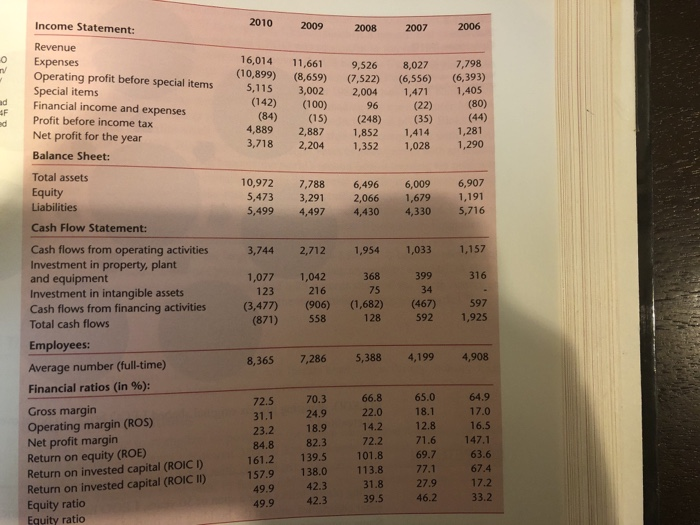

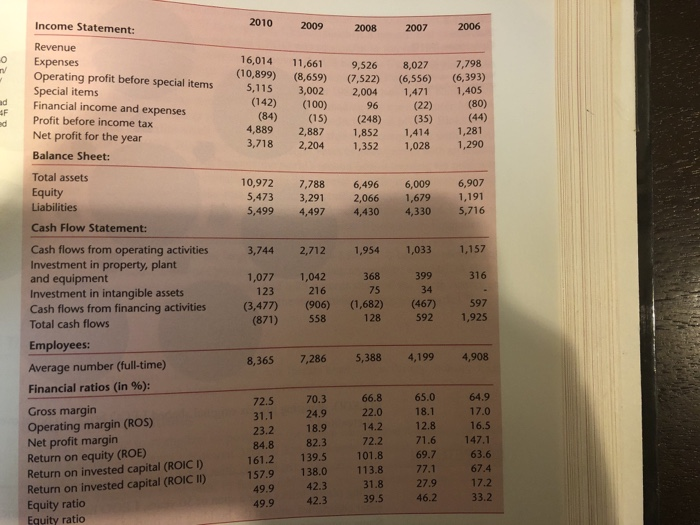

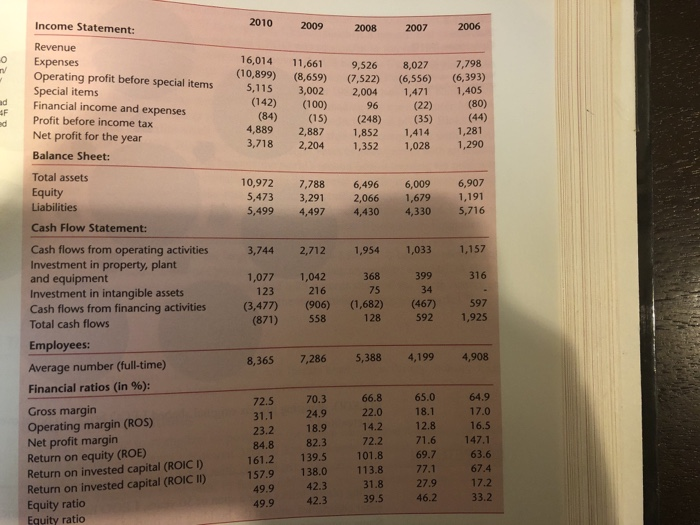

Study the LEGO Group Financial Highlights. How is Legos financial performance between 2006-2010?

Income Statement: 2010 2007 Revenue O Expenses 7,798 (10,899) (8,659) (7,522) (6,556) (6,393) 1,405 16,014 11,661 9,526 8,027 2,0041,471 Operating profit before special items Special items Financial income and expenses Profit before income tax Net profit for the year Balance Sheet: 5,115 3,002 (142) (100) 96 (22) (80) (84) (15) (248) (35) (44) d 4,889 2,887 1,852 1,414 1,281 3,718 2,204 1,352 1,028 1,290 Total assets 10,972 7,788 6,496 6,009 6,907 5,473 3,291 2,066 1,6791,191 4,430 4,3305,716 Liabilities 5,499 4,497 Cash Flow Statement Cash flows from operating activities Investment in property, plant and equipment Investment in intangible assets Cash flows from financing activities3,477) (906) Total cash flows 3,744 2,712 1,954 1,0331,157 1,0771,042 123 216 (1,682)(467)597 592 1,925 (871) 558 Employees: Average number (full-time) Financial ratios (in %): 8,365 7,286 5,388 4,199 4,908 65.0 64.9 17.0 16.5 70.3 66.8 Gross margin Operating margin (ROS) Net profit margin Return on equity (ROE) Return on invested capital (ROIC D Return on invested capital (ROIC I) Equity ratio Equity ratio 31.1 24.9 22.0 18.1 232 18.9142 128 84.8 82.3 72.2 71.6147.1 63.6 67.4 17.2 33.2 161.2 139.5101.8 69.7 157.9138.0113.8 42.3 42.3 31.8 39.5 27.9 49.9 49.9 Income Statement: 2010 2007 Revenue O Expenses 7,798 (10,899) (8,659) (7,522) (6,556) (6,393) 1,405 16,014 11,661 9,526 8,027 2,0041,471 Operating profit before special items Special items Financial income and expenses Profit before income tax Net profit for the year Balance Sheet: 5,115 3,002 (142) (100) 96 (22) (80) (84) (15) (248) (35) (44) d 4,889 2,887 1,852 1,414 1,281 3,718 2,204 1,352 1,028 1,290 Total assets 10,972 7,788 6,496 6,009 6,907 5,473 3,291 2,066 1,6791,191 4,430 4,3305,716 Liabilities 5,499 4,497 Cash Flow Statement Cash flows from operating activities Investment in property, plant and equipment Investment in intangible assets Cash flows from financing activities3,477) (906) Total cash flows 3,744 2,712 1,954 1,0331,157 1,0771,042 123 216 (1,682)(467)597 592 1,925 (871) 558 Employees: Average number (full-time) Financial ratios (in %): 8,365 7,286 5,388 4,199 4,908 65.0 64.9 17.0 16.5 70.3 66.8 Gross margin Operating margin (ROS) Net profit margin Return on equity (ROE) Return on invested capital (ROIC D Return on invested capital (ROIC I) Equity ratio Equity ratio 31.1 24.9 22.0 18.1 232 18.9142 128 84.8 82.3 72.2 71.6147.1 63.6 67.4 17.2 33.2 161.2 139.5101.8 69.7 157.9138.0113.8 42.3 42.3 31.8 39.5 27.9 49.9 49.9