Answered step by step

Verified Expert Solution

Question

1 Approved Answer

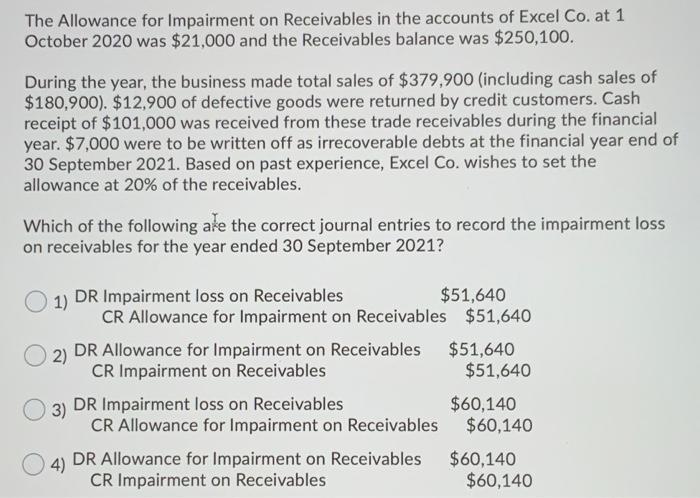

The Allowance for Impairment on Receivables in the accounts of Excel Co. at 1 October 2020 was $21,000 and the Receivables balance was $250,100.

The Allowance for Impairment on Receivables in the accounts of Excel Co. at 1 October 2020 was $21,000 and the Receivables balance was $250,100. During the year, the business made total sales of $379,900 (including cash sales of $180,900). $12,900 of defective goods were returned by credit customers. Cash receipt of $101,000 was received from these trade receivables during the financial year. $7,000 were to be written off as irrecoverable debts at the financial year end of 30 September 2021. Based on past experience, Excel Co. wishes to set the allowance at 20% of the receivables. Which of the following ake the correct journal entries to record the impairment loss on receivables for the year ended 30 September 2021? DR Impairment loss on Receivables CR Allowance for Impairment on Receivables $51,640 1) $51,640 2) DR Allowance for Impairment on Receivables $51,640 CR Impairment on Receivables $51,640 $60,140 $60,140 3) DR Impairment loss on Receivables CR Allowance for Impairment on Receivables $60,140 $60,140 4) DR Allowance for Impairment on Receivables CR Impairment on Receivables

Step by Step Solution

★★★★★

3.38 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

Beginning Balance of Accounts Receivable is 250100 Total Sales during the year 379900 Transaction Ge...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started