Answered step by step

Verified Expert Solution

Question

1 Approved Answer

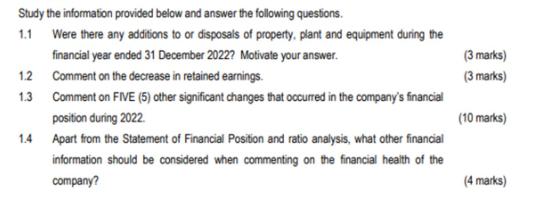

Study the information provided below and answer the following questions. 1.1 Were there any additions to or disposals of property, plant and equipment during

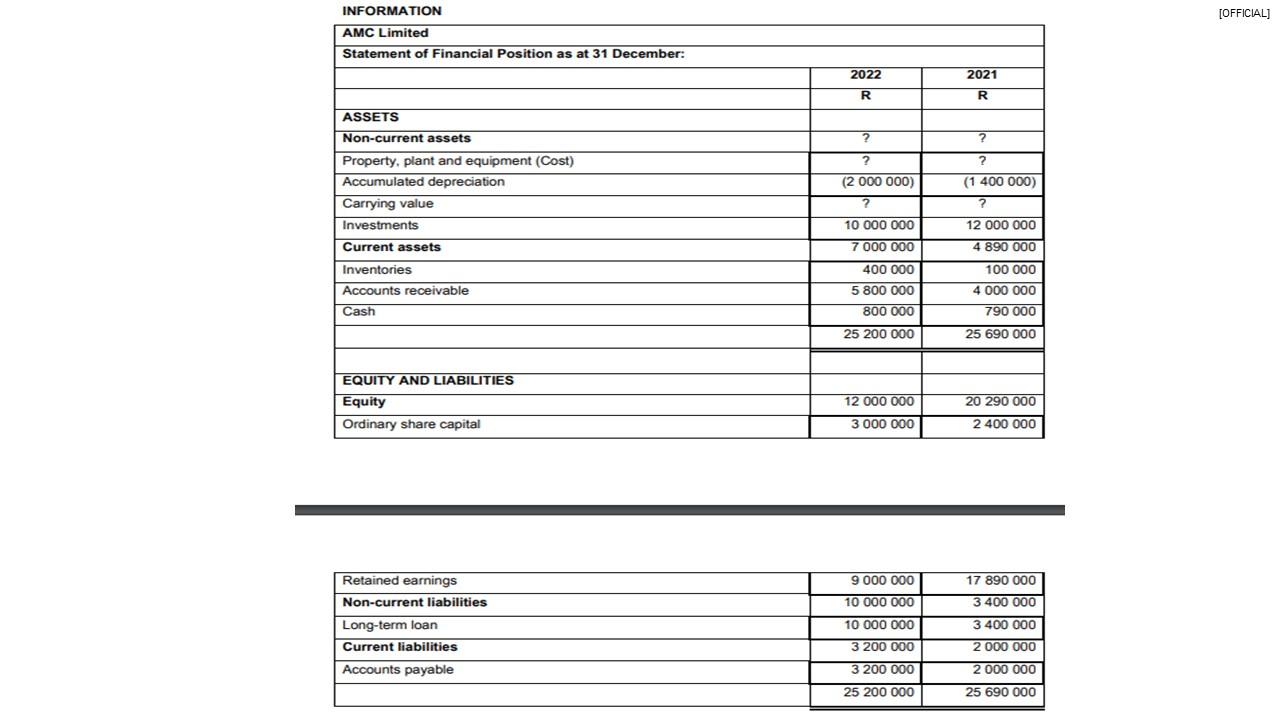

Study the information provided below and answer the following questions. 1.1 Were there any additions to or disposals of property, plant and equipment during the financial year ended 31 December 2022? Motivate your answer. Comment on the decrease in retained earnings. Comment on FIVE (5) other significant changes that occurred in the company's financial position during 2022. 1.2 1.3 1.4 Apart from the Statement of Financial Position and ratio analysis, what other financial information should be considered when commenting on the financial health of the company? (3 marks) (3 marks) (10 marks) (4 marks) INFORMATION AMC Limited Statement of Financial Position as at 31 December: ASSETS Non-current assets Property, plant and equipment (Cost) Accumulated depreciation Carrying value Investments Current assets Inventories Accounts receivable Cash EQUITY AND LIABILITIES Equity Ordinary share capital Retained earnings Non-current liabilities Long-term loan Current liabilities Accounts payable 2022 R ? ? (2 000 000) ? 10 000 000 7 000 000 400 000 5 800 000 800 000 25 200 000 12 000 000 3 000 000 9 000 000 10 000 000 10 000 000 3 200 000 3 200 000 25 200 000 2021 R ? ? (1 400 000) ? 12 000 000 4 890 000 100 000 4 000 000 790 000 25 690 000 20 290 000 2 400 000 17 890 000 3 400 000 3 400 000 2 000 000 2 000 000 25 690 000 [OFFICIAL]

Step by Step Solution

★★★★★

3.39 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

11 There were no additions to or disposals of property plant and equipment during the financial year ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started