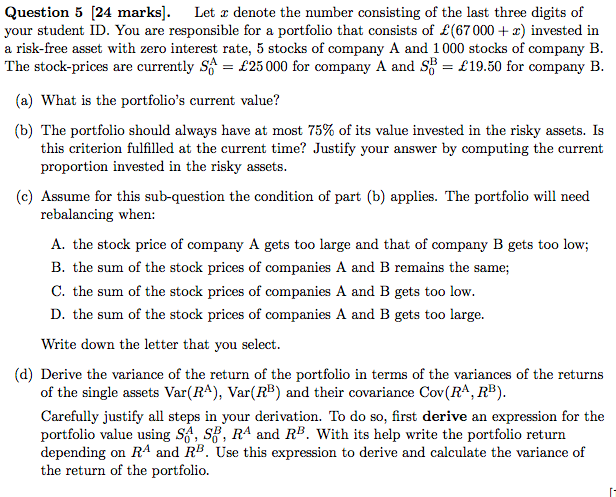

Question 5 (24 marks). Let x denote the number consisting of the last three digits of your student ID. You are responsible for a portfolio that consists of (67000 + 2) invested in a risk-free asset with zero interest rate, 5 stocks of company A and 1000 stocks of company B. The stock-prices are currently SA = 25 000 for company A and S = 19.50 for company B. (a) What is the portfolio's current value? (b) The portfolio should always have at most 75% of its value invested in the risky assets. Is this criterion fulfilled at the current time? Justify your answer by computing the current proportion invested in the risky assets. (C) Assume for this sub-question the condition of part (b) applies. The portfolio will need rebalancing when: A. the stock price of company A gets too large and that of company B gets too low; B. the sum of the stock prices of companies A and B remains the same; C. the sum of the stock prices of companies A and B gets too low. D. the sum of the stock prices of companies A and B gets too large. Write down the letter that you select. (d) Derive the variance of the return of the portfolio in terms of the variances of the returns of the single assets Var(R4), Var(RB) and their covariance Cov(RA, RB). Carefully justify all steps in your derivation. To do so, first derive an expression for the portfolio value using SA, S, R4 and R. With its help write the portfolio return depending on R4 and RB. Use this expression to derive and calculate the variance of the return of the portfolio. Question 5 (24 marks). Let x denote the number consisting of the last three digits of your student ID. You are responsible for a portfolio that consists of (67000 + 2) invested in a risk-free asset with zero interest rate, 5 stocks of company A and 1000 stocks of company B. The stock-prices are currently SA = 25 000 for company A and S = 19.50 for company B. (a) What is the portfolio's current value? (b) The portfolio should always have at most 75% of its value invested in the risky assets. Is this criterion fulfilled at the current time? Justify your answer by computing the current proportion invested in the risky assets. (C) Assume for this sub-question the condition of part (b) applies. The portfolio will need rebalancing when: A. the stock price of company A gets too large and that of company B gets too low; B. the sum of the stock prices of companies A and B remains the same; C. the sum of the stock prices of companies A and B gets too low. D. the sum of the stock prices of companies A and B gets too large. Write down the letter that you select. (d) Derive the variance of the return of the portfolio in terms of the variances of the returns of the single assets Var(R4), Var(RB) and their covariance Cov(RA, RB). Carefully justify all steps in your derivation. To do so, first derive an expression for the portfolio value using SA, S, R4 and R. With its help write the portfolio return depending on R4 and RB. Use this expression to derive and calculate the variance of the return of the portfolio