Question: Studying the case given below, answer this question in detail: Ralph Lauren China aims to increase its annual sales to US$500 million within the next

Studying the case given below, answer this question in detail: Ralph Lauren China aims to increase its annual sales to US$500 million within the next 3 years. Who should the company target to help the company achieve this objective? Give reasons for your answer. Give at least 4-5 targets with reasons.

TEMPLATE:

Target

Reasons

Target

Reasons

Target

Reasons

CASE:

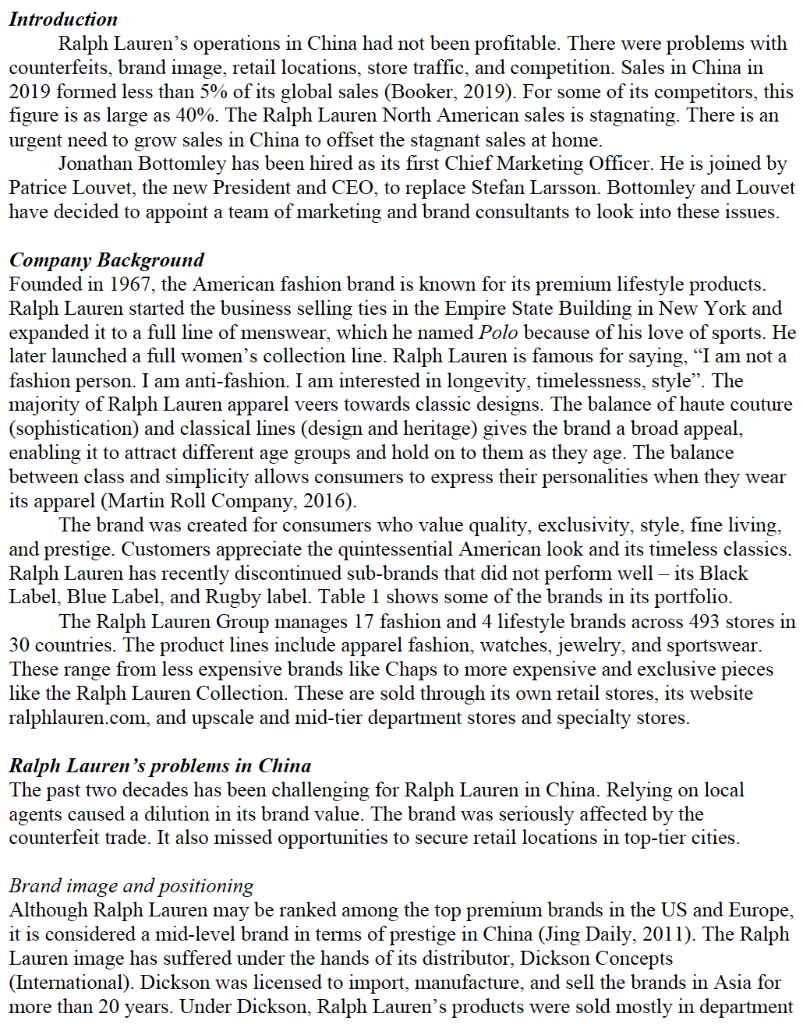

Introduction Ralph Lauren's operations in China had not been profitable. There were problems with counterfeits, brand image, retail locations, store traffic, and competition. Sales in China in 2019 formed less than 5% of its global sales (Booker, 2019). For some of its competitors, this figure is as large as 40%. The Ralph Lauren North American sales is stagnating. There is an urgent need to grow sales in China to offset the stagnant sales at home. Jonathan Bottomley has been hired as its first Chief Marketing Officer. He is joined by Patrice Louvet, the new President and CEO, to replace Stefan Larsson. Bottomley and Louvet have decided to appoint a team of marketing and brand consultants to look into these issues. Company Background Founded in 1967, the American fashion brand is known for its premium lifestyle products. Ralph Lauren started the business selling ties in the Empire State Building in New York and expanded it to a full line of menswear, which he named Polo because of his love of sports. He later launched a full women's collection line. Ralph Lauren is famous for saying, I am not a fashion person. I am anti-fashion. I am interested in longevity, timelessness, style. The majority of Ralph Lauren apparel veers towards classic designs. The balance of haute couture (sophistication) and classical lines (design and heritage) gives the brand a broad appeal, enabling it to attract different age groups and hold on to them as they age. The balance between class and simplicity allows consumers to express their personalities when they wear its apparel (Martin Roll Company, 2016). The brand was created for consumers who value quality, exclusivity, style, fine living, and prestige. Customers appreciate the quintessential American look and its timeless classics. Ralph Lauren has recently discontinued sub-brands that did not perform well its Black Label, Blue Label, and Rugby label. Table 1 shows some of the brands in its portfolio. The Ralph Lauren Group manages 17 fashion and 4 lifestyle brands across 493 stores in 30 countries. The product lines include apparel fashion, watches, jewelry, and sportswear. These range from less expensive brands like Chaps to more expensive and exclusive pieces like the Ralph Lauren Collection. These are sold through its own retail stores, its website ralphlauren.com, and upscale and mid-tier department stores and specialty stores. Ralph Lauren's problems in China The past two decades has been challenging for Ralph Lauren in China. Relying on local agents caused a dilution in its brand value. The brand was seriously affected by the counterfeit trade. It also missed opportunities to secure retail locations in top-tier cities. Brand image and positioning Although Ralph Lauren may be ranked among the top premium brands in the US and Europe, it is considered a mid-level brand in terms of prestige in China (Jing Daily, 2011). The Ralph Lauren image has suffered under the hands of its distributor, Dickson Concepts (International). Dickson was licensed to import, manufacture, and sell the brands in Asia for more than 20 years. Under Dickson, Ralph Lauren's products were sold mostly in department stores. These carried its Polo, business shirts, knitwear, and other items from its less expensive lines. Table 1: A selection of Ralph Lauren's sub-brands Brand Description Ralph Lauren Top-end label, most expensive label. Traditional style, luxurious, Purple Label tailored apparel inspired by London's Saville Row. Made from superior materials and often in smaller runs. Often crafted in Italy by fine suit makers and tailors. Ralph Lauren Black Label Second most prestigious label, priced higher than Polo Ralph Lauren but lower than Purple Label. It is more fashion forward, featuring slimmer cuts, more luxurious finishes than most Polo products. Upscale department store distribution. (Discontinued) Polo Ralph Lauren Premium brand, men's Polo shirts, sportswear and tailored clothing for men. Ralph Lauren Collection Top-end brand, timeless, sophisticated for the fashion conscious woman. Ralph Lauren Blue Label Less expensive, younger styling and fit. Upscale distribution. Quality is mixed. (Discontinued) Lauren Ralph Lauren Moderately priced women's clothing, ranging from formal office wear to casual, preppy gear, bags and footwear. Broad-based department store distribution. Double RL (RRL) Rustic, outdoor workwear for the younger customer. Rugby Lower price point, preppy (rugby) inspired lifestyle apparel in edgier styles for male and female aged 16 to 25. (Discontinued) Chaps Similar to Lauren Ralph Lauren, casual sportswear and dresses at a slightly lower price point for men, women and children. Not sold by Ralph Lauren directly. Source: Martin Roll Company (2016) Some local agents also mixed the prices of its Purple Label, Black Label, and Blue Label, leaving customers confused about the brand's positioning. In fact, each of these sub- brands targeted a different market segment, including the luxury, high-end business, and youth-oriented fashion segments. When low-end items are mixed with higher-end lines, it is difficult to create a distinctive and upmarket brand image. Inside its stores, Ralph Lauren was sending mixed messages to customers. One store used a Louis Vuitton trunk as part of its dcor. Customers wondered why a competitor's product was put on display in a Ralph Lauren store. The staff explained that the Louis Vuitton trunk was intended to display a certain