Question

Study the income statement and balance sheet shown on below and answer the following questions. Supposing that the 2022 sales are projected to increase by

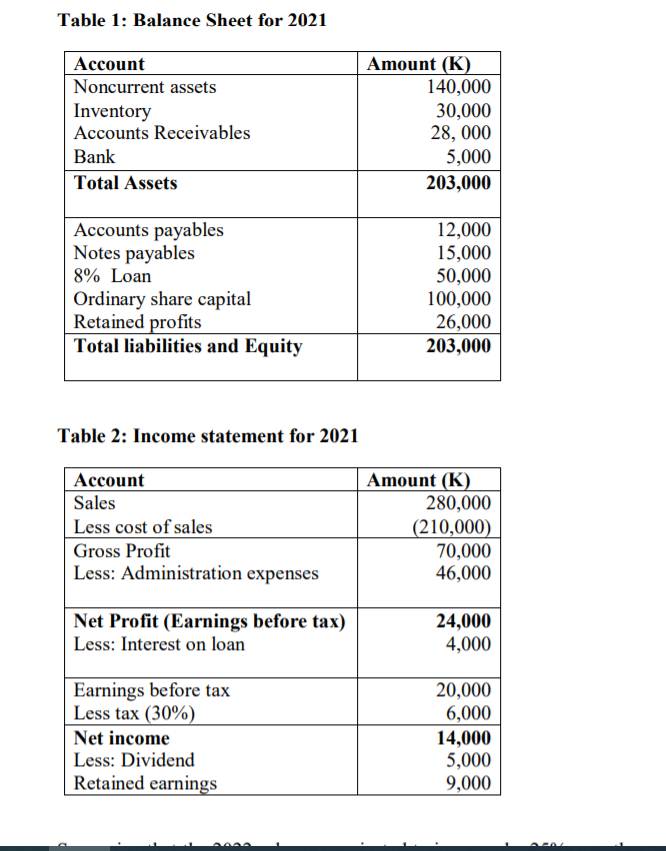

Study the income statement and balance sheet shown on below and answer the following questions.

Supposing that the 2022 sales are projected to increase by 25% over the year 2021 sales and that there is proportional relationship between sales to operating costs, interest expenses, current assets and spontaneous liabilities. The company has been operating at full capacity and planned to maintain the dividend ratio and profit margin position of the previous year. Required i. Using the Percentage of Sales method, compute the additional funds needed (AFN), assuming that the company was operating at full capacity in the year 2021. (8 Marks)

ii. Using the Formula method, compute the additional funds needed, assuming that the company was operating at full capacity in the year 2021. (4 Marks)

ii. Using the Formula method, compute the additional funds needed, assuming that the company was operating at full capacity in the year 2021. (4 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started