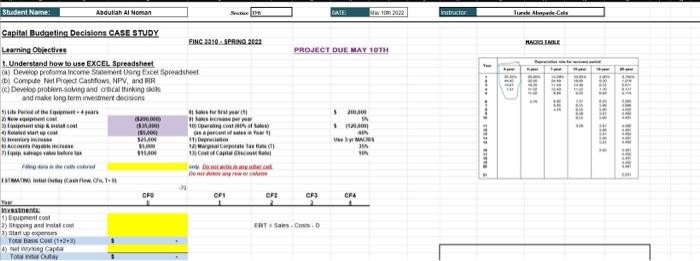

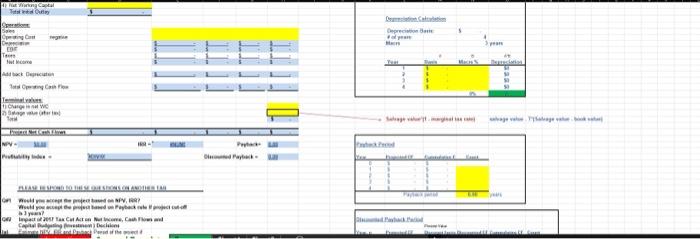

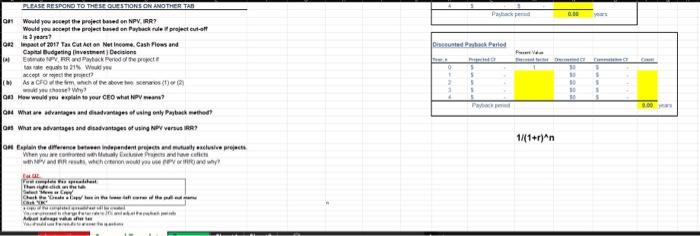

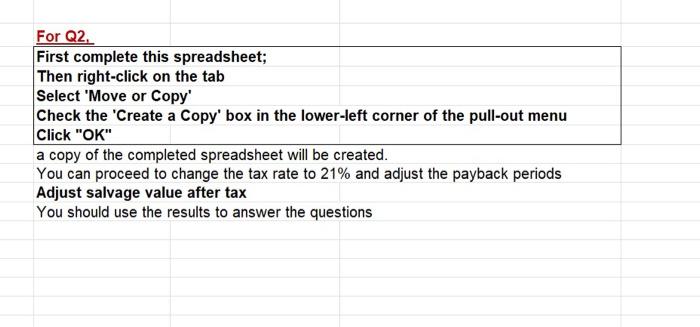

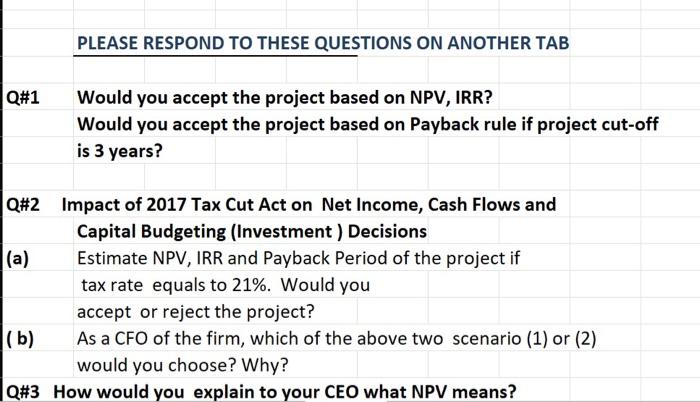

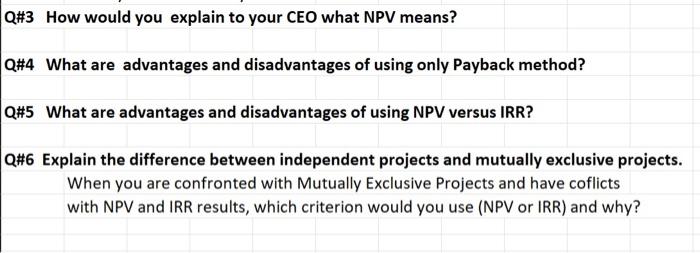

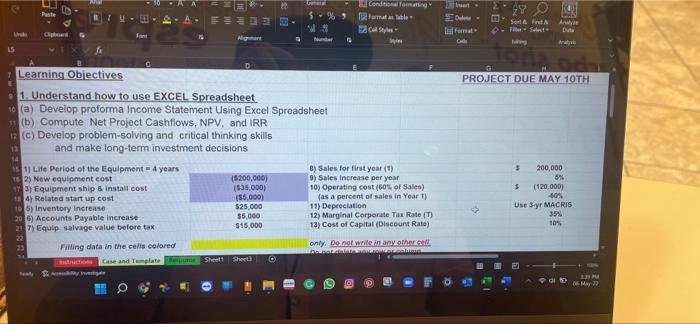

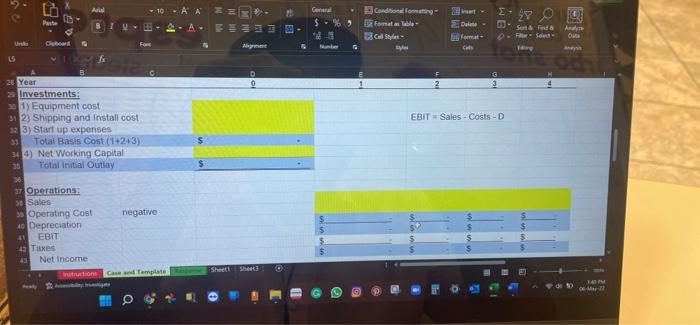

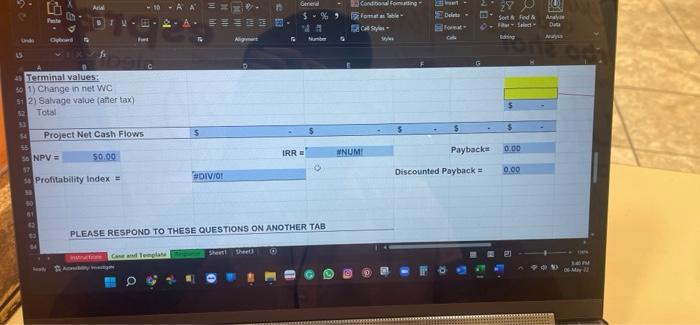

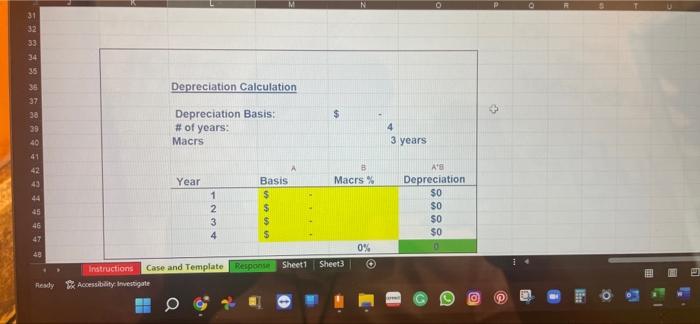

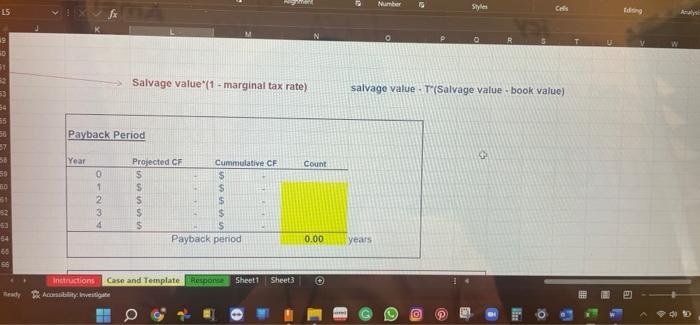

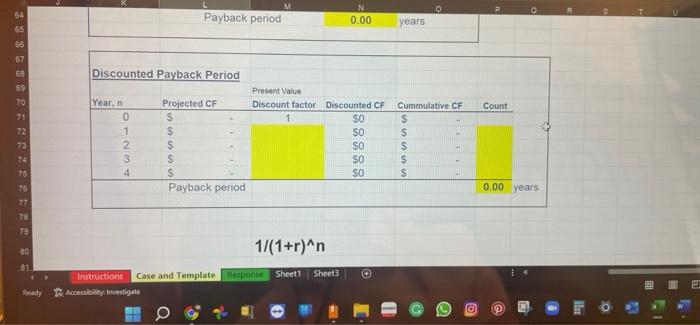

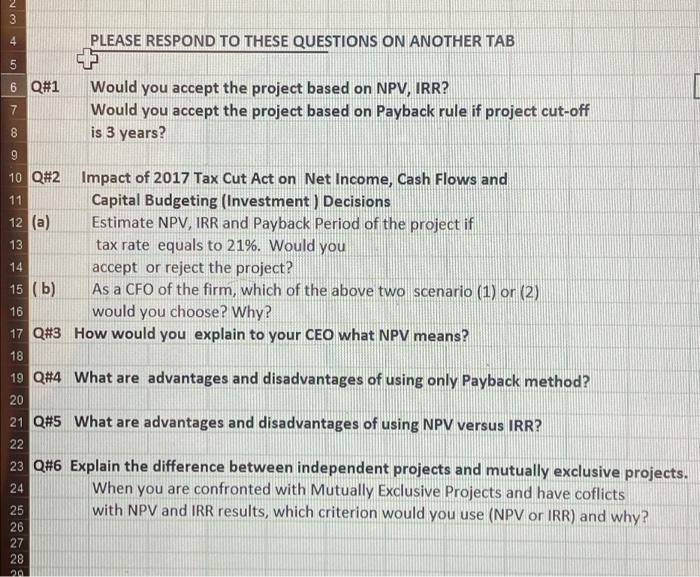

Student Name: Andullah Al Noman STE CATE Max 10222 HWORDS ARE PROJECT DUE MAY 10TH ili Capital Budgeting Decisions CASE STUDY FINC2350 - SPRING 2022 Learning Objectives 1. Understand how to use EXCEL Spreadsheet A) Derio pronta Incore Seering Ech Spreadsheet Computer Prorect Cashflows, NPV, and IRR (c) Develop problem solving and ortical thinking and make long term weer decisions of the pare for Wow 2 10 Boneco I. as per 1 10 re . Cette never ... lon - CFO CF1 OFE # 18 # 2011 40 WARS SI CF3 CF4 1 ENT.CD Instea incos 3) con 2) arte per ToBasis (2 Networking Cat Totuta Cat Depreciation Cm Tous Tout com A back Com VIC NH WC on my regter V. e delle ya 20 Tax Cutite me, Cal CA melon 0.00 yo Pic Ve PLEASE RESPOND TO THE QUESTIONS ON ANOTHER TAB om Would you rept the project based on NPV IRRY Would you accept the project bited on Payback rute project et of is or act of 2017 To Cut Act on Net Income. Cash Flows and Capital Budgering investment Decisions DAI EPVR Pocket taxes Www seceptor rohet (*Asacro temach of the above wyt Oh How would you explain to your own lem? OM What are tages and disadvantages of wing only Pythof Out What are avantages and disadvantages of using NP Versus RR? 0 S 3 1 + PRVO 1/(1+r)^n on plain the difference between independent and fully sive project When you are not have Ni wachorro Pvc wy! Vest Then the Chartered For Q2. First complete this spreadsheet; Then right-click on the tab Select "Move or Copy Check the 'Create a Copy' box in the lower-left corner of the pull-out menu Click "OK" a copy of the completed spreadsheet will be created. You can proceed to change the tax rate to 21% and adjust the payback periods Adjust salvage value after tax You should use the results to answer the questions PLEASE RESPOND TO THESE QUESTIONS ON ANOTHER TAB Q#1 Would you accept the project based on