lifestyle. For many Chinese consumers who cannot distinguish luxury brands from lifestyle, this message is confusing. Many customers only care about price and brand logos. Another example involved its made-in-China products. One store in a luxury mall stocks only products with Made in China labels. Customers will be confused when they see Ralph Lauren promote its top Purple Label in some locations while in another store, all the merchandise is made in China. Customers looking for luxury products want to buy only European or foreign-made products. Locally made products are less desirable (Coghlan, 2011). Threats from counterfeit products Ralph Lauren is one of the most pirated fashion brands. Its pony logo is easy to embroider, and appears on fake luxury brands that are sold on Silk Street in Beijing and Wanda Street in Shenyang. Some of these pirated items are poor quality. Wrong retail store locations In major cities, the best locations are already occupied by other luxury brands. So local agents chose locations in rapidly developing second and third tier cities. Brand awareness is low in these cities and Ralph Lauren failed to make much headway in second and third tier cities. To secure a spot in a premium mall, Ralph Lauren needs to convince the developer that it is a top luxury brand able to generate sales as well as draw customers. But other European luxury tenants that do not consider it a luxury brand may persuade the developer against leasing space to Ralph Lauren. China's luxury market Chinese consumers accounted for 33% of the global luxury market in 2018, spending 770 billion yuan (US$115 billion), at home and abroad. This figure is expected to double to 1.2 trillion yuan by 2025. The growth is primarily driven by the increase in the upper middle- class (households earning between US$2600 and US$3900 per month), which is expected to reach 350 million by 2025. The affluent class (households earning above US$3900) will almost triple, increasing to 65 million by 2025 (McKinsey & Co, 2019). The middle class is expected to represent 65% of all Chinese households by 2027. This expanding group will continue to produce first time buyers of luxury goods. Luxury-consuming households spend an average of 80,000 yuan per year. The luxury market posted 20% growth in 2018. The Central Government encouraged domestic consumption and financial institutions actively promoted their credit cards, with the number of credit cards issued expected to reach 800 million by 2020. The US-China trade war, lower import taxes, yuan devaluation, stricter controls over the gray markets, and the willingness of brands to lower prices are encouraging more consumers to purchase locally. Burberry, Gucci, Moncler, and Louis Vuitton have cut the prices for some of their products by 3 to 5% Consumers made 27% of their luxury purchases locally in 2018, an increase of 23% in 2015. This is expected to further increase to 50% by 2025 (Deloitte, 2017). Noting this trend, luxury brands added purchasing channels. Consumers are likely to shop overseas or resort to daigou if the price differential is greater than 500 yuan (McKinsey & Co., 2019). Daigou, or "to buy on behalf, refers to the purchasing of sought-after goods for resale in one's home country Luxury brands are still viewed by many as a way to enhance social status and to show off success and wealth or to conform to social norms. But there are signs that buyers are becoming more rational and beginning to focus on product design, quality, and brand heritage To distinguish themselves from other buyers and to match the brand with their lifestyle, some now prefer low-key, smaller brands, designer labels, or special offerings. The government's anti-graft drive has eliminated expensive gift-giving to government officials, which has eliminatedor significantly decreasedthis motivation for purchasing luxury items. Rather, consumers now buy for their own pleasure and for family and friends. Buyers today are younger, well-travelled, and digitally savvy. They place more importance on craftsmanship, understated elegance, or fun (Wang, 2019). Department stores and clothing specialist retailers are the major channels for branded apparel. Along with the development of modern shopping malls and arcades in Tiers 1 to 3 cities, a few high streets" (e.g., Hangzhou Euro Street) have emerged in major urban cities. Premium retailer brands have opened stores in these places. But in lower tier cities, the major stores for apparel are still located along the main streets in shopping areas. Department stores remain important, especially in low-tier cities as they offer a place for families to spend time together on weekends. Lower-tier cities are increasing in size, population, and income. Improved infrastructure and recent government policies could triple consumption in these cities between 2017 to 2030 (Morgan Stanley, 2018). The key drivers of growth in population and consumption are lower living costs and a more flexible hukou (household registration system designed to control domestic migration) policy. The latter grants easier access to social security system in lower- tier cities, reducing the need for savings and making the cities more attractive to migrant workers. Competition Foreign brands dominate the market. A McKinsey survey showed that European brands have the highest recognition and are most strongly desired (McKinsey & Co., 2019). In contrast, more than one-half the respondents could not identify the country of origin of North American brands such as Brooks Brothers, Canada Goose, and Theory. Because Ralph Lauren offers labels that range from relatively inexpensive to exclusive, its competitors come from both the middle and luxury segments. Repositioning it as a more premium brand would bring it into direct competition with Burberry, Gucci, and similar companies. Burberry Burberry, a British luxury fashion house, was founded in 1856. China accounted for 40% of its total sales in 2019 (McCormick and Eley, 2019). Burberry operates 61 