Answered step by step

Verified Expert Solution

Question

1 Approved Answer

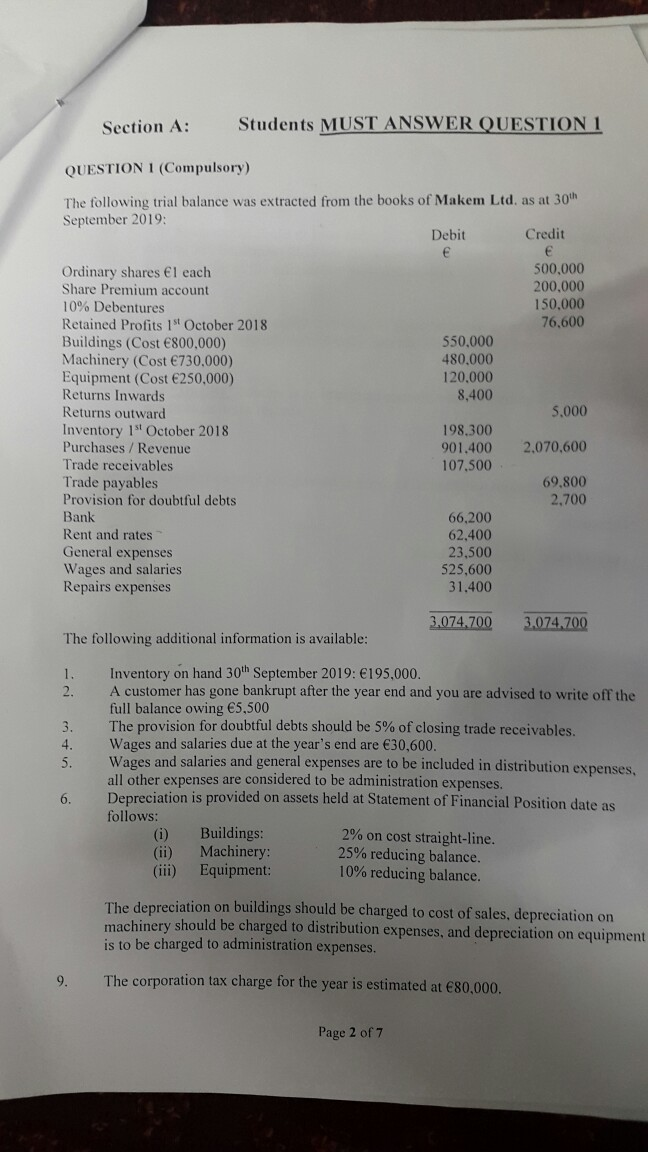

Students MUST ANSWER QUESTION 1 Section A: QUESTION I (Compulsory) The following trial balance was extracted from the books of Makem Ltd, as at 30th

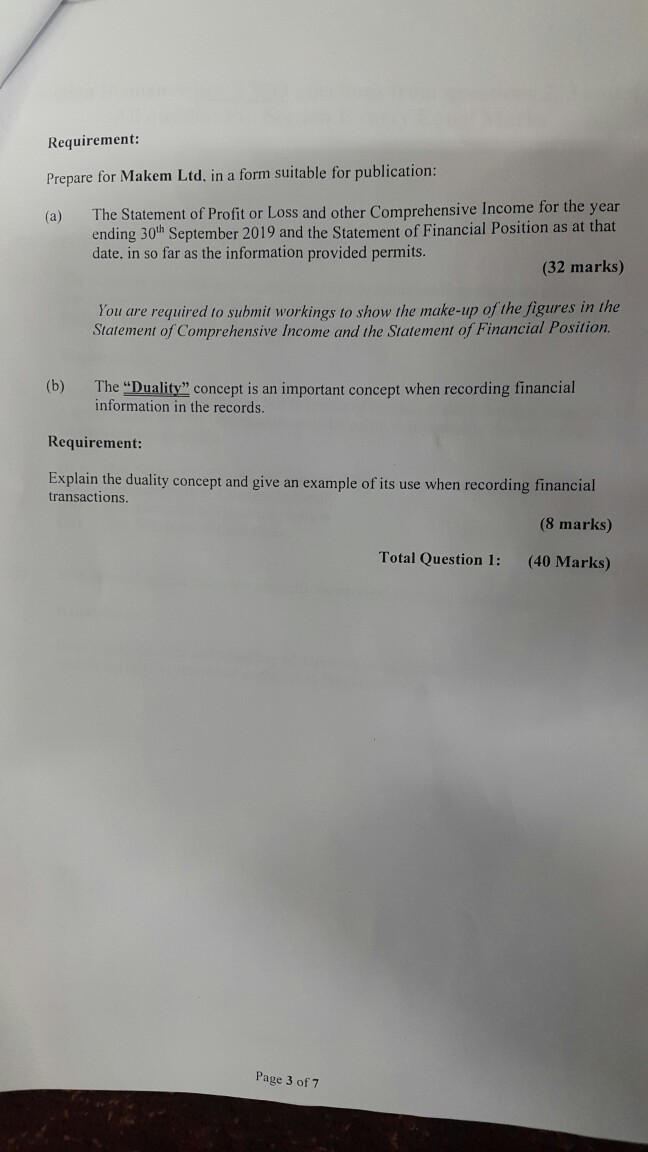

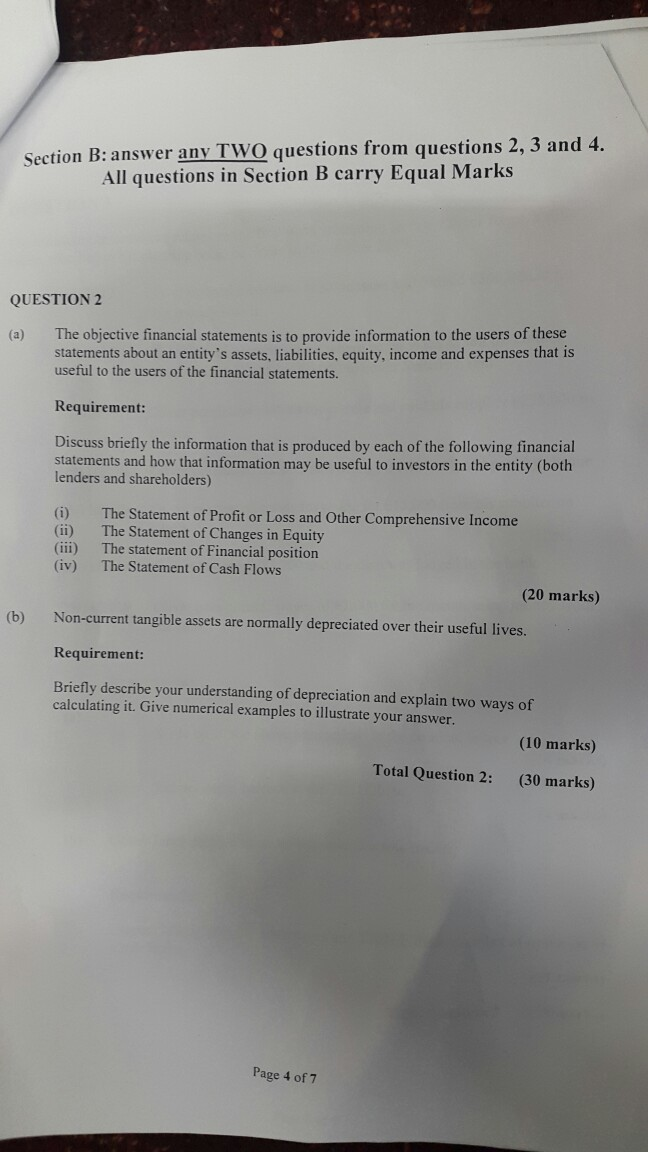

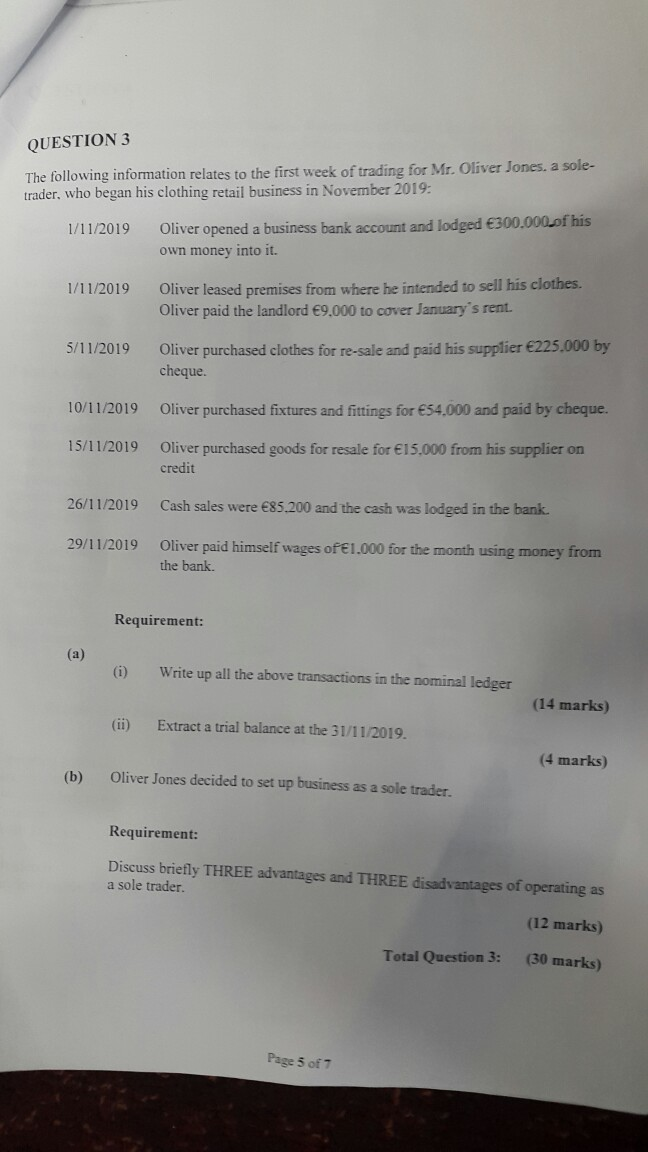

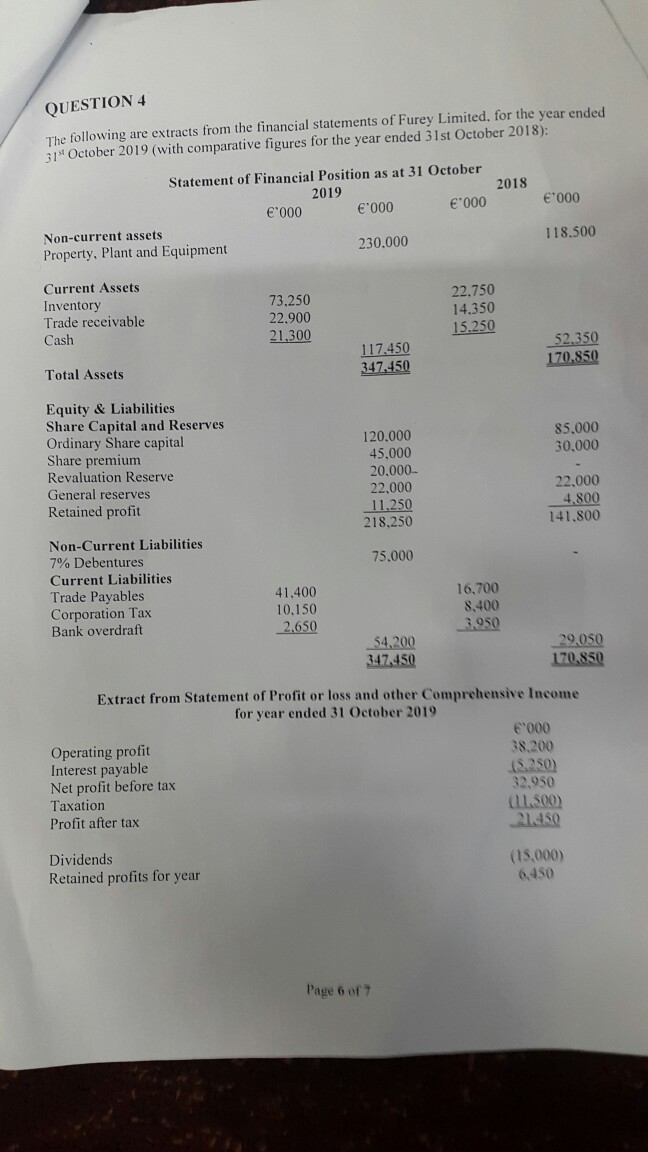

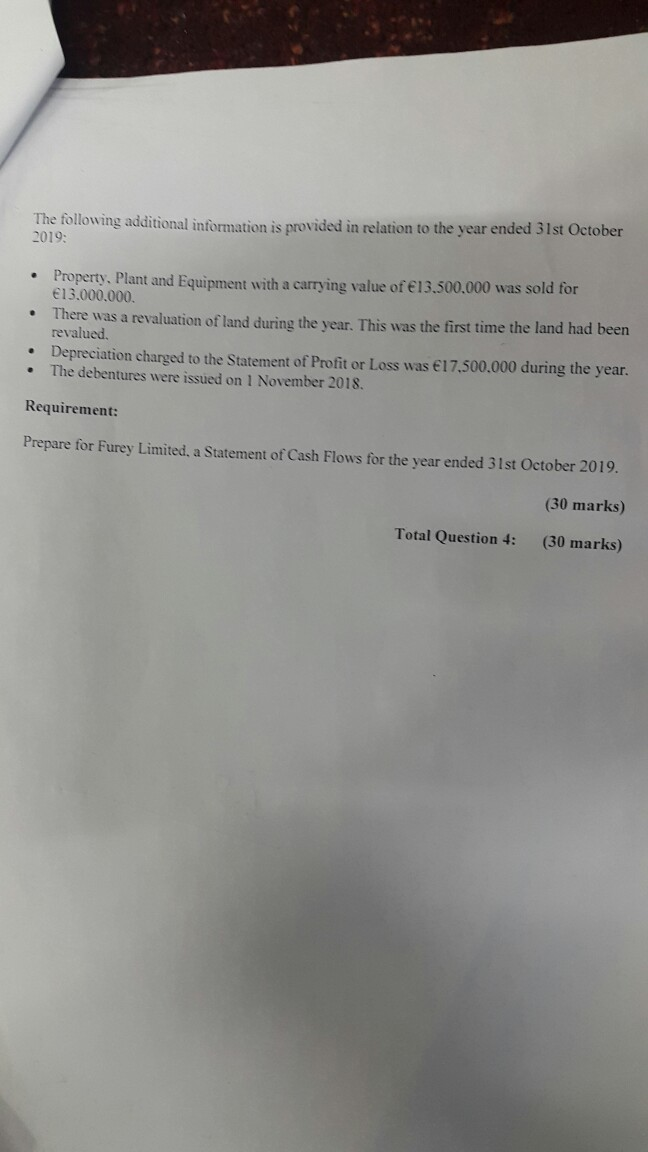

Students MUST ANSWER QUESTION 1 Section A: QUESTION I (Compulsory) The following trial balance was extracted from the books of Makem Ltd, as at 30th September 2019: Credit Debit 500,000 200,000 Ordinary shares l each Share Premium account 10% Debentures 150,000 76,600 Retained Profits 1st October 2018 Buildings (Cost E800,000) Machinery (Cost 730,000) Equipment (Cost 250,000) Returns Inwards Returns outward 550,000 480.000 120,000 8,400 5,000 Inventory 1 October 2018 Purchases / Revenue Trade receivables Trade payables Provision for doubtful debts Bank Rent and rates General expenses Wages and salaries Repairs expenses 198.300 901.400 107,500 2,070,600 69,800 2,700 66,200 62,400 23,500 525,600 31,400 3,074,700 3,074,700 The following additional information is available: Inventory on hand 30th September 2019: 195,000. A customer has gone bankrupt after the year end and you are advised to write off the full balance owing 5,500 The provision for doubtful debts should be 5% of closing trade receivables. Wages and salaries due at the year's end are 30,600. Wages and salaries and general expenses are to be included in distribution expenses, all other expenses are considered to be administration expenses. Depreciation is provided on assets held at Statement of Financial Position date as 1. 2. 3. 4. 5. 6. follows: Buildings: Machinery: Equipment: (i) (ii) (iii) 2% on cost straight-line. 25% reducing balance. 