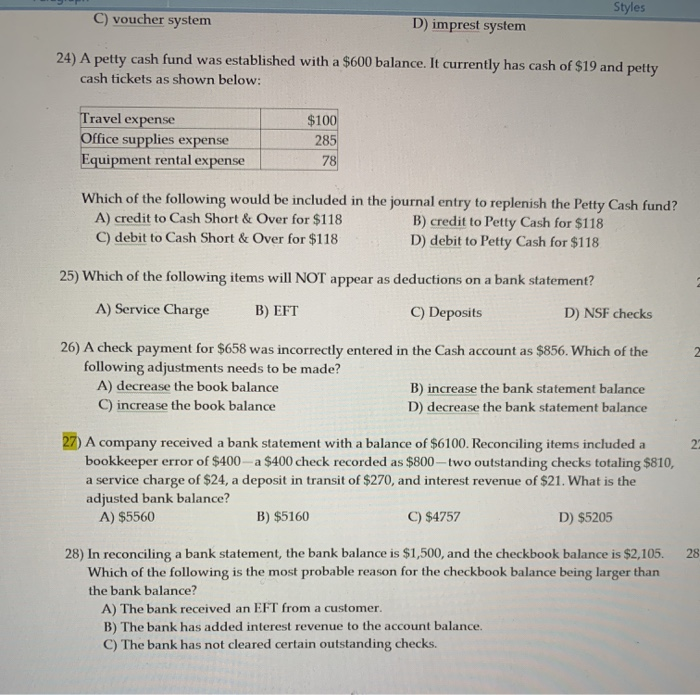

Styles C) voucher system D) imprest system 24) A petty cash fund was established with a $600 balance. It currently has cash of $19 and petty cash tickets as shown below: $100 Travel expense Office supplies expense Equipment rental expense 285 78 Which of the following would be included in the journal entry to replenish the Petty Cash fund? A) credit to Cash Short & Over for $118 B) credit to Petty Cash for $118 C) debit to Cash Short & Over for $118 D) debit to Petty Cash for $118 25) Which of the following items will NOT appear as deductions on a bank statement? A) Service Charge B) EFT C) Deposits D) NSF checks 2 26) A check payment for $658 was incorrectly entered in the Cash account as $856. Which of the following adjustments needs to be made? A) decrease the book balance B) increase the bank statement balance C) increase the book balance D) decrease the bank statement balance - 27 27) A company received a bank statement with a balance of $6100. Reconciling items included a bookkeeper error of $400 a $400 check recorded as $800-two outstanding checks totaling $810, a service charge of $24, a deposit in transit of $270, and interest revenue of $21. What is the adjusted bank balance? A) $5560 B) $5160 C) $4757 D) $5205 28 28) In reconciling a bank statement, the bank balance is $1,500, and the checkbook balance is $2,105. Which of the following is the most probable reason for the checkbook balance being larger than the bank balance? A) The bank received an EFT from a customer. B) The bank has added interest revenue to the account balance C) The bank has not cleared certain outstanding checks. Ulhce supplies expense Equipment rental expense Which of the following would be included in the journal entry to replenish the Petty Cash fund? A) credit to Cash Short & Over for $118 B) credit to Petty Cash for $118 C) debit to Cash Short & Over for $118 D) debit to Petty Cash for $118 25) Which of the following items will NOT appear as deductions on a bank statement? 25) A) Service Charge B) EFT C) Deposits D) NSF checks 26) 26) A check payment for $658 was incorrectly entered in the Cash account as $856. Which of the following adjustments needs to be made? A) decrease the book balance B) increase the bank statement balance C) increase the book balance D) decrease the bank statement balance 27 27) A company received a bank statement with a balance of $6100. Reconciling items included a bookkeeper error of $400-a $400 check recorded as $800-two outstanding checks totaling $810, a service charge of $24, a deposit in transit of $270, and interest revenue of $21. What is the adjusted bank balance? A) $5560 B) $5160 C) $4757 D) $5205 28) In reconciling a bank statement, the bank balance is $1,500, and the checkbook balance is $2,105. Which of the following is the most probable reason for the checkbook balance being larger than the bank balance? A) The bank received an EFT from a customer. B) The bank has added interest revenue to the account balance. C) The bank has not cleared certain outstanding checks