Answered step by step

Verified Expert Solution

Question

1 Approved Answer

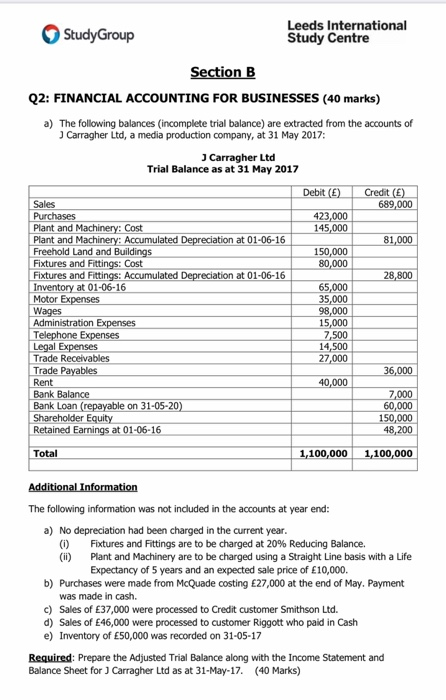

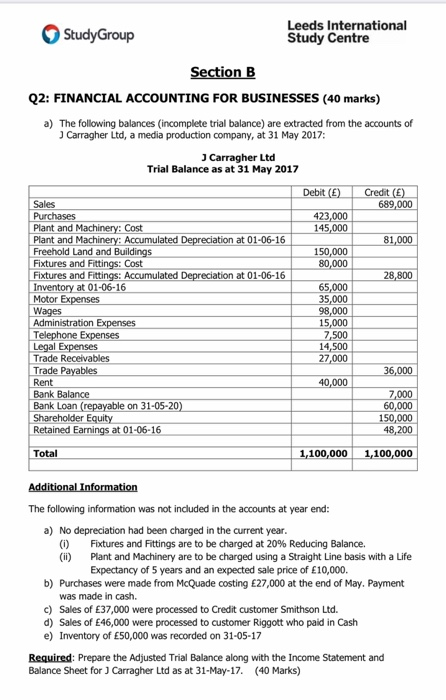

Study Group Leeds International Study Centre Section B Q2: FINANCIAL ACCOUNTING FOR BUSINESSES (40 marks) a) The following balances (incomplete trial balance) are extracted from

Study Group Leeds International Study Centre Section B Q2: FINANCIAL ACCOUNTING FOR BUSINESSES (40 marks) a) The following balances (incomplete trial balance) are extracted from the accounts of Carragher Ltd, a media production company, at 31 May 2017: Carragher Ltd Trial Balance as at 31 May 2017 Debit (6) Credit () 689,000 423,000 145,000 81,000 150,000 80,000 28,800 Sales Purchases Plant and Machinery: Cost Plant and Machinery: Accumulated Depreciation at 01-06-16 Freehold Land and Buildings Fixtures and Fittings: Cost Fixtures and Fittings: Accumulated Depreciation at 01-06-16 Inventory at 01-06-16 Motor Expenses Wages Administration Expenses Telephone Expenses Legal Expenses Trade Receivables Trade Payables Rent Bank Balance Bank Loan (repayable on 31-05-20) Shareholder Equity Retained Earnings at 01-06-16 65,000 35,000 98,000 15,000 7,500 14,500 27,000 36,000 40,000 7,000 60,000 150,000 48,200 Total 1,100,000 1,100,000 Additional Information The following information was not included in the accounts at year end: a) No depreciation had been charged in the current year. 0 Fixtures and Fittings are to be charged at 20% Reducing Balance. Plant and Machinery are to be charged using a Straight Line basis with a Life Expectancy of 5 years and an expected sale price of 10,000. b) Purchases were made from McQuade costing 27,000 at the end of May. Payment was made in cash. c) Sales of 37,000 were processed to credit customer Smithson Ltd. d) Sales of 46,000 were processed to customer Riggott who paid in Cash e) Inventory of 50,000 was recorded on 31-05-17 Required: Prepare the Adjusted Trial Balance along with the Income Statement and Balance Sheet for ) Carragher Ltd as at 31-May-17. (40 Marks) Study Group Leeds International Study Centre Section B Q2: FINANCIAL ACCOUNTING FOR BUSINESSES (40 marks) a) The following balances (incomplete trial balance) are extracted from the accounts of Carragher Ltd, a media production company, at 31 May 2017: Carragher Ltd Trial Balance as at 31 May 2017 Debit (6) Credit () 689,000 423,000 145,000 81,000 150,000 80,000 28,800 Sales Purchases Plant and Machinery: Cost Plant and Machinery: Accumulated Depreciation at 01-06-16 Freehold Land and Buildings Fixtures and Fittings: Cost Fixtures and Fittings: Accumulated Depreciation at 01-06-16 Inventory at 01-06-16 Motor Expenses Wages Administration Expenses Telephone Expenses Legal Expenses Trade Receivables Trade Payables Rent Bank Balance Bank Loan (repayable on 31-05-20) Shareholder Equity Retained Earnings at 01-06-16 65,000 35,000 98,000 15,000 7,500 14,500 27,000 36,000 40,000 7,000 60,000 150,000 48,200 Total 1,100,000 1,100,000 Additional Information The following information was not included in the accounts at year end: a) No depreciation had been charged in the current year. 0 Fixtures and Fittings are to be charged at 20% Reducing Balance. Plant and Machinery are to be charged using a Straight Line basis with a Life Expectancy of 5 years and an expected sale price of 10,000. b) Purchases were made from McQuade costing 27,000 at the end of May. Payment was made in cash. c) Sales of 37,000 were processed to credit customer Smithson Ltd. d) Sales of 46,000 were processed to customer Riggott who paid in Cash e) Inventory of 50,000 was recorded on 31-05-17 Required: Prepare the Adjusted Trial Balance along with the Income Statement and Balance Sheet for ) Carragher Ltd as at 31-May-17. (40 Marks)

