Answered step by step

Verified Expert Solution

Question

1 Approved Answer

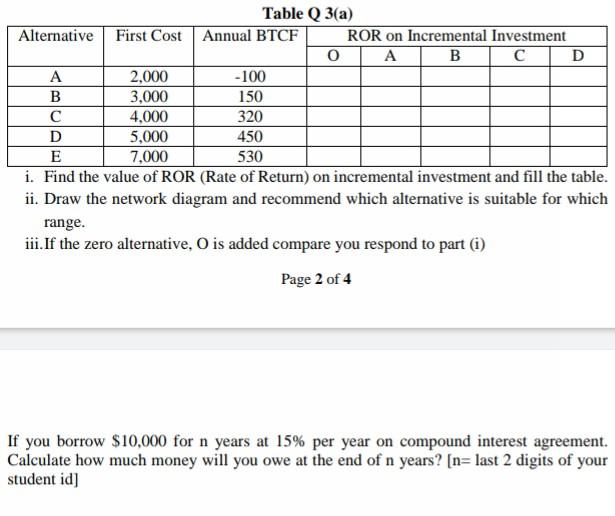

Student ID:190208120 Table Q 3(a) Alternative First Cost Annual BTCF ROR on Incremental Investment B D A 2,000 -100 B 3,000 150 4,000 320 D

Student ID:190208120

Table Q 3(a) Alternative First Cost Annual BTCF ROR on Incremental Investment B D A 2,000 -100 B 3,000 150 4,000 320 D 5,000 450 E 7,000 530 i. Find the value of ROR (Rate of Return) on incremental investment and fill the table. ii. Draw the network diagram and recommend which alternative is suitable for which range. iii. If the zero alternative, O is added compare you respond to part (i) Page 2 of 4 If you borrow $10,000 for n years at 15% per year on compound interest agreement. Calculate how much money will you owe at the end of n years? (n= last 2 digits of your student id] Table Q 3(a) Alternative First Cost Annual BTCF ROR on Incremental Investment B D A 2,000 -100 B 3,000 150 4,000 320 D 5,000 450 E 7,000 530 i. Find the value of ROR (Rate of Return) on incremental investment and fill the table. ii. Draw the network diagram and recommend which alternative is suitable for which range. iii. If the zero alternative, O is added compare you respond to part (i) Page 2 of 4 If you borrow $10,000 for n years at 15% per year on compound interest agreement. Calculate how much money will you owe at the end of n years? (n= last 2 digits of your student id]Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started