10% reducing balance. The depreciation on buildings should be charged to cost of sales, depreciation on machinery should be charged to distribution expenses, and depreciation on equipment is to be charged to administration expenses. The corporation tax charge for the year is estimated at 80,000. 9. Page 2 of 7 Requirement: Prepare for Makem Ltd, in a form suitable for publication: The Statement of Profit or Loss and other Comprehensive Income for the year ending 30th September 2019 and the Statement of Financial Position as at that date, in so far as the information provided permits. (a) (32 marks) You are required to submit workings to show the make-up of the figures in the Statement of Comprehensive Income and the Statement of Financial Position. (b) The "Duality" concept is an important concept when recording financial information in the records. Requirement: Explain the duality concept and give an example of its use when recording financial transactions. (8 marks) Total Question 1: (40 Marks) Page 3 of 7 Section B: answer any TWO questions from questions 2, 3 and 4. All questions in Section B carry Equal Marks QUESTION 2 The objective financial statements is to provide information to the users of these statements about an entity's assets, liabilities, equity, income and expenses that is useful to the users of the financial statements. (a) Requirement: Discuss briefly the information that is produced by each of the following financial statements and how that information may be useful to investors in the entity (both lenders and shareholders) (i) (ii) (iii) (iv) The Statement of Profit or Loss and Other Comprehensive Income The Statement of Changes in Equity The statement of Financial position The Statement of Cash Flows (20 marks) Non-current tangible assets are normally depreciated over their useful lives. (b) Requirement: Briefly describe your understanding of depreciation and explain two ways of calculating it. Give numerical examples to illustrate your answer. (10 marks) Total Question 2: (30 marks) Page 4 of 7 QUESTION 3 The following information relates to the first week of trading for Mr. Oliver Jones. a sole- trader, who began his clothing retail business in November 2019: Oliver opened a business bank account and lodged 300.000of his own money into it. 1/11/2019 Oliver leased premises from where he intended to sell his clothes. Oliver paid the landlord 9,000 to cover January's rent. 1/11/2019 Oliver purchased clothes for re-sale and paid his supplier 225.000 by cheque. 5/11/2019 Oliver purchased fixtures and fittings for 54,000 and paid by cheque. 10/11/2019 15/11/2019 Oliver purchased goods for resale for 15.000 from his supplier on credit 26/11/2019 Cash sales were 85.200 and the cash was lodged in the bank. Oliver paid himself wages of 1.000 for the month using money from 29/11/2019 the bank. Requirement: (a) Write up all the above transactions in the nominal ledger (i) (14 marks) (ii) Extract a trial balance at the 31/11/2019. (4 marks) Oliver Jones decided to set up business as a sole trader. (b) Requirement: Discuss briefly THREE advantages and THREE disadvantages of operating as a sole trader. (12 marks) Total Question 3: (30 marks) Page 5 of 7 QUESTION 4 The following are extracts from the financial statements of Furey Limited, for the year ended 31 October 2019 (with comparative figures for the year ended 31st October 2018): Statement of Financial Position as at 31 October 2019 2018 '000 E'000 '000 000.3 Non-current assets 118.500 230.000 Property, Plant and Equipment Current Assets 22.750 14.350 15.250 Inventory Trade receivable Cash 73.250 22,900 21,300 52.350 170,850 117.450 347.450 Total Assets Equity & Liabilities Share Capital and Reserves Ordinary Share capital Share premium Revaluation