stores located mainly in Tier 1 cities. Its classic trench coats, menswear, and women's designer apparel are the key drivers of sales in China. However, its distinctive tartan pattern is widely counterfeited. It has since revamped its design and logo, and the new look monogram by Ricardo Tisci is well-received in China, attracting millennials. Targeting the upper middle class, Burberry adopts premium pricing. Burberry is well known for its digital strategy and social media campaigns. It was the first luxury brand to put products on the WeChat platform, allowing customers to pay through WeChat Pay. Kris Wu, an actor and singer popular with millennials, is its brand ambassador. Burberry launched a new collection, the Burberry x Kris Wu Edit 2017, to provide a fresh interpretation of its classic items and a youthful touch to the brand. Sales growth was weak in 2019. Burberry refurbished some stores and planned to close 38 stores in secondary locations. It entered into an exclusive partnership with Tencent to develop social retail. The store, powered by Tencent technology, to open in Shenzhen, offers unique experiences that connect customers' social and online lives to their physical environments. Gucci The Italian brand was founded in 1921. It entered China in 1997, opening stores in Beijing and Shanghai. By 2014, Gucci had 59 stores in Tier 1 to 3 cities. It has an online store (Gucci.cn) offering the full range of products from its current season's collection, including bags, shoes, apparel and jewelry. Its ready-to-wear collections has Chinese-inspired elements. Gucci makes sure that it stocks enough entry-level products, such as smaller bags and belts, for millennials (Cooper, 2019). To encourage purchases in China, it does not pass on the full import tax to customers. Prices are only 10-13% higher than those in other countries. Gucci enjoys strong brand awareness in China, a result of its successful brand building campaigns. It devotes more than 50% of its marketing spending on digital channels, co- operating with Tencent to leverage the tech giant's access to abundant data and smart retail. "Gucci Inspiration Map" is a short film released on Tencent Video, featuring popular Chinese Key Opinion Leaders (KOLs) to attract younger consumers. In 2020, Gucci released a campaign video on Douyin (Chinese version of Tik Tok but more advanced in the area of e- commerce). Gucci will use this channel to share its brand legacy videos and stories to attract millennials and Generation Z who love short-video formats. Brooks Brothers Established in 1818, Brooks Brothers touts itself as America's oldest retail brand. Forty of the United States' 45 Presidents have worn their suits. In 2016, Brooks Brothers shifted its distribution from Dickson Concepts, which was a licensee model, to a directly operated one, partnering with Walton Brown, a premier fashion retail and brand management group. Dickson Concepts had set higher prices but the stores it established were not in the best locations. China is Brooks Brothers' third largest market where it has 20 retail stores and 20 outlets. Brooks Brothers is looking to modify its store locations and rebrand, by repositioning stores alongside recognized luxury retailers, such as Gucci, Givenchy, and Guerlain, though not necessarily at the same price-point. Its biggest challenge is that customers have little knowledge of the brand and will therefore judge its quality based on its price. Brooks Brothers has an official flagship store on JD.com, a trusted platform for high- end, fashion conscious Chinese customers. JD.com provides a comprehensive omnichannel luxury experience. With the JD Luxury Express "white glove" service, professionally-dressed couriers, driven in electric cars, will hand-deliver purchases to consumers' homes. Brooks Brothers also sells its suits, apparel, and its more affordable line Red Fleece on Alibaba's Tmall. China's luxury consumers China's post-1980s (born in the 1980s) generation formed the largest group (10.2 million or 43%) of luxury buyers in 2018, accounting for an annual spending of 415 billion yuan (or 56% of total spending on luxury) in 2018. The post--1965-and-1970s generation (Generation X), the second largest group (7 million or 29%), spent 185 billion yuan (or 22% of total spending on luxury) in 2018. The post-1990s (Generation Z) generation is fast catching up to the previous generation in spending power. This group of 6.7 million consumers (28%) spent 170 billion yuan (or 23% of total spending) on luxury items in 2018 (McKinsey & Co., 2019). China's luxury consumers are getting younger, with the average age now at 25 years. Demand for luxury is driven by the post-1980s generation, who broadly map to Generation Y. This group benefited the most from the country's rapid economic growth. They spend an average of 41,000 yuan per year on luxury. The post-1990s consumers, enticed by luxury streetwear, spend 25,000 yuan a year on luxury. Born under the one-child policy, these dynamic and digitally engrossed consumers from urban middle-class households have parents who are willing to support their luxury spending. The post-1980s and post-1990s groups constitute 415 million or 34% of China's population (Fung Business Intelligence, 2017). Millennials (born between 1977-2000) buy luxury to feel different rather than to fit in with society. They look for unique ways to express themselves and are eager to embrace innovative trends such as the convergence of high fashion and sportswear. They are active on social media and fond of online shopping, exploring brands online and offline. They discuss issues such as brand reputation and price comparison with friends. They want to be seen and photographed in the latest styles (McKinsey & Co., 2019). To accommodate these changing demands, luxury brands have to constantly update their styles or use creative marketing to create the illusion of newness. Millennials value design, fabric, and the production process, preferring foreign brands from France and