NPV, IRR? Would you accept the project based on Payback rule if project cut-off is 3 years? Q#2 Impact of 2017 Tax Cut Act on Net Income, Cash Flows and Capital Budgeting (Investment ) Decisions (a) Estimate NPV, IRR and Payback period of the project if tax rate equals to 21%. Would you accept or reject the project? (b) As a CFO of the firm, which of the above two scenario (1) or (2) would you choose? Why? Q#3 How would you explain to your CEO what NPV means? Q#3 How would you explain to your CEO what NPV means? Q#4 What are advantages and disadvantages of using only Payback method? Q#5 What are advantages and disadvantages of using NPV versus IRR? Q#6 Explain the difference between independent projects and mutually exclusive projects. When you are confronted with Mutually Exclusive Projects and have coflicts with NPV and IRR results, which criterion would you use (NPV or IRR) and why? Paste 29 A- mable Soft El Fort Ary Date Ali Nu raini Learning Objectives PROJECT DUE MAY 10TH 1. Understand how to use EXCEL Spreadsheet 10 (a) Develop proforma Income Statement Using Excel Spreadsheet (b) Compute Net Project Cashflows, NPV, and IRR 2 (c) Develop problem-solving and critical thinking skills 13 and make long-term investment decisions 14 1) Life Period of the Equipment = 4 years B) Sales for first year (1) 152) New equipment cost (5200,000) 9) Sales Increase per year 175) Equipment ship & Install cost (635,000) 10) Operating cost (60% of Sales) 14) Related start up cost (55.0001 (as a percent of sales in Yeart) 105) Inventory Increase $25,000 11) Depreciation 206) Accounts Payable increase $5,000 12) Marginal Corporate Tax Rate (T) 217) Equip salvage value before tax $15.000 13) Cost of Capital (Discount Rate) Filing data in the cells colored only. Do not write in any other Am Case and Template e Shell Sheet 5 200,000 6% $ [120.000) 105 Use 3-yr MACRIS 35 10% O EL poo 06 23 10AA Ger Conditional formating Format : Table 0 Paste BI $ 2 De 28 Sunt inds FS Hir Andy OM Gabor Format Cuis Aby 0 EBIT Sales - Costs -D $ 26 Year 25 Investments 301) Equipment cost 312) Shipping and Install cost 323) Start up expenses Total Basis Cost (1+2+3) 344) Net Working Capital 35 Total initial Outlay 30 ST Operations 30 Sales 30 Operating Cost negative 10 Depreciation 41 EBIT 43 Taxes Net income rutrum Sheet Case Template Map 10 - AA 3 A. Grer % 9 Condition forming lomasole Caps