Reserve General reserves Retained profit 85,000 30.000 120.000 45,000 20.000- 22,000 11,250 218,250 22,000 4,800 141.800 Non-Current Liabilities 7% Debentures 75,000 Current Liabilities Trade Payables Corporation Tax Bank overdraft 41,400 10,150 2,650 16,700 8,400 3.950 54,200 29,050 347.450 170,850 Extract from Statement of Profit or loss and other Comprehensive Income for year ended 31 October 2019 "000 38.200 (8.250) 32,950 Operating profit Interest payable Net profit before tax Taxation 1.500) 21.450 Profit after tax Dividends Retained profits for year (15,000) 6,450 Page 6 of 7 The following additional information is provided in relation to the year ended 31st October 2019: Property, Plant and Equipment wvith a carrying value of 13.500.000 was sold for 13.000.000. There was a revaluation of land during the year, This was the first time the land had been revalued. Depreciation charged to the Statement of Profit or Loss was 17,500.000 during the year. The debentures were issued on 1 November 2018. Requirement: Prepare for Furey Limited, a Statement of Cash Flows for the year ended 31st October 2019. (30 marks) Total Question 4: (30 marks) Students MUST ANSWER QUESTION 1 Section A: QUESTION I (Compulsory) The following trial balance was extracted from the books of Makem Ltd, as at 30th September 2019: Credit Debit 500,000 200,000 Ordinary shares l each Share Premium account 10% Debentures 150,000 76,600 Retained Profits 1st October 2018 Buildings (Cost E800,000) Machinery (Cost 730,000) Equipment (Cost 250,000) Returns Inwards Returns outward 550,000 480.000 120,000 8,400 5,000 Inventory 1 October 2018 Purchases / Revenue Trade receivables Trade payables Provision for doubtful debts Bank Rent and rates General expenses Wages and salaries Repairs expenses 198.300 901.400 107,500 2,070,600 69,800 2,700 66,200 62,400 23,500 525,600 31,400 3,074,700 3,074,700 The