Question: SU below market for two consecutive year. The study provides evidence that poor performing CEOs are roughly 16% more likely to leave their jobs than

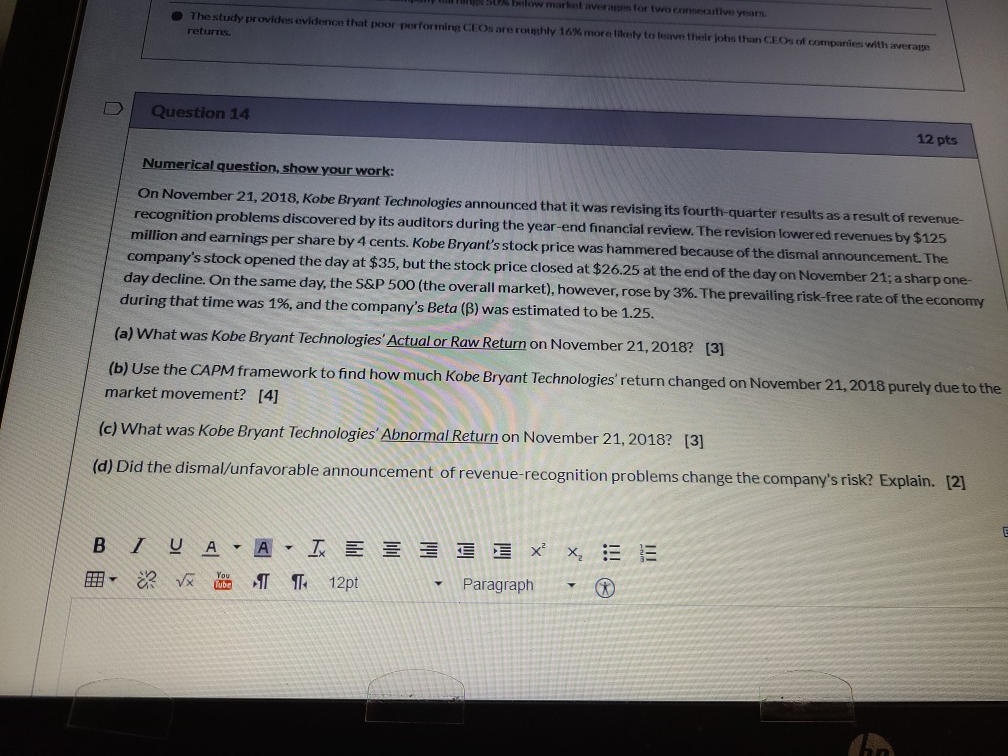

SU below market for two consecutive year. The study provides evidence that poor performing CEOs are roughly 16% more likely to leave their jobs than CEO of companies with average returns Question 14 12 pts Numerical question, show your work: On November 21, 2018, Kobe Bryant Technologies announced that it was revising its fourth-quarter results as a result of revenue recognition problems discovered by its auditors during the year-end financial review. The revision lowered revenues by $125 million and earnings per share by 4 cents. Kobe Bryant's stock price was hammered because of the dismal announcement. The company's stock opened the day at $35, but the stock price closed at $26.25 at the end of the day on November 21; a sharpone- day decline. On the same day, the S&P 500 (the overall market), however, rose by 3%. The prevailing risk-free rate of the economy during that time was 1%, and the company's Beta () was estimated to be 1.25. (a) What was Kobe Bryant Technologies' Actual or Raw Return on November 21, 2018? (3] (b) Use the CAPM framework to find how much Kobe Bryant Technologies' return changed on November 21, 2018 purely due to the market movement? [4] (c) What was Kobe Bryant Technologies' Abnormal Return on November 21, 2018? [3] (d) Did the dismal/unfavorable announcement of revenue-recognition problems change the company's risk? Explain. [2] B IV A - A - I E I ? ? Va 12pt II x x := - Paragraph -

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts