Answered step by step

Verified Expert Solution

Question

1 Approved Answer

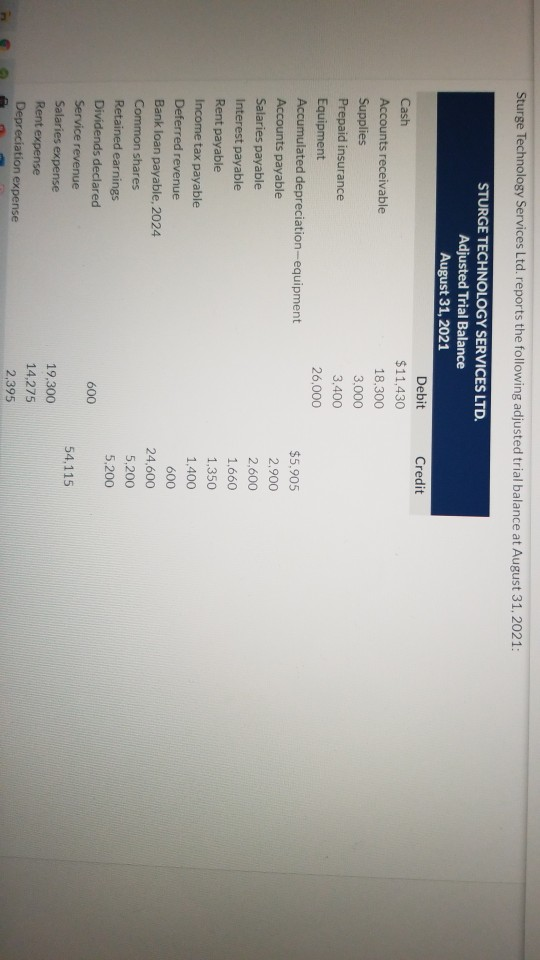

Sturge Technology Services Ltd. reports the following adjusted trial balance at August 31, 2021: Credit STURGE TECHNOLOGY SERVICES LTD. Adjusted Trial Balance August 31, 2021

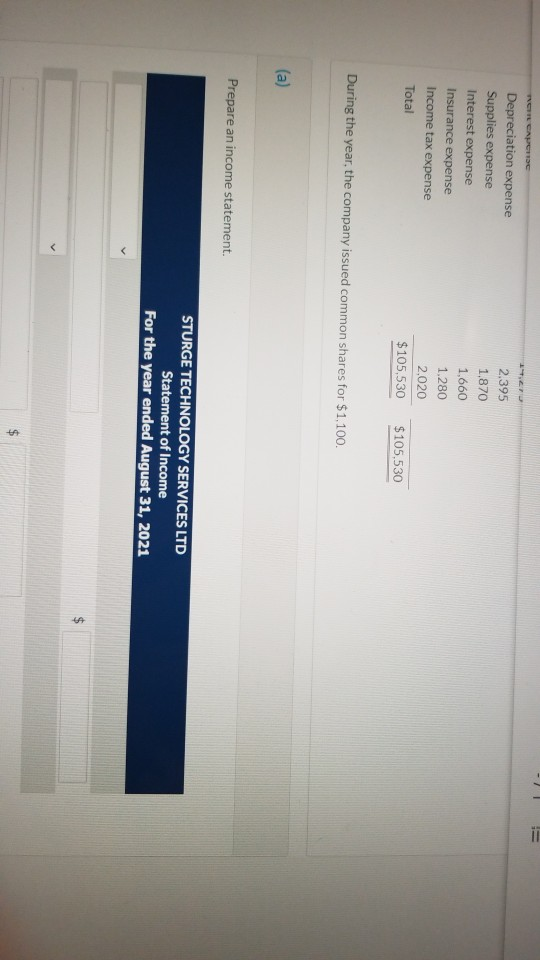

Sturge Technology Services Ltd. reports the following adjusted trial balance at August 31, 2021: Credit STURGE TECHNOLOGY SERVICES LTD. Adjusted Trial Balance August 31, 2021 Debit Cash $11,430 Accounts receivable 18,300 Supplies 3.000 Prepaid insurance 3,400 Equipment 26.000 Accumulated depreciation-equipment Accounts payable Salaries payable Interest payable Rent payable Income tax payable Deferred revenue Bank loan payable, 2024 Common shares Retained earnings Dividends declared 600 Service revenue Salaries expense 19,300 14,275 Depreciation expense 2,395 $5.905 2.900 2,600 1.660 1,350 1.400 600 24.600 5,200 5,200 54.115 Rent expense = NO CACC Depreciation expense Supplies expense Interest expense Insurance expense Income tax expense Total 2.395 1,870 1,660 1.280 2.020 $105.530 $105,530 During the year, the company issued common shares for $1.100. (a) Prepare an income statement. STURGE TECHNOLOGY SERVICES LTD Statement of Income For the year ended August 31, 2021 $ QueSLUI OUI TU - 71 Prepare an income statement. STURGE TECHNOLOGY SERVICES LTD Statement of Income For the year ended August 31, 2021 $ $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started