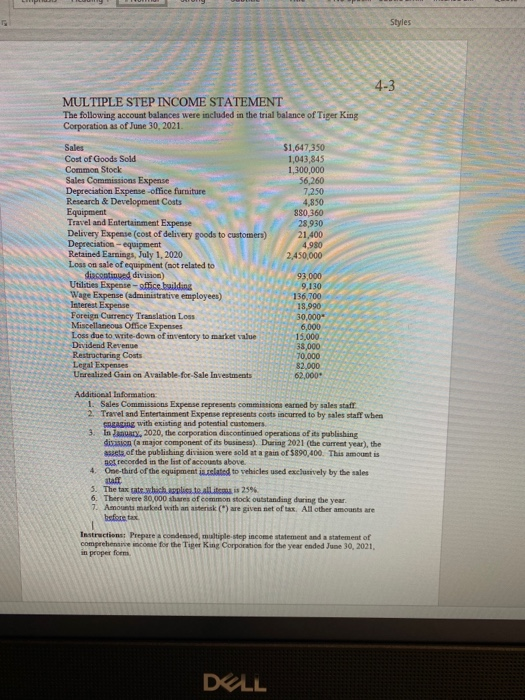

Styles 4-3 MULTIPLE STEP INCOME STATEMENT The following account balances were included in the trial balance of Tiger King Corporation as of June 30, 2021 $1,647,350 1,043,845 1,300,000 56,260 7,250 4,850 880,360 28,930 21,400 4.980 2,450,000 Sales Cost of Goods Sold Common Stock Sales Commissions Expense Depreciation Expense office furniture Research & Development Costs Equipment Travel and Entertainment Expense Delivery Expense (cost of delivery goods to customers) Depreciation equipment Retained Earnings, July 1, 2020 Loss on sale of equipment (not related to discontinued division) Utilities Expense-office building Wage Expense (administrative employees) Interest Expense Foreign Currency Translation Loss Miscellaneous Office Expenses Loss due to write down of inventory to market value Dividend Revenue Restructuring Costs Legal Expenses Unrealized Gain on Available for Sale Investments 93,000 9,130 136,700 18,990 30,000 6,000 15,000 38,000 70,000 82.000 62,000 Additional Information: 1. Sales Commissions Expense represents commissions earned by sales staff 2. Travel and Entertainment Expense represents couts incurred to by sales staff when Engaging with existing and potential customers. 3. In July, 2020, the corporation discontinued operations of its publishing dission (a major component of its business). During 2021 (the current year), the assets of the publishing division were sold at a pain of 5890,400. This amount is est recorded in the list of accounts above. 4. One-third of the equipment is slated to vehicles used exclusively by the sales staff 5. The tax tate, which aplicate all its is 2596 6. There were 30,000 shares of common stock outstanding during the year. 7. Amounts muked with an asterisk (*) are given net of tax. All other amounts are before tax Instructions: Prepare a condensed, multiple-step income statement and a statement of comprehensive come for the Tiger King Corporation for the year ended June 30, 2021, in proper forms DULL Styles 4-3 MULTIPLE STEP INCOME STATEMENT The following account balances were included in the trial balance of Tiger King Corporation as of June 30, 2021 $1,647,350 1,043,845 1,300,000 56,260 7,250 4,850 880,360 28,930 21,400 4.980 2,450,000 Sales Cost of Goods Sold Common Stock Sales Commissions Expense Depreciation Expense office furniture Research & Development Costs Equipment Travel and Entertainment Expense Delivery Expense (cost of delivery goods to customers) Depreciation equipment Retained Earnings, July 1, 2020 Loss on sale of equipment (not related to discontinued division) Utilities Expense-office building Wage Expense (administrative employees) Interest Expense Foreign Currency Translation Loss Miscellaneous Office Expenses Loss due to write down of inventory to market value Dividend Revenue Restructuring Costs Legal Expenses Unrealized Gain on Available for Sale Investments 93,000 9,130 136,700 18,990 30,000 6,000 15,000 38,000 70,000 82.000 62,000 Additional Information: 1. Sales Commissions Expense represents commissions earned by sales staff 2. Travel and Entertainment Expense represents couts incurred to by sales staff when Engaging with existing and potential customers. 3. In July, 2020, the corporation discontinued operations of its publishing dission (a major component of its business). During 2021 (the current year), the assets of the publishing division were sold at a pain of 5890,400. This amount is est recorded in the list of accounts above. 4. One-third of the equipment is slated to vehicles used exclusively by the sales staff 5. The tax tate, which aplicate all its is 2596 6. There were 30,000 shares of common stock outstanding during the year. 7. Amounts muked with an asterisk (*) are given net of tax. All other amounts are before tax Instructions: Prepare a condensed, multiple-step income statement and a statement of comprehensive come for the Tiger King Corporation for the year ended June 30, 2021, in proper forms DULL