Italy, followed by Great Britain, Japan, and the US They are better-educated than earlier generations and 70% of this group owns homes. If luxury brands are to host events, younger consumers would prefer to attend fashion shows and art-related gatherings. Louis Vuitton's Volez Voguez Voyagez, a museum- quality exhibition in Shanghai in 2018 was very successful. The event created a sense of exoticism for guests dreaming of an escape from the depths of China's winter (McKinsey & Co., 2019). Digitalization and buying behavior Young consumers in Tier 1 to 3 cities make 92% of their luxury purchases offline, usually in premium malls for the high-quality service and experience. They also visit brand stores, duty- free shops and other outlets. The post-1990s generation who prefer affordable luxury tend to visit duty-free stores when they travel abroad. It is expected that offline channels will continue to dominate luxury sales. There are four types of online channels for luxury. (1) Brand-owned channels (e.g., Brand.com, brand app, WeChat public account, and WeChat mini program) offer the richest experience, content flexibility and ownership of customer data. (2) Cooperator channels (e.g., Tmall flagship stores and WeChat commerce) give brands some control which allows brands to benefit to some degree from platform traffic. (3) Aggregators (e.g., Tmall's Luxury Pavilion and JD.com's Toplife) enable brands to outsource the building and operating of the channels. Tmall's Luxury Pavilion is exclusive to a group of ultra-rich consumers. Luxury Pavilion and JD.com's Toplife can also share the brand's design concepts with users. Furthermore, JD.com can provide one-stop logistics services as has dedicated warehouse, aircraft, and vehicles. Finally, (4) luxury vertical sites (e.g. Farfetch, Mei.com, Net-a-porter, and Secoo) allow brands to sell goods at a discount but brands have less control over customer experience and how products are presented, which can affect image. Many brands are more active in brand-owned channels but less in the other types of channels. Brands often use digital and influencer marketing. Since 2015, the top 40 luxury brands have nearly doubled their marketing spending on digital marketing, devoting 40% to 70% of their digital marketing budget to WeChat. The top 40 luxury brands use WeChat to identify and target consumers for online and offline sales, which allows consumers to make bookings, obtain coupons, and manage their membership cards. Key Opinion Leaders can help to create buzz for product launches. Burberry collaborated with Mr. Bags to launch a special edition via WeChat and the DK88 hand bags were sold out in less than ten minutes. Luxury consumers consult both online and offline information sources on luxury and fashion three to five hours per week. These consumers seek information on the latest products, the celebrities who promote the brands, and their lifestyles. They also check peer reviews to read about the product experiences of other consumers. For purchase decision, the most impactful source of information is the in-person experience in the store (McKinsey & Co., 2019). Sales staff can provide purchase advice and suggestions, sometimes via WeChat. Post- 1980s and 1990s consumers value staff who provide product information updates and help in selecting accessories based on their knowledge of customer personality, preferences, or past purchases. They appreciate staff who could help them gain access to fashion shows or parties. Post-1965s and 1970s consumers, in contrast, prefer staff who understand their personal life, family situation, and emotional needs. Millennials are usually able to make purchasing decisions in less than a week. Approximately one-half of millennials have decided on their choice before stepping into the store. But they may switch to a different product if they spot new items in the store that they cannot resist. The post-1965s and 1970s group take a little longer than millennials to decide. This group prefers to shop for luxury in premium department stores. Repositioning the brand After terminating its relationship with Dickson Concepts, Ralph Lauren closed 95 outlets (about 60% of its stores). It pulled all products out of China, except for its high-end goods, to re-establish its positioning as a luxury brand. It competed with other luxury brands for premium retail space and sales staff. But this exclusive luxury positioning could not change consumers' perception of the brand. For years, they have been conditioned to associate it with lower quality. Its numerous lines and haphazard pricing left them confused about its positioning. Many still question whether Ralph Lauren is even popular outside of China or if it is indeed a luxury brand. Some have seen its Polo shirts but have little knowledge of its other products. The repositioning and the ensuing competition with European luxury brands contributed to its losses. Sales were US$221 million in 2019, a mere 3.5% of the company's total revenue. Louvet thinks a new strategy is needed. Should Ralph Lauren focus on its more affordable Polo brand? This could help to drive sales and profits. After all, brand awareness of Polo is a high 83%, beating many of its competitors with higher sales. Or should Ralph Lauren focus on high-end luxury (e.g., its Purple Label and Ralph Lauren Collection) and try to improve its distribution network? Not all its customers reside in top tier cities. The company now has 106 stores, of which 13 are in Beijing and 18 in Shanghai. It needs to be careful with costs. Earlier, a significant number of underperforming stores were closed. Besides flagship stores in premium locations, how else should Ralph Lauren communicate its luxury positioning? Can digitalization help? If so, how? The goal for the China operations is to increase annual sales to US$500 million within the next three years. What else should it do to achieve this? Ralph Lauren has focused on the middle-class. Currently, shoppers in its stores are evenly split between men