Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Study the information below and answer the questions that follow. INFORMATION Use the following data to answer the questions that follow: A company has

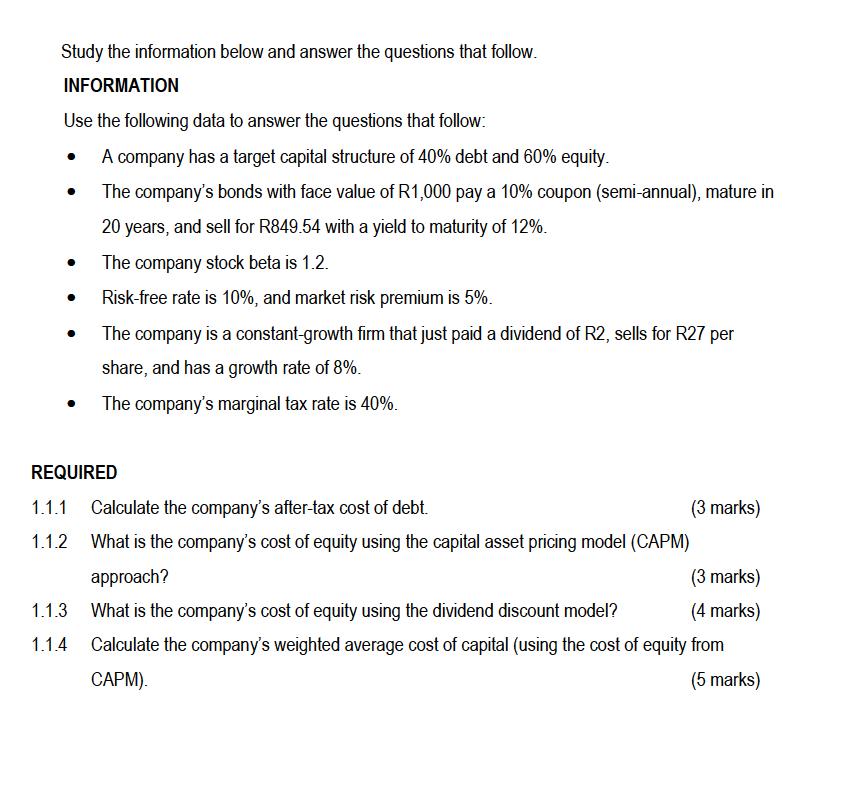

Study the information below and answer the questions that follow. INFORMATION Use the following data to answer the questions that follow: A company has a target capital structure of 40% debt and 60% equity. The company's bonds with face value of R1,000 pay a 10% coupon (semi-annual), mature in 20 years, and sell for R849.54 with a yield to maturity of 12%. The company stock beta is 1.2. 1.1.3 1.1.4 Risk-free rate is 10%, and market risk premium is 5%. The company is a constant-growth firm that just paid a dividend of R2, sells for R27 per share, and has a growth rate of 8%. The company's marginal tax rate is 40%. REQUIRED 1.1.1 Calculate the company's after-tax cost of debt. 1.1.2 What is the company's cost of equity using the capital asset pricing model (CAPM) approach? (3 marks) (4 marks) What is the company's cost of equity using the dividend discount model? Calculate the company's weighted average cost of capital (using the cost of equity from CAPM). (5 marks) (3 marks)

Step by Step Solution

★★★★★

3.56 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

111 The companys aftertax cost of debt is calculated as follows Step 1 Calculate the beforetax cost of debt This is the coupon rate of the bond which is 10 Step 2 Determine the marginal tax rate In th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started