zal Dets To Sort Bed & Pete Any i Sed IN Und D Terminal values 501) Change in net WC 512) Salvage value (after tax) 2 Total $ $ Project Net Cash Flows 55 56 NPV 50.00 IRRE UNUMI Payback 0.00 Discounted Payback 0.00 sa Profitability Index = #DIVIO! PLEASE RESPOND TO THESE QUESTIONS ON ANOTHER TAB Sheet The Candle SA Cell Styles Style Format Celle Sort & Find -- Select ding 0 63 67 Undo Clipboard Font Alignment Mambo L5 fx B C D PLEASE RESPOND TO THESE QUESTIONS ON ANOTHER TAB 64 65 #1 Would you accept the project based on NPV, IRR? 66 Would you accept the project based on Payback rule if project cut-off is 3 years? 50 Q82 Impact of 2017 Tax Cut Act on Net Income, Cash Flows and GO Capital Budgeting (Investment ) Decisions 70 (a) Estimate NPV, IRR and Payback period of the project if 71 tax rate equals to 21% Would you 172 accept or reject the project? 75 (b) As a CFO of the firm, which of the above two scenarios (1) or (2) 74 would you choose? Why? 7 Q#3 How would you explain to your CEO what NPV means? 78 77 014 What are advantages and disadvantages of using only Payback method? Ta 79 #15 What are advantages and disadvantages of using NPV versus IRR? 80 Instructions Case and Template point Sheet1 Sheet The Accesy vite Ready PROJECT -Capital Budgeting-FINC 3310 SPRING 2022(1) - p Search Ahad w Page Layout Formulas Data Review View Help w 10 - A A = TU General $ - % 98 Number Fon G Alignment M N O Year 20 33.33% 44 45 1481 741 Depreciation rate for rewry period 5-year 10 year 20.00 14.20 10.00 5.00% 30.00 2440 18.00 0.50 10.30 17:40 14.40 2.55 1152 1240 11.52 7.70 115 R. 0.22 6.00 3.750 7.210 6.67 0170 5 5. 8.32 2.05 4.40 737 8.55 6.55 650 55 pyonano 0.22 5.00 5.00 5:01 5.00 5205 4 3.622 440 4.461 3.28 501 5.00 5.01 5.90 591 48 4 4.400 4401 4400 10 2.05 4400 4401 4182 4401 20 23 2.294 Ease and Template Response Sheet1 Sheet3 | IC % 0 P 31 -32 33 34 35 Depreciation Calculation 35 37 38 $ 33 Depreciation Basis: # of years: Macrs 40 3 years 41 42 43 44 B Macrs % Year 1 2 3 4 Basis $ $ $ As Depreciation SO SO SO $0 46 47 0% Sheet1 Sheet3 instructions Case and Template Response Accessibility Investigate Ready O 3 Number 15 Styles Celes 19 O R u V W Salvage value 1 - marginal tax rate) salvage value. T'Salvage value-book value) 53 Year Count 50 Payback Period 57 Projected CF Cummulative CF S S 60 1 s $ 2 $ $ 3 S $ 53 4 S S Payback period 85 SS Instructions