and women and the average age is 34 years. And there is this problem of counterfeit products. What should be done to fight these? Louvet hopes the consultants will provide some solutions. Louvet and Bottomley will travel to Shanghai to meet with them next week. Introduction Ralph Lauren's operations in China had not been profitable. There were problems with counterfeits, brand image, retail locations, store traffic, and competition. Sales in China in 2019 formed less than 5% of its global sales (Booker, 2019). For some of its competitors, this figure is as large as 40%. The Ralph Lauren North American sales is stagnating. There is an urgent need to grow sales in China to offset the stagnant sales at home. Jonathan Bottomley has been hired as its first Chief Marketing Officer. He is joined by Patrice Louvet, the new President and CEO, to replace Stefan Larsson. Bottomley and Louvet have decided to appoint a team of marketing and brand consultants to look into these issues. Company Background Founded in 1967, the American fashion brand is known for its premium lifestyle products. Ralph Lauren started the business selling ties in the Empire State Building in New York and expanded it to a full line of menswear, which he named Polo because of his love of sports. He later launched a full women's collection line. Ralph Lauren is famous for saying, I am not a fashion person. I am anti-fashion. I am interested in longevity, timelessness, style. The majority of Ralph Lauren apparel veers towards classic designs. The balance of haute couture (sophistication) and classical lines (design and heritage) gives the brand a broad appeal, enabling it to attract different age groups and hold on to them as they age. The balance between class and simplicity allows consumers to express their personalities when they wear its apparel (Martin Roll Company, 2016). The brand was created for consumers who value quality, exclusivity, style, fine living, and prestige. Customers appreciate the quintessential American look and its timeless classics. Ralph Lauren has recently discontinued sub-brands that did not perform well its Black Label, Blue Label, and Rugby label. Table 1 shows some of the brands in its portfolio. The Ralph Lauren Group manages 17 fashion and 4 lifestyle brands across 493 stores in 30 countries. The product lines include apparel fashion, watches, jewelry, and sportswear. These range from less expensive brands like Chaps to more expensive and exclusive pieces like the Ralph Lauren Collection. These are sold through its own retail stores, its website ralphlauren.com, and upscale and mid-tier department stores and specialty stores. Ralph Lauren's problems in China The past two decades has been challenging for Ralph Lauren in China. Relying on local agents caused a dilution in its brand value. The brand was seriously affected by the counterfeit trade. It also missed opportunities to secure retail locations in top-tier cities. Brand image and positioning Although Ralph Lauren may be ranked among the top premium brands in the US and Europe, it is considered a mid-level brand in terms of prestige in China (Jing Daily, 2011). The Ralph Lauren image has suffered under the hands of its distributor, Dickson Concepts (International). Dickson was licensed to import, manufacture, and sell the brands in Asia for more than 20 years. Under Dickson, Ralph Lauren's products were sold mostly in department stores. These carried its Polo, business shirts, knitwear, and other items from its less expensive lines. Table 1: A selection of Ralph Lauren's sub-brands Brand Description Ralph Lauren Top-end label, most expensive label. Traditional style, luxurious, Purple Label tailored apparel inspired by London's Saville Row. Made from superior materials and often in smaller runs. Often crafted in Italy by fine suit makers and tailors. Ralph Lauren Black Label Second most prestigious label, priced higher than Polo Ralph Lauren but lower than Purple Label. It is more fashion forward, featuring slimmer cuts, more luxurious finishes than most Polo products. Upscale department store distribution. (Discontinued) Polo Ralph Lauren Premium brand, men's Polo shirts, sportswear and tailored clothing for men. Ralph Lauren Collection Top-end brand, timeless, sophisticated for the fashion conscious woman. Ralph Lauren Blue Label Less expensive, younger styling and fit. Upscale distribution. Quality is mixed. (Discontinued) Lauren Ralph Lauren Moderately priced women's clothing, ranging from formal office wear to casual, preppy gear, bags and footwear. Broad-based department store distribution. Double RL (RRL) Rustic, outdoor workwear for the younger customer. Rugby Lower price point, preppy (rugby) inspired lifestyle apparel in edgier styles for male and female aged 16 to 25. (Discontinued) Chaps Similar to Lauren Ralph Lauren, casual sportswear and dresses at a slightly lower price point for men, women and children. Not sold by Ralph Lauren directly. Source: Martin Roll Company (2016) Some local agents also mixed the prices of its Purple Label, Black Label, and Blue Label, leaving customers confused about the brand's positioning. In fact, each of these sub- brands targeted a different market segment, including the luxury, high-end business, and youth-oriented fashion segments. When low-end items are mixed with higher-end lines, it is difficult to create a distinctive and upmarket brand image. Inside its stores, Ralph Lauren was sending mixed messages to customers. One store used a Louis Vuitton trunk as part of its dcor. Customers wondered why a competitor's product was put on display in a Ralph Lauren store. The staff explained that the Louis Vuitton trunk was intended to display a certain lifestyle. For many Chinese consumers who cannot distinguish luxury brands from lifestyle, this message is confusing. Many customers only care about price and brand logos. Another example involved its made-in-China products. One store in a luxury mall stocks only products with Made in China labels. Customers will