Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Stuppose that California Co., a U.S. based MNC, seeks to capitalize a difference in interest rates between euros and British pounds via the use of

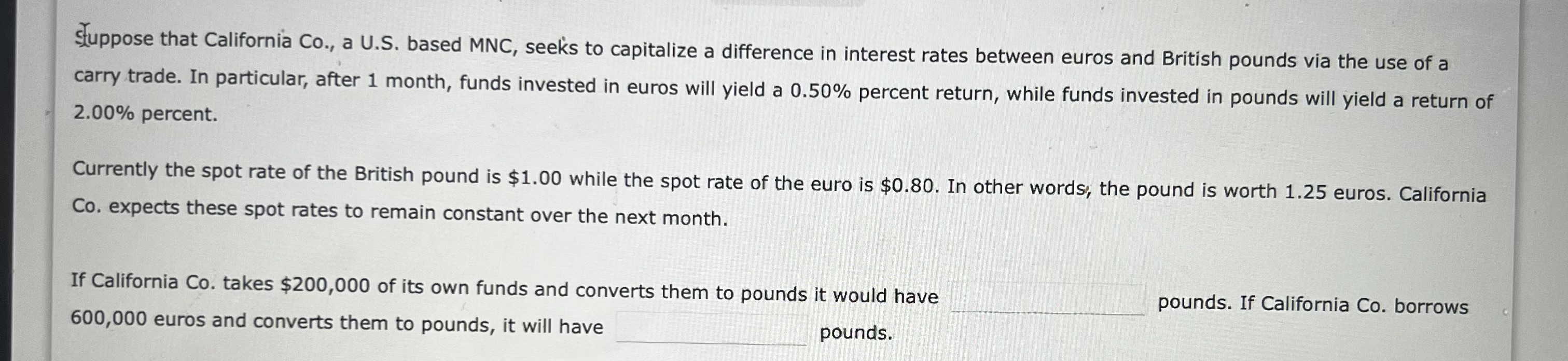

Stuppose that California Co., a U.S. based MNC, seeks to capitalize a difference in interest rates between euros and British pounds via the use of a carry trade. In particular, after 1 month, funds invested in euros will yield a 0.50% percent return, while funds invested in pounds will yield a return of 2.00% percent. Currently the spot rate of the British pound is $1.00 while the spot rate of the euro is $0.80. In other words; the pound is worth 1.25 euros. California Co. expects these spot rates to remain constant over the next month. If California Co. takes $200,000 of its own funds and converts them to pounds it would have 600,000 euros and converts them to pounds, it will have pounds. If California Co. borrows pounds

Stuppose that California Co., a U.S. based MNC, seeks to capitalize a difference in interest rates between euros and British pounds via the use of a carry trade. In particular, after 1 month, funds invested in euros will yield a 0.50% percent return, while funds invested in pounds will yield a return of 2.00% percent. Currently the spot rate of the British pound is $1.00 while the spot rate of the euro is $0.80. In other words; the pound is worth 1.25 euros. California Co. expects these spot rates to remain constant over the next month. If California Co. takes $200,000 of its own funds and converts them to pounds it would have 600,000 euros and converts them to pounds, it will have pounds. If California Co. borrows pounds Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started