Case and Template Response Sheet1 Sheet3 Readly Aconsibility Investigate 0.00 years @ a M o Payback period N 0.00 years 64 65 66 Discounted Payback Period Year. n 0 Cummulative CF 68 69 70 71 72 73 74 Count ON- Present Value Discount factor Discounted CF SO $0 $0 $0 SO Projected CF S $ S S $ Payback period SU U U 2 3 4 75 0.00 years 76 77 78 79 1/(1+r)^n 30 31 Sheet1 Sheet3 Instructions Case and Template Response Accessibility: Investigate Ready o WN 3 4 5 6 Q#1 PLEASE RESPOND TO THESE QUESTIONS ON ANOTHER TAB + Would you accept the project based on NPV, IRR? Would you accept the project based on Payback rule if project cut-off is 3 years? 7 8 9 10 Q#2 Impact of 2017 Tax Cut Act on Net Income, Cash Flows and 11 Capital Budgeting (Investment ) Decisions 12 (a) Estimate NPV, IRR and Payback Period of the project if 13 tax rate equals to 21%. Would you accept or reject the project? 15 (6) As a CFO of the firm, which of the above two scenario (1) or (2) 16 would you choose? Why? 17 Q#3 How would you explain to your CEO what NPV means? 14 18 19 Q#4 What are advantages and disadvantages of using only Payback method? 20 21 Q#5 What are advantages and disadvantages of using NPV versus IRR? 22 23 Q#6 Explain the difference between independent projects and mutually exclusive projects. When you are confronted with Mutually Exclusive Projects and have coflicts 25 with NPV and IRR results, which criterion would you use (NPV or IRR) and why? 26 27 24 28 Student Name: Andullah Al Noman STE CATE Max 10222 HWORDS ARE PROJECT DUE MAY 10TH ili Capital Budgeting Decisions CASE STUDY FINC2350 - SPRING 2022 Learning Objectives 1. Understand how to use EXCEL Spreadsheet A) Derio pronta Incore Seering Ech Spreadsheet Computer Prorect Cashflows, NPV, and IRR (c) Develop problem solving and ortical thinking and make long term weer decisions of the pare for Wow 2 10 Boneco I. as per 1 10 re . Cette never ... lon - CFO CF1 OFE # 18 # 2011 40 WARS SI CF3 CF4 1 ENT.CD Instea incos 3) con 2) arte per ToBasis (2 Networking Cat Totuta Cat Depreciation Cm Tous Tout com A back Com VIC NH WC on my regter V. e delle ya 20 Tax Cutite me, Cal CA melon 0.00 yo Pic Ve PLEASE RESPOND TO THE QUESTIONS ON ANOTHER TAB om Would you rept the project based on NPV IRRY Would you accept the project bited on Payback rute project et of is or act of 2017 To Cut Act on Net Income. Cash Flows and