following additional information is available: Inventory on hand 30th September 2019: 195,000. A customer has gone bankrupt after the year end and you are advised to write off the full balance owing 5,500 The provision for doubtful debts should be 5% of closing trade receivables. Wages and salaries due at the year's end are 30,600. Wages and salaries and general expenses are to be included in distribution expenses, all other expenses are considered to be administration expenses. Depreciation is provided on assets held at Statement of Financial Position date as 1. 2. 3. 4. 5. 6. follows: Buildings: Machinery: Equipment: (i) (ii) (iii) 2% on cost straight-line. 25% reducing balance. 10% reducing balance. The depreciation on buildings should be charged to cost of sales, depreciation on machinery should be charged to distribution expenses, and depreciation on equipment is to be charged to administration expenses. The corporation tax charge for the year is estimated at 80,000. 9. Page 2 of 7 Requirement: Prepare for Makem Ltd, in a form suitable for publication: The Statement of Profit or Loss and other Comprehensive Income for the year ending 30th September 2019 and the Statement of Financial Position as at that date, in so far as the information provided permits. (a) (32 marks) You are required to submit workings to show the make-up of the figures in the Statement of Comprehensive Income and the Statement of Financial Position. (b) The "Duality" concept is an important concept when recording financial information in the records. Requirement: Explain the duality concept and give an example of its use when recording financial transactions. (8 marks) Total Question 1: (40 Marks) Page 3 of 7 Section B: answer any TWO questions from questions 2, 3 and 4. All questions in Section B carry Equal Marks QUESTION 2 The objective financial statements is to provide information to