Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Students are required to: Select a company ( real or fictitious ) that is publicly traded or has financial data available for analysis, students will

Students are required to:

Select a company real or fictitious that is publicly traded or has financial data available for analysis, students will act as financial analysts for a fictitious company or a real small business seeking to make informed investment decisions. The project will involve conducting a comprehensive financial analysis and providing investment recommendations based on the findings.

Provide a detailed explanation of financial management

Gather relevant financial data for the selected company. Use financial management principles to monitor the startup's financial performance and ensure that the marketing initiatives are financially sustainable. This may involve developing a cash budget.

Conduct a financial analysis: Students will perform a thorough

financial analysis of the company. This analysis should include:

Ratio Analysis: Calculate and interpret key financial ratios such as

profitability ratios, liquidity ratios, leverage ratios, and efficiency

ratios.

Investment Recommendation: Based on the financial analysis

provide a clear investment recommendation. Should the company

be considered as a potential investment? Should it be avoided?

Students should justify their recommendation.

Adjustments and additional information

Stocktaking on February revealed the following inventories:

Trading inventory R

Stationery R

The telephone account for February R was due to be paid on March

A debtor who was declared insolvent paid R which represented of her debt. The balance of

her account must now be written off.

The provision for bad debts must be decreased to R

Rent has been received up to March Note: The rental was increased by R per month

with effect from November

The insurance total includes an annual premium of R that was paid for the period June

to May

Provide for outstanding interest on the mortgage loan for February

Provide for the outstanding interest on fixed deposit. The investment in fixed deposit was made on

September

A payment for the annual service of a motor vehicle was not recorded, R

Provide for depreciation as follows:

On equipment at pa on cost

On vehicles at pa using the diminishing balance method. Note: A vehicle with a cost price of

R was purchased on December The purchase has been recorded.

INFORMATION

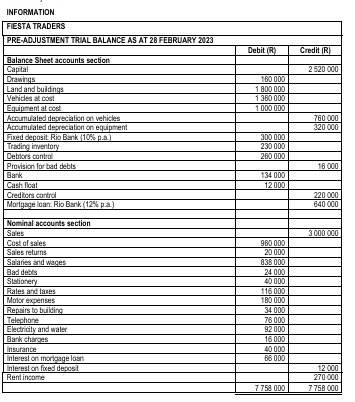

tableFIESTA TRADERSPREADJUSTMENT TRIAL BALANCE AS AT FEBRUARY Debit R Credit RBalance Sheet accounts sectionCapialDrawingsLand and buildings,Vetricles at costEquiptemilat costAccurmulaled depreciation on vehicles,,Actumulaled depreciation on equip remi,,Fixed deposit Rio Bank paTrading itwentory,Deblors cintiol,Pruvision for bad debts,,BarkCash float,Creditors cantrol,,Marigage loant Rio Bank paNominal atcounts sectionSalesCost of sales,Sales returns,Salaties and wages,Bad debts,SistioneryRales and tazes,Molor expenses,Repsirs to building,TelephoneElectricity and waler,Bark charges,InsuranceInlerest on morigage losin,inlerest on fixed deposit,,Rent incotre,,

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started