Capital Budgering investment Decisions DAI EPVR Pocket taxes Www seceptor rohet (*Asacro temach of the above wyt Oh How would you explain to your own lem? OM What are tages and disadvantages of wing only Pythof Out What are avantages and disadvantages of using NP Versus RR? 0 S 3 1 + PRVO 1/(1+r)^n on plain the difference between independent and fully sive project When you are not have Ni wachorro Pvc wy! Vest Then the Chartered For Q2. First complete this spreadsheet; Then right-click on the tab Select "Move or Copy Check the 'Create a Copy' box in the lower-left corner of the pull-out menu Click "OK" a copy of the completed spreadsheet will be created. You can proceed to change the tax rate to 21% and adjust the payback periods Adjust salvage value after tax You should use the results to answer the questions PLEASE RESPOND TO THESE QUESTIONS ON ANOTHER TAB Q#1 Would you accept the project based on NPV, IRR? Would you accept the project based on Payback rule if project cut-off is 3 years? Q#2 Impact of 2017 Tax Cut Act on Net Income, Cash Flows and Capital Budgeting (Investment ) Decisions (a) Estimate NPV, IRR and Payback period of the project if tax rate equals to 21%. Would you accept or reject the project? (b) As a CFO of the firm, which of the above two scenario (1) or (2) would you choose? Why? Q#3 How would you explain to your CEO what NPV means? Q#3 How would you explain to your CEO what NPV means? Q#4 What are advantages and disadvantages of using only Payback method? Q#5 What are advantages and disadvantages of using NPV versus IRR? Q#6 Explain the difference between independent projects and mutually exclusive projects. When you are confronted with Mutually Exclusive Projects and have coflicts with NPV and IRR results, which criterion would you use (NPV or IRR) and why? Paste 29 A- mable Soft El Fort Ary Date Ali Nu raini Learning Objectives PROJECT DUE MAY 10TH 1. Understand how to use EXCEL Spreadsheet 10 (a) Develop proforma Income Statement Using Excel Spreadsheet (b) Compute Net Project Cashflows, NPV, and IRR 2 (c) Develop problem-solving and critical thinking skills 13 and make long-term investment decisions 14 1) Life Period of the Equipment = 4 years B) Sales for first year (1) 152) New equipment cost (5200,000) 9) Sales Increase per year 175) Equipment ship & Install cost (635,000) 10) Operating cost (60% of Sales) 14) Related