be confused when they see Ralph Lauren promote its top Purple Label in some locations while in another store, all the merchandise is made in China. Customers looking for luxury products want to buy only European or foreign-made products. Locally made products are less desirable (Coghlan, 2011). Threats from counterfeit products Ralph Lauren is one of the most pirated fashion brands. Its pony logo is easy to embroider, and appears on fake luxury brands that are sold on Silk Street in Beijing and Wanda Street in Shenyang. Some of these pirated items are poor quality. Wrong retail store locations In major cities, the best locations are already occupied by other luxury brands. So local agents chose locations in rapidly developing second and third tier cities. Brand awareness is low in these cities and Ralph Lauren failed to make much headway in second and third tier cities. To secure a spot in a premium mall, Ralph Lauren needs to convince the developer that it is a top luxury brand able to generate sales as well as draw customers. But other European luxury tenants that do not consider it a luxury brand may persuade the developer against leasing space to Ralph Lauren. China's luxury market Chinese consumers accounted for 33% of the global luxury market in 2018, spending 770 billion yuan (US$115 billion), at home and abroad. This figure is expected to double to 1.2 trillion yuan by 2025. The growth is primarily driven by the increase in the upper middle- class (households earning between US$2600 and US$3900 per month), which is expected to reach 350 million by 2025. The affluent class (households earning above US$3900) will almost triple, increasing to 65 million by 2025 (McKinsey & Co, 2019). The middle class is expected to represent 65% of all Chinese households by 2027. This expanding group will continue to produce first time buyers of luxury goods. Luxury-consuming households spend an average of 80,000 yuan per year. The luxury market posted 20% growth in 2018. The Central Government encouraged domestic consumption and financial institutions actively promoted their credit cards, with the number of credit cards issued expected to reach 800 million by 2020. The US-China trade war, lower import taxes, yuan devaluation, stricter controls over the gray markets, and the willingness of brands to lower prices are encouraging more consumers to purchase locally. Burberry, Gucci, Moncler, and Louis Vuitton have cut the prices for some of their products by 3 to 5% Consumers made 27% of their luxury purchases locally in 2018, an increase of 23% in 2015. This is expected to further increase to 50% by 2025 (Deloitte, 2017). Noting this trend, luxury brands added purchasing channels. Consumers are likely to shop overseas or resort to daigou if the price differential is greater than 500 yuan (McKinsey & Co., 2019). Daigou, or "to buy on behalf, refers to the purchasing of sought-after goods for resale in one's home country Luxury brands are still viewed by many as a way to enhance social status and to show off success and wealth or to conform to social norms. But there are signs that buyers are becoming more rational and beginning to focus on product design, quality, and brand heritage To distinguish themselves from other buyers and to match the brand with their lifestyle, some now prefer low-key, smaller brands, designer labels, or special offerings. The government's anti-graft drive has eliminated expensive gift-giving to government officials, which has eliminatedor significantly decreasedthis motivation for purchasing luxury items. Rather, consumers now buy for their own pleasure and for family and friends. Buyers today are younger, well-travelled, and digitally savvy. They place more importance on craftsmanship, understated elegance, or fun (Wang, 2019). Department stores and clothing specialist retailers are the major channels for branded apparel. Along with the development of modern shopping malls and arcades in Tiers 1 to 3 cities, a few high streets" (e.g., Hangzhou Euro Street) have emerged in major urban cities. Premium retailer brands have opened stores in these places. But in lower tier cities, the major stores for apparel are still located along the main streets in shopping areas. Department stores remain important, especially in low-tier cities as they offer a place for families to spend time together on weekends. Lower-tier cities are increasing in size, population, and income. Improved infrastructure and recent government policies could triple consumption in these cities between 2017 to 2030 (Morgan Stanley, 2018). The key drivers of growth in population and consumption are lower living costs and a more flexible hukou (household registration system designed to control domestic migration) policy. The latter grants easier access to social security system in lower- tier cities, reducing the need for savings and making the cities more attractive to migrant workers. Competition Foreign brands dominate the market. A McKinsey survey showed that European brands have the highest recognition and are most strongly desired (McKinsey & Co., 2019). In contrast, more than one-half the respondents could not identify the country of origin of North American brands such as Brooks Brothers, Canada Goose, and Theory. Because Ralph Lauren offers labels that range from relatively inexpensive to exclusive, its competitors come from both the middle and luxury segments. Repositioning it as a more premium brand would bring it into direct competition with Burberry, Gucci, and similar companies. Burberry Burberry, a British luxury fashion house, was founded in 1856. China accounted for 40% of its total sales in 2019 (McCormick and Eley, 2019). Burberry operates 61 stores located mainly in Tier 1 cities. Its classic trench coats, menswear, and women's designer apparel are the key drivers of sales in China. However, its distinctive tartan pattern is widely counterfeited. It has since revamped its design and logo, and the new look monogram by Ricardo Tisci is well-received in