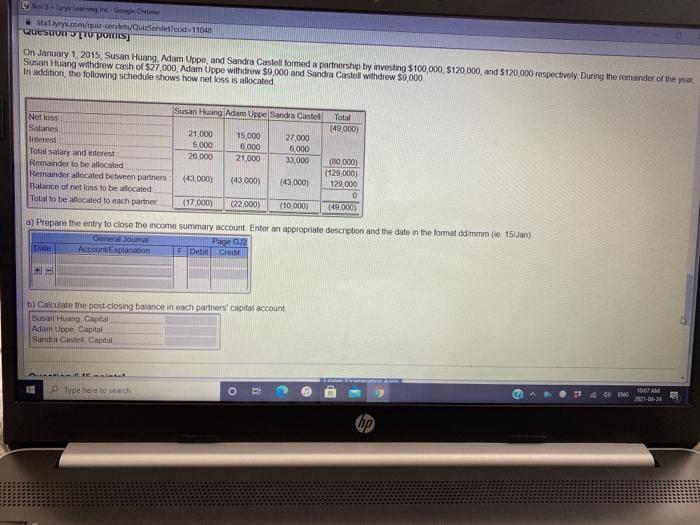

styy.com/servletServicode 11048 Questo ti pomics On January 1, 2015, Susan Huang, Adam Uppe, and Sandra Castellformed a partnership by investing $100,000 $120,000, and $120,000 respectively. During the remainder of the year Susan Huang withdrew cash of $27.000, Adam Uppe withdrew $9,000 and Sandra Castel withdrew $9,000 In addition, the following schedule shows how met loss is allocated Susan Huang Adam Uppe Sandra Castel Total (49.000) Netloss Salanes deres Total salary and interest Romainder to be allocated Renainder allocated between partners Balance of met loss to be allocated Total to be located to each partner 21.000 5.000 26.000 15.000 6.000 21,000 27.000 6.000 33,000 (43.000) (43.000) (43 000) 180,000) (129,000) 129,000 0 (17.000) (22,000) (10.000) (49.000) a) Prepare the entry to close the income summary account Enter an appropriate description General Journal Page 2 Dale Account Explanation F Deb Credit the date in the format ddim ( 15/Jan) by Calculate the post closing balance in each partners capital account Susan Huang, Capital Adam Uppe Capital Sandra Castel Capital --- Type here to search de 1000 AM 1-02 up styy.com/servletServicode 11048 Questo ti pomics On January 1, 2015, Susan Huang, Adam Uppe, and Sandra Castellformed a partnership by investing $100,000 $120,000, and $120,000 respectively. During the remainder of the year Susan Huang withdrew cash of $27.000, Adam Uppe withdrew $9,000 and Sandra Castel withdrew $9,000 In addition, the following schedule shows how met loss is allocated Susan Huang Adam Uppe Sandra Castel Total (49.000) Netloss Salanes deres Total salary and interest Romainder to be allocated Renainder allocated between partners Balance of met loss to be allocated Total to be located to each partner 21.000 5.000 26.000 15.000 6.000 21,000 27.000 6.000 33,000 (43.000) (43.000) (43 000) 180,000) (129,000) 129,000 0 (17.000) (22,000) (10.000) (49.000) a) Prepare the entry to close the income summary account Enter an appropriate description General Journal Page 2 Dale Account Explanation F Deb Credit the date in the format ddim ( 15/Jan) by Calculate the post closing balance in each partners capital account Susan Huang, Capital Adam Uppe Capital Sandra Castel Capital --- Type here to search de 1000 AM 1-02 up