start up cost (55.0001 (as a percent of sales in Yeart) 105) Inventory Increase $25,000 11) Depreciation 206) Accounts Payable increase $5,000 12) Marginal Corporate Tax Rate (T) 217) Equip salvage value before tax $15.000 13) Cost of Capital (Discount Rate) Filing data in the cells colored only. Do not write in any other Am Case and Template e Shell Sheet 5 200,000 6% $ [120.000) 105 Use 3-yr MACRIS 35 10% O EL poo 06 23 10AA Ger Conditional formating Format : Table 0 Paste BI $ 2 De 28 Sunt inds FS Hir Andy OM Gabor Format Cuis Aby 0 EBIT Sales - Costs -D $ 26 Year 25 Investments 301) Equipment cost 312) Shipping and Install cost 323) Start up expenses Total Basis Cost (1+2+3) 344) Net Working Capital 35 Total initial Outlay 30 ST Operations 30 Sales 30 Operating Cost negative 10 Depreciation 41 EBIT 43 Taxes Net income rutrum Sheet Case Template Map 10 - AA 3 A. Grer % 9 Condition forming lomasole Caps zal Dets To Sort Bed & Pete Any i Sed IN Und D Terminal values 501) Change in net WC 512) Salvage value (after tax) 2 Total $ $ Project Net Cash Flows 55 56 NPV 50.00 IRRE UNUMI Payback 0.00 Discounted Payback 0.00 sa Profitability Index = #DIVIO! PLEASE RESPOND TO THESE QUESTIONS ON ANOTHER TAB Sheet The Candle SA Cell Styles Style Format Celle Sort & Find -- Select ding 0 63 67 Undo Clipboard Font Alignment Mambo L5 fx B C D PLEASE RESPOND TO THESE QUESTIONS ON ANOTHER TAB 64 65 #1 Would you accept the project based on NPV, IRR? 66 Would you accept the project based on Payback rule if project cut-off is 3 years? 50 Q82 Impact of 2017 Tax Cut Act on Net Income, Cash Flows and GO Capital Budgeting (Investment ) Decisions 70 (a) Estimate NPV, IRR and Payback period of the project if 71 tax rate equals to 21% Would you 172 accept or reject the project? 75 (b) As a CFO of the firm, which of the above two scenarios (1) or (2) 74 would you choose? Why? 7 Q#3 How would you explain to your CEO what NPV means? 78 77 014 What are advantages and disadvantages of using only Payback method? Ta 79 #15 What are advantages and disadvantages of using NPV versus IRR? 80 Instructions Case and Template point Sheet1 Sheet The Accesy vite Ready PROJECT -Capital Budgeting-FINC 3310 SPRING 2022(1) - p Search Ahad w Page Layout Formulas Data Review View Help w 10 - A A = TU General $ - % 98 Number Fon G Alignment M N O Year 20 33.33% 44 45 1481 741 Depreciation rate for rewry period 5-year 10 year 20.00 14.20 10.00 5.00% 30.00 2440 18.00 0.50 10.30 17:40 14.40 2.55 1152 1240 11.52 7.70 115 R. 0.22 6.00 3.750 7.210 6.67 0170 5 5. 