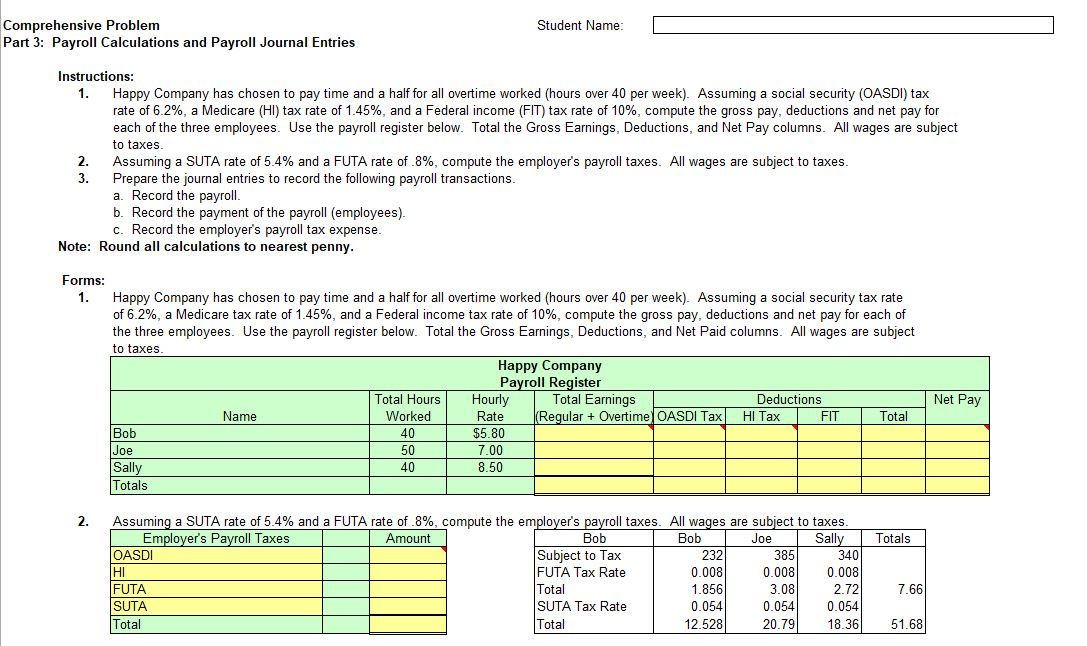

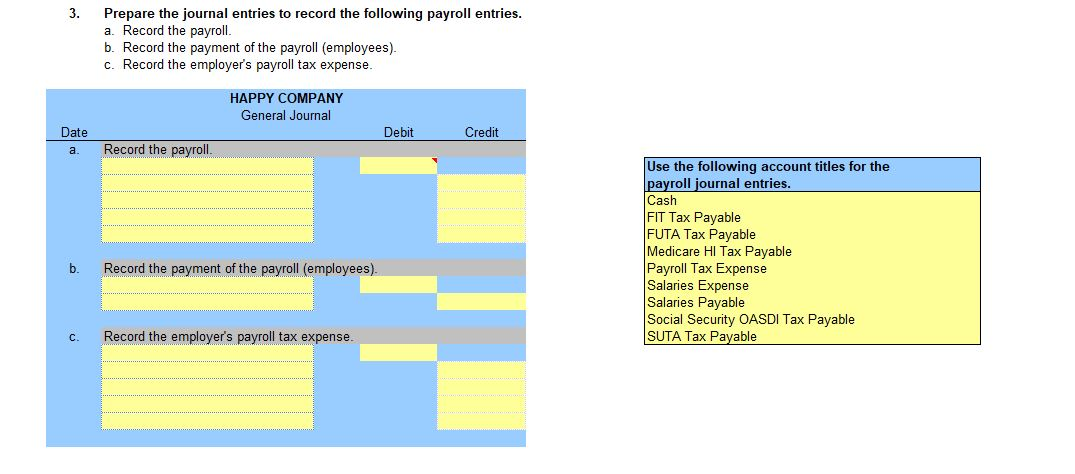

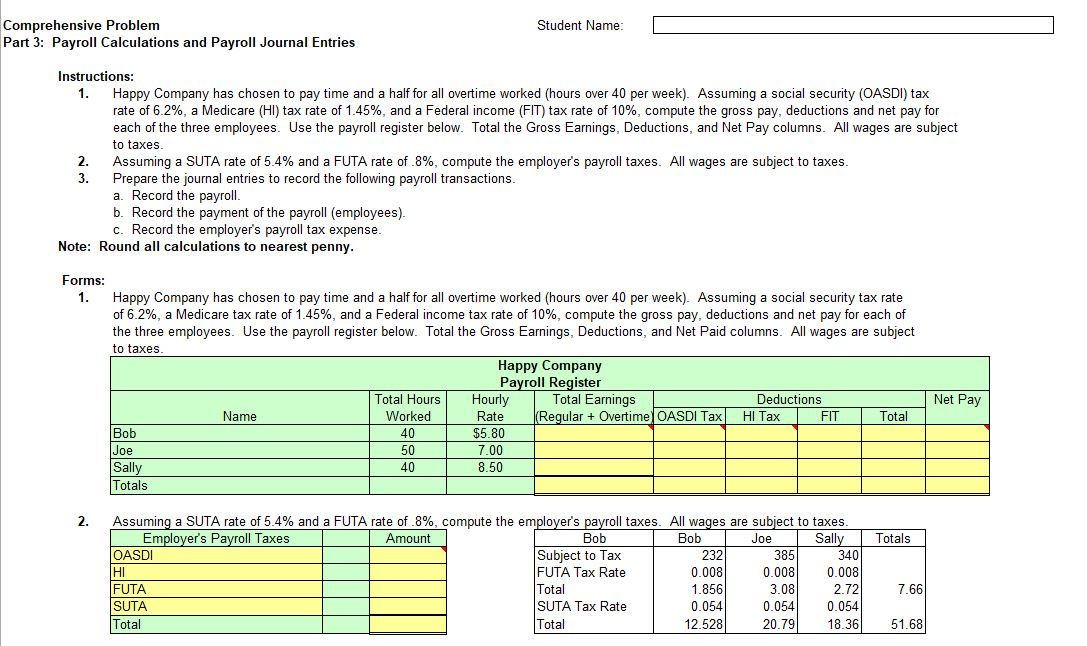

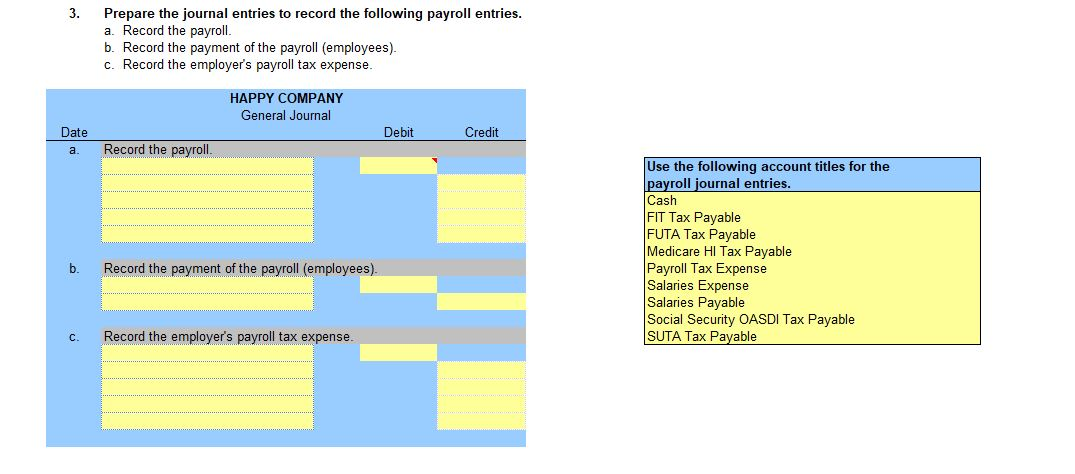

Student Name: Comprehensive Problem Part 3: Payroll Calculations and Payroll Journal Entries Instructions: 1. Happy Company has chosen to pay time and a half for all overtime worked (hours over 40 per week). Assuming a social security (OASDI) tax rate of 6.2%, a Medicare (HI) tax rate of 1.45%, and a Federal income (FIT) tax rate of 10%, compute the gross pay, deductions and net pay for each of the three employees. Use the payroll register below. Total the Gross Earnings, Deductions, and Net Pay columns. All wages are subject to taxes. Assuming a SUTA rate of 5.4% and a FUTA rate of 8%, compute the employer's payroll taxes. All wages are subject to taxes. Prepare the journal entries to record the following payroll transactions. a. Record the payroll. b. Record the payment of the payroll (employees). c. Record the employer's payroll tax expense. Note: Round all calculations to nearest penny. Forms: 1. Happy Company has chosen to pay time and a half for all overtime worked (hours over 40 per week). Assuming a social security tax rate of 6.2%, a Medicare tax rate of 1.45%, and a Federal income tax rate of 10%, compute the gross