the users of these statements about an entity's assets, liabilities, equity, income and expenses that is useful to the users of the financial statements. (a) Requirement: Discuss briefly the information that is produced by each of the following financial statements and how that information may be useful to investors in the entity (both lenders and shareholders) (i) (ii) (iii) (iv) The Statement of Profit or Loss and Other Comprehensive Income The Statement of Changes in Equity The statement of Financial position The Statement of Cash Flows (20 marks) Non-current tangible assets are normally depreciated over their useful lives. (b) Requirement: Briefly describe your understanding of depreciation and explain two ways of calculating it. Give numerical examples to illustrate your answer. (10 marks) Total Question 2: (30 marks) Page 4 of 7 QUESTION 3 The following information relates to the first week of trading for Mr. Oliver Jones. a sole- trader, who began his clothing retail business in November 2019: Oliver opened a business bank account and lodged 300.000of his own money into it. 1/11/2019 Oliver leased premises from where he intended to sell his clothes. Oliver paid the landlord 9,000 to cover January's rent. 1/11/2019 Oliver purchased clothes for re-sale and paid his supplier 225.000 by cheque. 5/11/2019 Oliver purchased fixtures and fittings for 54,000 and paid by cheque. 10/11/2019 15/11/2019 Oliver purchased goods for resale for 15.000 from his supplier on credit 26/11/2019 Cash sales were 85.200 and the cash was lodged in the bank. Oliver paid himself wages of 1.000 for the month using money from 29/11/2019 the bank. Requirement: (a) Write up all the above transactions in the nominal ledger (i) (14 marks) (ii) Extract a trial balance at the 31/11/2019. (4 marks) Oliver Jones decided to set up business as a sole trader. (b) Requirement: Discuss briefly THREE