8.32 2.05 4.40 737 8.55 6.55 650 55 pyonano 0.22 5.00 5.00 5:01 5.00 5205 4 3.622 440 4.461 3.28 501 5.00 5.01 5.90 591 48 4 4.400 4401 4400 10 2.05 4400 4401 4182 4401 20 23 2.294 Ease and Template Response Sheet1 Sheet3 | IC % 0 P 31 -32 33 34 35 Depreciation Calculation 35 37 38 $ 33 Depreciation Basis: # of years: Macrs 40 3 years 41 42 43 44 B Macrs % Year 1 2 3 4 Basis $ $ $ As Depreciation SO SO SO $0 46 47 0% Sheet1 Sheet3 instructions Case and Template Response Accessibility Investigate Ready O 3 Number 15 Styles Celes 19 O R u V W Salvage value 1 - marginal tax rate) salvage value. T'Salvage value-book value) 53 Year Count 50 Payback Period 57 Projected CF Cummulative CF S S 60 1 s $ 2 $ $ 3 S $ 53 4 S S Payback period 85 SS Instructions Case and Template Response Sheet1 Sheet3 Readly Aconsibility Investigate 0.00 years @ a M o Payback period N 0.00 years 64 65 66 Discounted Payback Period Year. n 0 Cummulative CF 68 69 70 71 72 73 74 Count ON- Present Value Discount factor Discounted CF SO $0 $0 $0 SO Projected CF S $ S S $ Payback period SU U U 2 3 4 75 0.00 years 76 77 78 79 1/(1+r)^n 30 31 Sheet1 Sheet3 Instructions Case and Template Response Accessibility: Investigate Ready o WN 3 4 5 6 Q#1 PLEASE RESPOND TO THESE QUESTIONS ON ANOTHER TAB + Would you accept the project based on NPV, IRR? Would you accept the project based on Payback rule if project cut-off is 3 years? 7 8 9 10 Q#2 Impact of 2017 Tax Cut Act on Net Income, Cash Flows and 11 Capital Budgeting (Investment ) Decisions 12 (a) Estimate NPV, IRR and Payback Period of the project if 13 tax rate equals to 21%. Would you accept or reject the project? 15 (6) As a CFO of the firm, which of the above two scenario (1) or (2) 16 would you choose? Why? 17 Q#3 How would you explain to your CEO what NPV means? 14 18 19 Q#4 What are advantages and disadvantages of using only Payback method? 20 21 Q#5 What are advantages and disadvantages of using NPV versus IRR? 22 23 Q#6 Explain the difference between independent projects and mutually exclusive projects. When you are confronted with Mutually Exclusive Projects and have coflicts 25 with NPV and IRR results, which criterion would you use (NPV or IRR) and why? 26 27 24 28