pay, deductions and net pay for each of the three employees. Use the payroll register below. Total the Gross Earnings, Deductions, and Net Paid columns. All wages are subject to taxes. Happy Company Payroll Register Total Hours Hourly Total Earnings Deductions Name Worked Rate (Regular + Overtime OASDI Tax HI Tax FIT | Total Bob 40 | $5.80 Joe 50 7.00 Sally 40 8.50 Totals Net Pay Totals Assuming a SUTA rate of 5.4% and a FUTA rate of 8%, compute the employer's payroll taxes. All wages are subject to taxes. Employer's Payroll Taxes Amount Bob Bob Joe Sally OASDI Subject to Tax 232 385 340 FUTA Tax Rate 0.008 0.008 0.008 FUTA Total 1.856 3.08 2.72 SUTA SUTA Tax Rate 0.054 0.054 0.054 Total Total 12.528 20.79 18.36 7.66 51.68 3. Prepare the journal entries to record the following payroll entries. a. Record the payroll. b. Record the payment of the payroll (employees). C. Record the employer's payroll tax expense. HAPPY COMPANY General Journal Debit Credit Date a. Record the payroll. Use the following account titles for the payroll journal entries. Cash FIT Tax Payable FUTA Tax Payable Medicare HI Tax Payable Payroll Tax Expense Salaries Expense Salaries Payable Social Security OASDI Tax Payable SUTA Tax Payable b. Record the payment of the payroll (employees). c. Record the employer's payroll tax expense