Study Group Leeds International Study Centre Section B Q2: FINANCIAL ACCOUNTING FOR BUSINESSES (40 marks) a) The following balances (incomplete trial balance) are extracted from the accounts of Carragher Ltd, a media production company, at 31 May 2017: Carragher Ltd Trial Balance as at 31 May 2017 Debit (6) Credit () 689,000 423,000 145,000 81,000 150,000 80,000 28,800 Sales Purchases Plant and Machinery: Cost Plant and Machinery: Accumulated Depreciation at 01-06-16 Freehold Land and Buildings Fixtures and Fittings: Cost Fixtures and Fittings: Accumulated Depreciation at 01-06-16 Inventory at 01-06-16 Motor Expenses Wages Administration Expenses Telephone Expenses Legal Expenses Trade Receivables Trade Payables Rent Bank Balance Bank Loan (repayable on 31-05-20) Shareholder Equity Retained Earnings at 01-06-16 65,000 35,000 98,000 15,000 7,500 14,500 27,000 36,000 40,000 7,000 60,000 150,000 48,200 Total 1,100,000 1,100,000 Additional Information The following information was not included in the accounts at year end: a) No depreciation had been charged in the current year. 0 Fixtures and Fittings are to be charged at 20% Reducing Balance. Plant and Machinery are to be charged using a Straight Line basis with a Life Expectancy of 5 years and an expected sale price of 10,000. b) Purchases were made from McQuade costing 27,000 at the end of May. Payment was made in cash. c) Sales of 37,000 were processed to credit customer Smithson Ltd. d) Sales of 46,000 were processed to customer Riggott who paid in Cash e) Inventory of 50,000 was recorded on 31-05-17 Required: Prepare the Adjusted Trial Balance along with the Income Statement and Balance Sheet for ) Carragher Ltd as at 31-May-17. (40 Marks) Study Group Leeds International Study Centre Section B Q2: FINANCIAL ACCOUNTING FOR BUSINESSES (40 marks) a) The following balances (incomplete trial balance) are extracted from the accounts of Carragher Ltd, a media production company, at 31 May 2017: Carragher Ltd Trial Balance as at 31 May 2017 Debit (6) Credit () 689,000 423,000 145,000 81,000 150,000 80,000 28,800 Sales Purchases Plant and Machinery: Cost Plant and Machinery: Accumulated Depreciation at 01-06-16 Freehold Land and Buildings Fixtures and Fittings: Cost Fixtures and Fittings: Accumulated Depreciation at 01-06-16 Inventory at 01-06-16 Motor Expenses Wages Administration Expenses Telephone Expenses Legal Expenses Trade Receivables Trade Payables Rent Bank Balance Bank Loan (repayable on 31-05-20) Shareholder Equity Retained Earnings at 01-06-16 65,000 35,000 98,000 15,000 7,500 14,500 27,000 36,000 40,000 7,000 60,000 150,000 48,200 Total 1,100,000 1,100,000 Additional Information The following information was not included in the accounts at year end: a) No depreciation had been charged in the current year. 0 Fixtures and Fittings are to be charged at 20% Reducing Balance. Plant and Machinery are to be charged using a Straight Line basis with a Life Expectancy of 5 years and an expected sale price of 10,000. b) Purchases were made from McQuade costing 27,000 at the end of May. Payment was made in cash. c) Sales of 37,000 were processed to credit customer Smithson Ltd. d) Sales of 46,000 were processed to customer Riggott who paid in Cash e) Inventory of 50,000 was recorded on 31-05-17 Required: Prepare the Adjusted Trial Balance along with the Income Statement and Balance Sheet for ) Carragher Ltd as at 31-May-17. (40 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started