China, attracting millennials. Targeting the upper middle class, Burberry adopts premium pricing. Burberry is well known for its digital strategy and social media campaigns. It was the first luxury brand to put products on the WeChat platform, allowing customers to pay through WeChat Pay. Kris Wu, an actor and singer popular with millennials, is its brand ambassador. Burberry launched a new collection, the Burberry x Kris Wu Edit 2017, to provide a fresh interpretation of its classic items and a youthful touch to the brand. Sales growth was weak in 2019. Burberry refurbished some stores and planned to close 38 stores in secondary locations. It entered into an exclusive partnership with Tencent to develop social retail. The store, powered by Tencent technology, to open in Shenzhen, offers unique experiences that connect customers' social and online lives to their physical environments. Gucci The Italian brand was founded in 1921. It entered China in 1997, opening stores in Beijing and Shanghai. By 2014, Gucci had 59 stores in Tier 1 to 3 cities. It has an online store (Gucci.cn) offering the full range of products from its current season's collection, including bags, shoes, apparel and jewelry. Its ready-to-wear collections has Chinese-inspired elements. Gucci makes sure that it stocks enough entry-level products, such as smaller bags and belts, for millennials (Cooper, 2019). To encourage purchases in China, it does not pass on the full import tax to customers. Prices are only 10-13% higher than those in other countries. Gucci enjoys strong brand awareness in China, a result of its successful brand building campaigns. It devotes more than 50% of its marketing spending on digital channels, co- operating with Tencent to leverage the tech giant's access to abundant data and smart retail. "Gucci Inspiration Map" is a short film released on Tencent Video, featuring popular Chinese Key Opinion Leaders (KOLs) to attract younger consumers. In 2020, Gucci released a campaign video on Douyin (Chinese version of Tik Tok but more advanced in the area of e- commerce). Gucci will use this channel to share its brand legacy videos and stories to attract millennials and Generation Z who love short-video formats. Brooks Brothers Established in 1818, Brooks Brothers touts itself as America's oldest retail brand. Forty of the United States' 45 Presidents have worn their suits. In 2016, Brooks Brothers shifted its distribution from Dickson Concepts, which was a licensee model, to a directly operated one, partnering with Walton Brown, a premier fashion retail and brand management group. Dickson Concepts had set higher prices but the stores it established were not in the best locations. China is Brooks Brothers' third largest market where it has 20 retail stores and 20 outlets. Brooks Brothers is looking to modify its store locations and rebrand, by repositioning stores alongside recognized luxury retailers, such as Gucci, Givenchy, and Guerlain, though not necessarily at the same price-point. Its biggest challenge is that customers have little knowledge of the brand and will therefore judge its quality based on its price. Brooks Brothers has an official flagship store on JD.com, a trusted platform for high- end, fashion conscious Chinese customers. JD.com provides a comprehensive omnichannel luxury experience. With the JD Luxury Express "white glove" service, professionally-dressed couriers, driven in electric cars, will hand-deliver purchases to consumers' homes. Brooks Brothers also sells its suits, apparel, and its more affordable line Red Fleece on Alibaba's Tmall. China's luxury consumers China's post-1980s (born in the 1980s) generation formed the largest group (10.2 million or 43%) of luxury buyers in 2018, accounting for an annual spending of 415 billion yuan (or 56% of total spending on luxury) in 2018. The post--1965-and-1970s generation (Generation X), the second largest group (7 million or 29%), spent 185 billion yuan (or 22% of total spending on luxury) in 2018. The post-1990s (Generation Z) generation is fast catching up to the previous generation in spending power. This group of 6.7 million consumers (28%) spent 170 billion yuan (or 23% of total spending) on luxury items in 2018 (McKinsey & Co., 2019). China's luxury consumers are getting younger, with the average age now at 25 years. Demand for luxury is driven by the post-1980s generation, who broadly map to Generation Y. This group benefited the most from the country's rapid economic growth. They spend an average of 41,000 yuan per year on luxury. The post-1990s consumers, enticed by luxury streetwear, spend 25,000 yuan a year on luxury. Born under the one-child policy, these dynamic and digitally engrossed consumers from urban middle-class households have parents who are willing to support their luxury spending. The post-1980s and post-1990s groups constitute 415 million or 34% of China's population (Fung Business Intelligence, 2017). Millennials (born between 1977-2000) buy luxury to feel different rather than to fit in with society. They look for unique ways to express themselves and are eager to embrace innovative trends such as the convergence of high fashion and sportswear. They are active on social media and fond of online shopping, exploring brands online and offline. They discuss issues such as brand reputation and price comparison with friends. They want to be seen and photographed in the latest styles (McKinsey & Co., 2019). To accommodate these changing demands, luxury brands have to constantly update their styles or use creative marketing to create the illusion of newness. Millennials value design, fabric, and the production process, preferring foreign brands from France and Italy, followed by Great Britain, Japan, and the US They are better-educated than earlier generations and 70% of this group owns homes. If luxury brands are to host events, younger consumers would prefer to attend fashion shows and art-related gatherings. Louis Vuitton's Volez Voguez Voyagez, a museum- quality exhibition