advantages and THREE disadvantages of operating as a sole trader. (12 marks) Total Question 3: (30 marks) Page 5 of 7 QUESTION 4 The following are extracts from the financial statements of Furey Limited, for the year ended 31 October 2019 (with comparative figures for the year ended 31st October 2018): Statement of Financial Position as at 31 October 2019 2018 '000 E'000 '000 000.3 Non-current assets 118.500 230.000 Property, Plant and Equipment Current Assets 22.750 14.350 15.250 Inventory Trade receivable Cash 73.250 22,900 21,300 52.350 170,850 117.450 347.450 Total Assets Equity & Liabilities Share Capital and Reserves Ordinary Share capital Share premium Revaluation Reserve General reserves Retained profit 85,000 30.000 120.000 45,000 20.000- 22,000 11,250 218,250 22,000 4,800 141.800 Non-Current Liabilities 7% Debentures 75,000 Current Liabilities Trade Payables Corporation Tax Bank overdraft 41,400 10,150 2,650 16,700 8,400 3.950 54,200 29,050 347.450 170,850 Extract from Statement of Profit or loss and other Comprehensive Income for year ended 31 October 2019 "000 38.200 (8.250) 32,950 Operating profit Interest payable Net profit before tax Taxation 1.500) 21.450 Profit after tax Dividends Retained profits for year (15,000) 6,450 Page 6 of 7 The following additional information is provided in relation to the year ended 31st October 2019: Property, Plant and Equipment wvith a carrying value of 13.500.000 was sold for 13.000.000. There was a revaluation of land during the year, This was the first time the land had been revalued. Depreciation charged to the Statement of Profit or Loss was 17,500.000 during the year. The debentures were issued on 1 November 2018. Requirement: Prepare for Furey Limited, a Statement of Cash Flows for the year ended 31st October 2019. (30 marks) Total Question 4: (30 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started