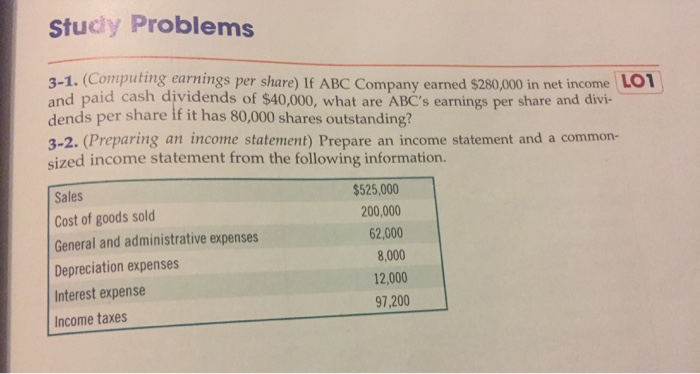

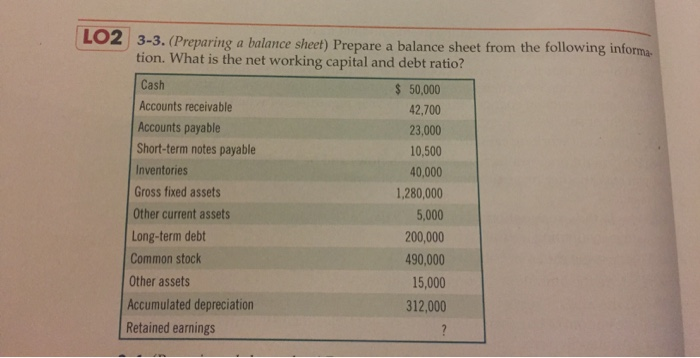

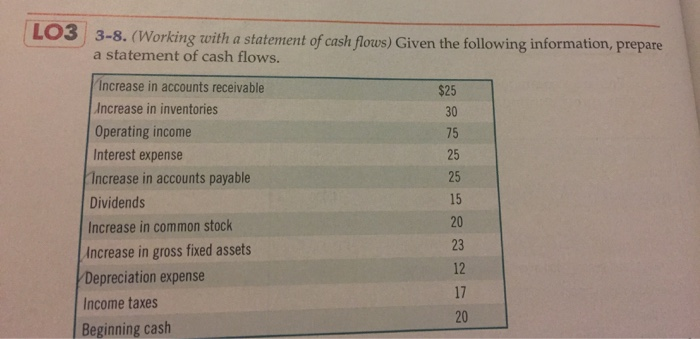

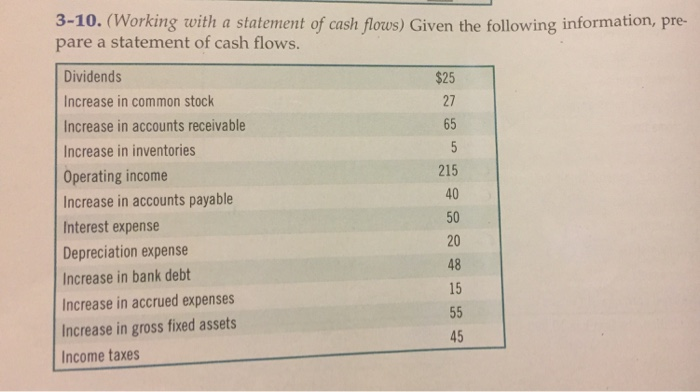

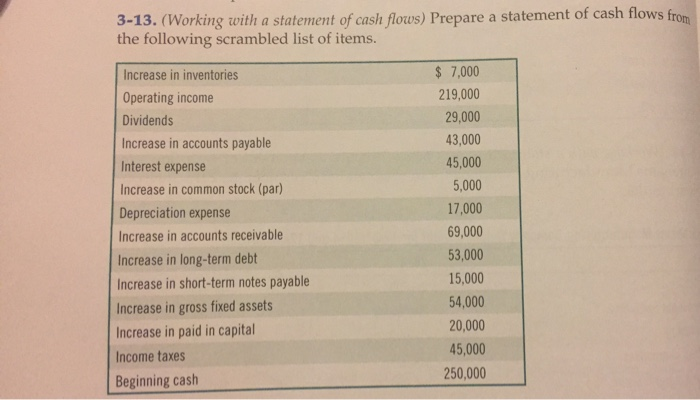

Study Problems 3-1. (Computing earnings per share) If ABC Company earned $280,000 in net income LOI and paid cash dividends of $40,000, what are ABC's earnings per share and divi- dends per share if it has 80,000 shares outstanding? 3-2. (Preparing an income statement) Prepare an income statement and a common sized income statement from the following information. Sales $525,000 Cost of goods sold 200,000 62,000 General and administrative expenses 8,000 Depreciation expenses 12,000 Interest expense 97.200 Income taxes 3-3. (Preparing a balance sheet) Prepare a balance sheet from the following informa. tion. What is the net working capital and debt ratio? Cash $ 50,000 Accounts receivable 42,700 Accounts payable 23,000 Short-term notes payable 10,500 Inventories 40,000 Gross fixed assets 1,280,000 Other current assets 5,000 Long-term debt 200,000 Common stock 490,000 Other assets 15,000 Accumulated depreciation 312,000 Retained earnings LO3 3-8. (Working with a statement of cash flows) Given the following information, prepare a statement of cash flows. Increase in accounts receivable Increase in inventories Operating income Interest expense Increase in accounts payable Dividends Increase in common stock Increase in gross fixed assets Depreciation expense Income taxes Beginning cash 3-10. (Working with a statement of cash flows) Given the following information, pre- pare a statement of cash flows. Dividends Increase in common stock Increase in accounts receivable Increase in inventories Operating income Increase in accounts payable Interest expense Depreciation expense Increase in bank debt Increase in accrued expenses Increase in gross fixed assets Income taxes 3-13. (Working with a statement of cash flows) Prepare a statement of cash flows from the following scrambled list of items. Increase in inventories Operating income Dividends Increase in accounts payable Interest expense Increase in common stock (par) Depreciation expense Increase in accounts receivable Increase in long-term debt Increase in short-term notes payable Increase in gross fixed assets Increase in paid in capital Income taxes Beginning cash $ 7,000 219,000 29,000 43,000 45,000 5,000 17,000 69,000 53,000 15.000 54,000 20,000 45,000 250,000