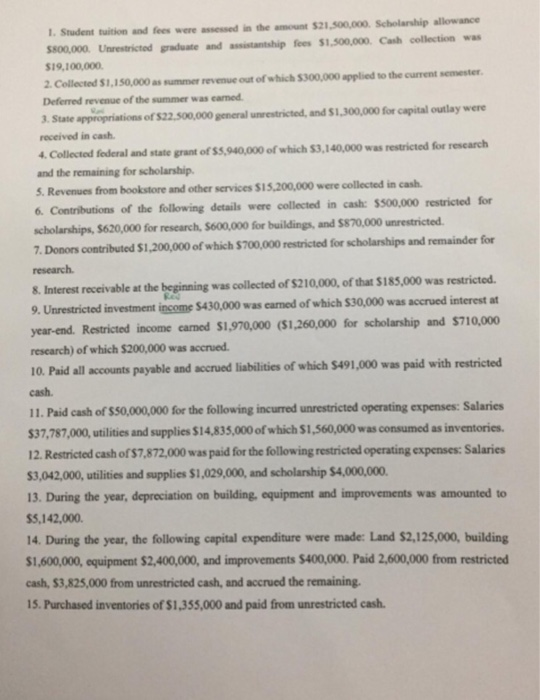

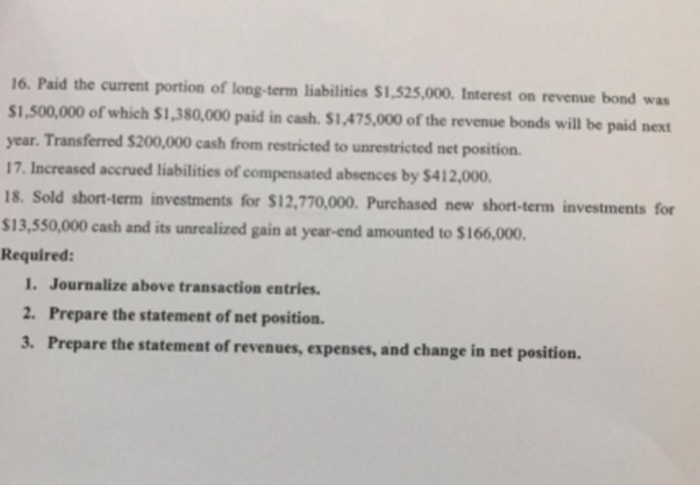

Student tuition and fees were assessed in the amount $21,500,000 Scholarship allowance 800,000. Unrestricted graduate and assistantship fees $1,500,000 Cash collection was $19,100,000 revenue out of which $300,000 applied to the current semester Deferred revenue of the summer was carned . State appropriations of $22,500,000 general unrestricted, and S1,300,000 for capital outlay wene received in cash. and state grant of SS94, of which S3, 140,000 was restricted for research and the remaining for scholarship. 5. Revenues from bookstore and other services $15,200,000 were collected in cash 6. Contributions of the following details were collected in cash: $500,000 restricted for scholarships, $620,000 for research, $600,000 for buildings, and $870,000 unrestricted 7. Donors contributed $1,200,000 of which $700,000 restricted for scholarships and remainder for research. 8. Interest receivable at the beginning was collected of $210,000, of that $185,000 was restricted. 9. Unrestricted investment income $430,000 was eamed of which $30,000 was accrued interest at year-end. Restricted income carned $1,970,000 (S1,260,000 for scholarship and $710,000 rescarch) of which $200,000 was accrued 10. Paid all accounts payable and accrued liabilities of which $491,000 was paid with restricted cash. 11. Paid cash of $$0,000,000 for the following incurred unrestricted operating expenses: Salaries 37,787,000, utilities and supplies $14,835,000 ofwhich $1,560,000 was consumed as inventories. 12. Restricted cash of $7,872,000 was paid for the following restricted operating expenses: Salaries 3,042,000, utilities and supplies $1,029,000, and scholarship $4,000,000. 13. During the year, depreciation on building, equipment and improvements was amounted to $5,142,000. 14. During the year, the following capital expenditure were made: Land $2,125,000, building 1,600,000, equipment $2,400,000, and improvements $400,000. Paid 2,600,000 from restricted cash, $3,825,000 from unrestricted cash, and accrued the remaining 15. Purchased inventories of $1,355,000 and paid from unrestricted cash 16. Paid the current portion of long-term liabilities $1,525,000. Interest on revenue bond was 1,500,000 of which $1,380,000 paid in cash $1,475,000 of the revenue bonds will be paid next year. Transferred $200,000 cash from restricted to unrestricted net position 17. Increased accrued liabilities of compensated absences by $412,000 18. Sold short-term investments for $12,770,000. Purchased new short-term investments for 13,550,000 cash and its unrealized gain at year-end amounted to $166,000. Required: I. Journalize above transaction entries. 2. Prepare the statement of net position. 3. Prepare the statement of revenues, expenses, and change in net position Student tuition and fees were assessed in the amount $21,500,000 Scholarship allowance 800,000. Unrestricted graduate and assistantship fees $1,500,000 Cash collection was $19,100,000 revenue out of which $300,000 applied to the current semester Deferred revenue of the summer was carned . State appropriations of $22,500,000 general unrestricted, and S1,300,000 for capital outlay wene received in cash. and state grant of SS94, of which S3, 140,000 was restricted for research and the remaining for scholarship. 5. Revenues from bookstore and other services $15,200,000 were collected in cash 6. Contributions of the following details were collected in cash: $500,000 restricted for scholarships, $620,000 for research, $600,000 for buildings, and $870,000 unrestricted 7. Donors contributed $1,200,000 of which $700,000 restricted for scholarships and remainder for research. 8. Interest receivable at the beginning was collected of $210,000, of that $185,000 was restricted. 9. Unrestricted investment income $430,000 was eamed of which $30,000 was accrued interest at year-end. Restricted income carned $1,970,000 (S1,260,000 for scholarship and $710,000 rescarch) of which $200,000 was accrued 10. Paid all accounts payable and accrued liabilities of which $491,000 was paid with restricted cash. 11. Paid cash of $$0,000,000 for the following incurred unrestricted operating expenses: Salaries 37,787,000, utilities and supplies $14,835,000 ofwhich $1,560,000 was consumed as inventories. 12. Restricted cash of $7,872,000 was paid for the following restricted operating expenses: Salaries 3,042,000, utilities and supplies $1,029,000, and scholarship $4,000,000. 13. During the year, depreciation on building, equipment and improvements was amounted to $5,142,000. 14. During the year, the following capital expenditure were made: Land $2,125,000, building 1,600,000, equipment $2,400,000, and improvements $400,000. Paid 2,600,000 from restricted cash, $3,825,000 from unrestricted cash, and accrued the remaining 15. Purchased inventories of $1,355,000 and paid from unrestricted cash 16. Paid the current portion of long-term liabilities $1,525,000. Interest on revenue bond was 1,500,000 of which $1,380,000 paid in cash $1,475,000 of the revenue bonds will be paid next year. Transferred $200,000 cash from restricted to unrestricted net position 17. Increased accrued liabilities of compensated absences by $412,000 18. Sold short-term investments for $12,770,000. Purchased new short-term investments for 13,550,000 cash and its unrealized gain at year-end amounted to $166,000. Required: I. Journalize above transaction entries. 2. Prepare the statement of net position. 3. Prepare the statement of revenues, expenses, and change in net position