in Shanghai in 2018 was very successful. The event created a sense of exoticism for guests dreaming of an escape from the depths of China's winter (McKinsey & Co., 2019). Digitalization and buying behavior Young consumers in Tier 1 to 3 cities make 92% of their luxury purchases offline, usually in premium malls for the high-quality service and experience. They also visit brand stores, duty- free shops and other outlets. The post-1990s generation who prefer affordable luxury tend to visit duty-free stores when they travel abroad. It is expected that offline channels will continue to dominate luxury sales. There are four types of online channels for luxury. (1) Brand-owned channels (e.g., Brand.com, brand app, WeChat public account, and WeChat mini program) offer the richest experience, content flexibility and ownership of customer data. (2) Cooperator channels (e.g., Tmall flagship stores and WeChat commerce) give brands some control which allows brands to benefit to some degree from platform traffic. (3) Aggregators (e.g., Tmall's Luxury Pavilion and JD.com's Toplife) enable brands to outsource the building and operating of the channels. Tmall's Luxury Pavilion is exclusive to a group of ultra-rich consumers. Luxury Pavilion and JD.com's Toplife can also share the brand's design concepts with users. Furthermore, JD.com can provide one-stop logistics services as has dedicated warehouse, aircraft, and vehicles. Finally, (4) luxury vertical sites (e.g. Farfetch, Mei.com, Net-a-porter, and Secoo) allow brands to sell goods at a discount but brands have less control over customer experience and how products are presented, which can affect image. Many brands are more active in brand-owned channels but less in the other types of channels. Brands often use digital and influencer marketing. Since 2015, the top 40 luxury brands have nearly doubled their marketing spending on digital marketing, devoting 40% to 70% of their digital marketing budget to WeChat. The top 40 luxury brands use WeChat to identify and target consumers for online and offline sales, which allows consumers to make bookings, obtain coupons, and manage their membership cards. Key Opinion Leaders can help to create buzz for product launches. Burberry collaborated with Mr. Bags to launch a special edition via WeChat and the DK88 hand bags were sold out in less than ten minutes. Luxury consumers consult both online and offline information sources on luxury and fashion three to five hours per week. These consumers seek information on the latest products, the celebrities who promote the brands, and their lifestyles. They also check peer reviews to read about the product experiences of other consumers. For purchase decision, the most impactful source of information is the in-person experience in the store (McKinsey & Co., 2019). Sales staff can provide purchase advice and suggestions, sometimes via WeChat. Post- 1980s and 1990s consumers value staff who provide product information updates and help in selecting accessories based on their knowledge of customer personality, preferences, or past purchases. They appreciate staff who could help them gain access to fashion shows or parties. Post-1965s and 1970s consumers, in contrast, prefer staff who understand their personal life, family situation, and emotional needs. Millennials are usually able to make purchasing decisions in less than a week. Approximately one-half of millennials have decided on their choice before stepping into the store. But they may switch to a different product if they spot new items in the store that they cannot resist. The post-1965s and 1970s group take a little longer than millennials to decide. This group prefers to shop for luxury in premium department stores. Repositioning the brand After terminating its relationship with Dickson Concepts, Ralph Lauren closed 95 outlets (about 60% of its stores). It pulled all products out of China, except for its high-end goods, to re-establish its positioning as a luxury brand. It competed with other luxury brands for premium retail space and sales staff. But this exclusive luxury positioning could not change consumers' perception of the brand. For years, they have been conditioned to associate it with lower quality. Its numerous lines and haphazard pricing left them confused about its positioning. Many still question whether Ralph Lauren is even popular outside of China or if it is indeed a luxury brand. Some have seen its Polo shirts but have little knowledge of its other products. The repositioning and the ensuing competition with European luxury brands contributed to its losses. Sales were US$221 million in 2019, a mere 3.5% of the company's total revenue. Louvet thinks a new strategy is needed. Should Ralph Lauren focus on its more affordable Polo brand? This could help to drive sales and profits. After all, brand awareness of Polo is a high 83%, beating many of its competitors with higher sales. Or should Ralph Lauren focus on high-end luxury (e.g., its Purple Label and Ralph Lauren Collection) and try to improve its distribution network? Not all its customers reside in top tier cities. The company now has 106 stores, of which 13 are in Beijing and 18 in Shanghai. It needs to be careful with costs. Earlier, a significant number of underperforming stores were closed. Besides flagship stores in premium locations, how else should Ralph Lauren communicate its luxury positioning? Can digitalization help? If so, how? The goal for the China operations is to increase annual sales to US$500 million within the next three years. What else should it do to achieve this? Ralph Lauren has focused on the middle-class. Currently, shoppers in its stores are evenly split between men and women and the average age is 34 years. And there is this problem of counterfeit products. What should be done to fight these? Louvet hopes the consultants will provide some solutions. Louvet and Bottomley will travel to Shanghai to meet with them next week

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts