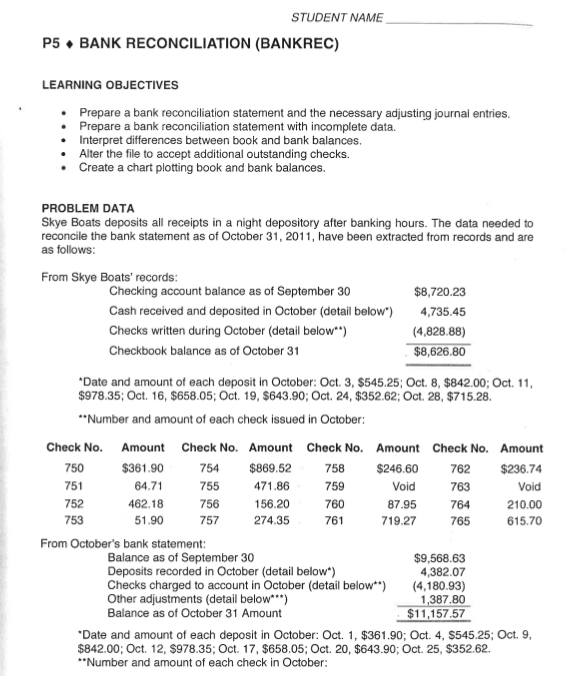

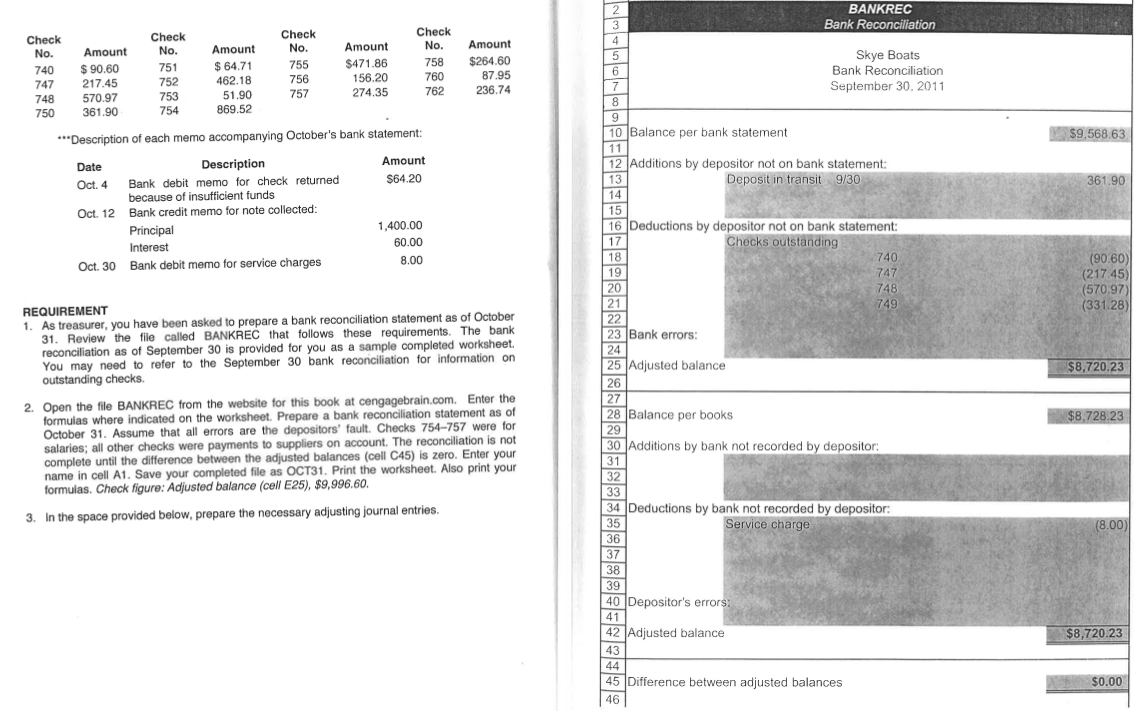

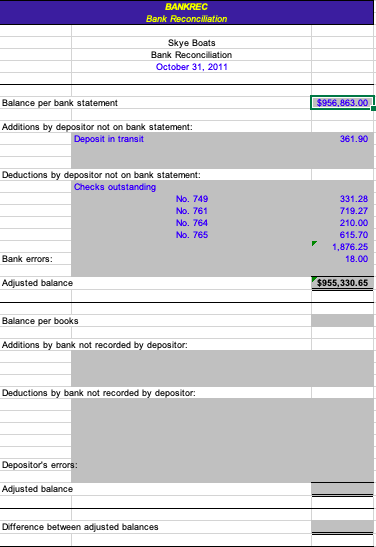

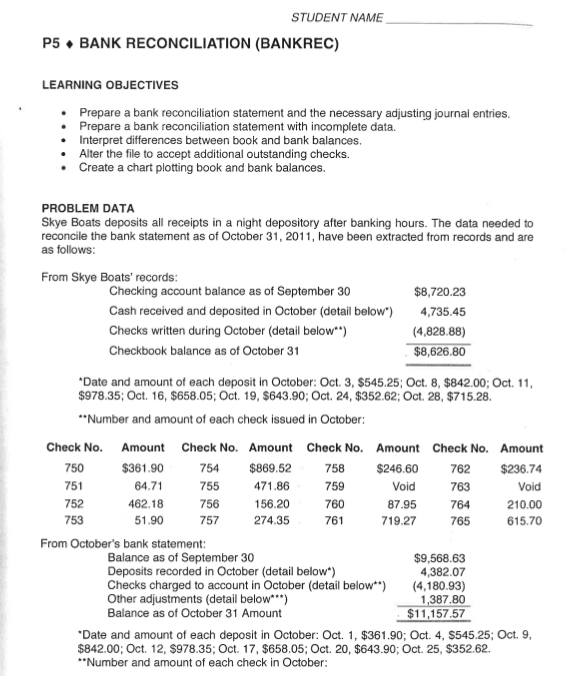

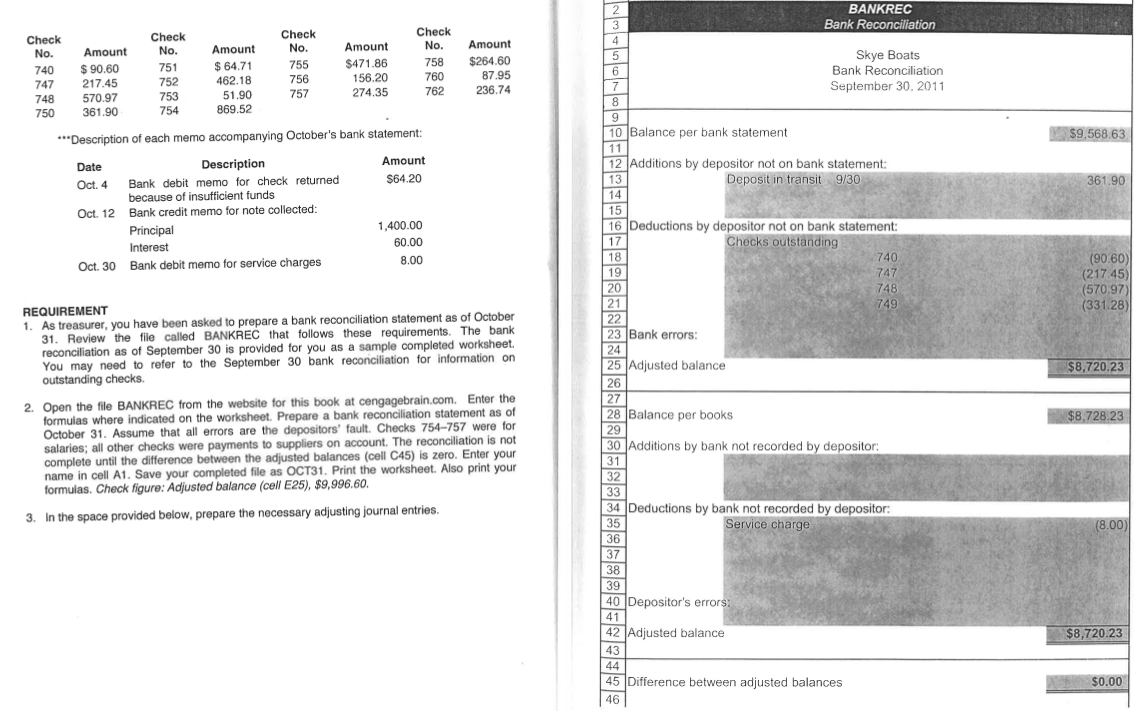

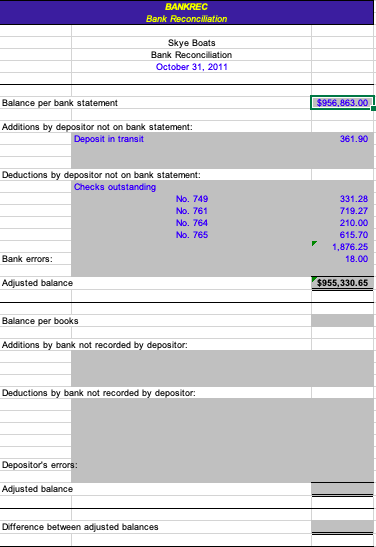

STUDENT NAME P5 BANK RECONCILIATION (BANKREC) LEARNING OBJECTIVES Prepare a bank reconciliation statement and the necessary adjusting journal entries. Prepare a bank reconciliation statement with incomplete data. Interpret differences between book and bank balances. Alter the file to accept additional outstanding checks. Create a chart plotting book and bank balances. PROBLEM DATA Skye Boats deposits all receipts in a night depository after banking hours. The data needed to reconcile the bank statement as of October 31, 2011, have been extracted from records and are as follows: From Skye Boats' records: Checking account balance as of September 30 $8,720.23 Cash received and deposited in October (detail below) 4,735.45 Checks written during October (detail below**) (4,828.88) Checkbook balance as of October 31 $8,626.80 'Date and amount of each deposit in October: Oct. 3, $545.25: Oct. 8, $842.00; Oct. 11, $978.35; Oct. 16, $658.05; Oct. 19, $643.90; Oct. 24, $352.62; Oct. 28, $715.28. **Number and amount of each check issued in October: Check No. Amount Check No. Amount Check No. Amount Check No. Amount 750 $361.90 754 $869.52 758 $246.60 $236.74 751 64.71 755 471.86 759 Void 763 Void 752 462.18 156.20 760 87.95 210.00 753 51.90 757 274.35 761 719.27 765 615.70 From October's bank statement: Balance as of September 30 $9,568.63 Deposits recorded in October (detail below) 4,382.07 Checks charged to account in October (detail below) (4,180.93) Other adjustments (detail below***) 1,387.80 Balance as of October 31 Amount $11,157.57 *Date and amount of each deposit in October: Oct. 1, $361.90; Oct. 4, $545.25. Oct. 9, $842.00; Oct. 12, $978.35; Oct. 17, $658.05; Oct. 20, $643.90; Oct. 25, $352.62. **Number and amount of each check in October: 762 756 764 Check No. 740 747 748 750 Amount $ 90.60 217.45 570.97 361.90 Check No. 751 752 Amount $ 64.71 462.18 51.90 869.52 Check No. 755 756 757 Amount $471.86 156.20 274.35 Check No. 758 760 762 Amount $264.60 87.95 236.74 753 754 $9,568.63 ***Description of each memo accompanying October's bank statement: Amount $64.20 361.90 Date Description Oct. 4 Bank debit memo for check returned because of insufficient funds Oct. 12 Bank credit memo for note collected: Principal Interest Oct. 30 Bank debit memo for service charges 1,400.00 60.00 8.00 2 BANKREC 3 Bank Reconciliation 4 5 Skye Boats 6 Bank Reconciliation September 30, 2011 8 9 10 Balance per bank statement 11 12 Additions by depositor not on bank statement: 13 Deposit in transit 9/30 14 15 16 Deductions by depositor not on bank statement: 17 Checks outstanding 18 18 740 19 19 747 20 748 21 749 22 23 Bank errors: 24 25 Adjusted balance 26 121 27 20 28 Balance per books 29 30 Additions by bank not recorded by depositor: 31 (90.60) (21745) (570.97) (331.28) $8,720.23 REQUIREMENT 1. As treasurer, you have been asked to prepare a bank reconciliation statement as of October 31. Review the file called BANKREC that follows these requirements. The bank reconciliation as of September 30 is provided for you as a sample completed worksheet. You may need to refer to the September 30 bank reconciliation for information on outstanding checks. 2. Open the file BANKREC from the website for this book at cengagebrain.com. Enter the formulas where indicated on the worksheet. Prepare a bank reconciliation statement as of October 31. Assume that all errors are the depositors' fault. Checks 754-757 were for salaries; all other checks were payments to suppliers on account. The reconciliation is not com until the difference between the adjusted balances (cell C45) is zero. Enter your name in cell A1. Save your completed file as OCT31. Print the worksheet. Also print your formulas. Check figure: Adjusted balance (cell E25). $9,996.60. $8,728.23 32 3. In the space provided below, prepare the necessary adjusting journal entries. (8.00) 33 34 Deductions by bank not recorded by depositor: 35 Service charge 00 36 37 38 39 40 Depositor's errors: 41 42 Adjusted balance 43 44 45 Difference between adjusted balances 46 $8,720.23 $0.00 BANKREC Bank Reconciliation Skye Boats Bank Reconciliation October 31, 2011 Balance per bank statement $956,863.00 Additions by depositor not on bank statement: Deposit in transit 361.90 Deductions by depositor not on bank statement: Checks outstanding No. 749 No. 761 No. 764 No. 765 331.28 719.27 210.00 615.70 1,876.25 18.00 Bank errors: Adjusted balance $955,330.65 Balance per books Additions by bank not recorded by depositor: Deductions by bank not recorded by depositor: Depositor's errors: Adjusted balance Difference between adjusted balances STUDENT NAME P5 BANK RECONCILIATION (BANKREC) LEARNING OBJECTIVES Prepare a bank reconciliation statement and the necessary adjusting journal entries. Prepare a bank reconciliation statement with incomplete data. Interpret differences between book and bank balances. Alter the file to accept additional outstanding checks. Create a chart plotting book and bank balances. PROBLEM DATA Skye Boats deposits all receipts in a night depository after banking hours. The data needed to reconcile the bank statement as of October 31, 2011, have been extracted from records and are as follows: From Skye Boats' records: Checking account balance as of September 30 $8,720.23 Cash received and deposited in October (detail below) 4,735.45 Checks written during October (detail below**) (4,828.88) Checkbook balance as of October 31 $8,626.80 'Date and amount of each deposit in October: Oct. 3, $545.25: Oct. 8, $842.00; Oct. 11, $978.35; Oct. 16, $658.05; Oct. 19, $643.90; Oct. 24, $352.62; Oct. 28, $715.28. **Number and amount of each check issued in October: Check No. Amount Check No. Amount Check No. Amount Check No. Amount 750 $361.90 754 $869.52 758 $246.60 $236.74 751 64.71 755 471.86 759 Void 763 Void 752 462.18 156.20 760 87.95 210.00 753 51.90 757 274.35 761 719.27 765 615.70 From October's bank statement: Balance as of September 30 $9,568.63 Deposits recorded in October (detail below) 4,382.07 Checks charged to account in October (detail below) (4,180.93) Other adjustments (detail below***) 1,387.80 Balance as of October 31 Amount $11,157.57 *Date and amount of each deposit in October: Oct. 1, $361.90; Oct. 4, $545.25. Oct. 9, $842.00; Oct. 12, $978.35; Oct. 17, $658.05; Oct. 20, $643.90; Oct. 25, $352.62. **Number and amount of each check in October: 762 756 764 Check No. 740 747 748 750 Amount $ 90.60 217.45 570.97 361.90 Check No. 751 752 Amount $ 64.71 462.18 51.90 869.52 Check No. 755 756 757 Amount $471.86 156.20 274.35 Check No. 758 760 762 Amount $264.60 87.95 236.74 753 754 $9,568.63 ***Description of each memo accompanying October's bank statement: Amount $64.20 361.90 Date Description Oct. 4 Bank debit memo for check returned because of insufficient funds Oct. 12 Bank credit memo for note collected: Principal Interest Oct. 30 Bank debit memo for service charges 1,400.00 60.00 8.00 2 BANKREC 3 Bank Reconciliation 4 5 Skye Boats 6 Bank Reconciliation September 30, 2011 8 9 10 Balance per bank statement 11 12 Additions by depositor not on bank statement: 13 Deposit in transit 9/30 14 15 16 Deductions by depositor not on bank statement: 17 Checks outstanding 18 18 740 19 19 747 20 748 21 749 22 23 Bank errors: 24 25 Adjusted balance 26 121 27 20 28 Balance per books 29 30 Additions by bank not recorded by depositor: 31 (90.60) (21745) (570.97) (331.28) $8,720.23 REQUIREMENT 1. As treasurer, you have been asked to prepare a bank reconciliation statement as of October 31. Review the file called BANKREC that follows these requirements. The bank reconciliation as of September 30 is provided for you as a sample completed worksheet. You may need to refer to the September 30 bank reconciliation for information on outstanding checks. 2. Open the file BANKREC from the website for this book at cengagebrain.com. Enter the formulas where indicated on the worksheet. Prepare a bank reconciliation statement as of October 31. Assume that all errors are the depositors' fault. Checks 754-757 were for salaries; all other checks were payments to suppliers on account. The reconciliation is not com until the difference between the adjusted balances (cell C45) is zero. Enter your name in cell A1. Save your completed file as OCT31. Print the worksheet. Also print your formulas. Check figure: Adjusted balance (cell E25). $9,996.60. $8,728.23 32 3. In the space provided below, prepare the necessary adjusting journal entries. (8.00) 33 34 Deductions by bank not recorded by depositor: 35 Service charge 00 36 37 38 39 40 Depositor's errors: 41 42 Adjusted balance 43 44 45 Difference between adjusted balances 46 $8,720.23 $0.00 BANKREC Bank Reconciliation Skye Boats Bank Reconciliation October 31, 2011 Balance per bank statement $956,863.00 Additions by depositor not on bank statement: Deposit in transit 361.90 Deductions by depositor not on bank statement: Checks outstanding No. 749 No. 761 No. 764 No. 765 331.28 719.27 210.00 615.70 1,876.25 18.00 Bank errors: Adjusted balance $955,330.65 Balance per books Additions by bank not recorded by depositor: Deductions by bank not recorded by depositor: Depositor's errors: Adjusted balance Difference between adjusted balances