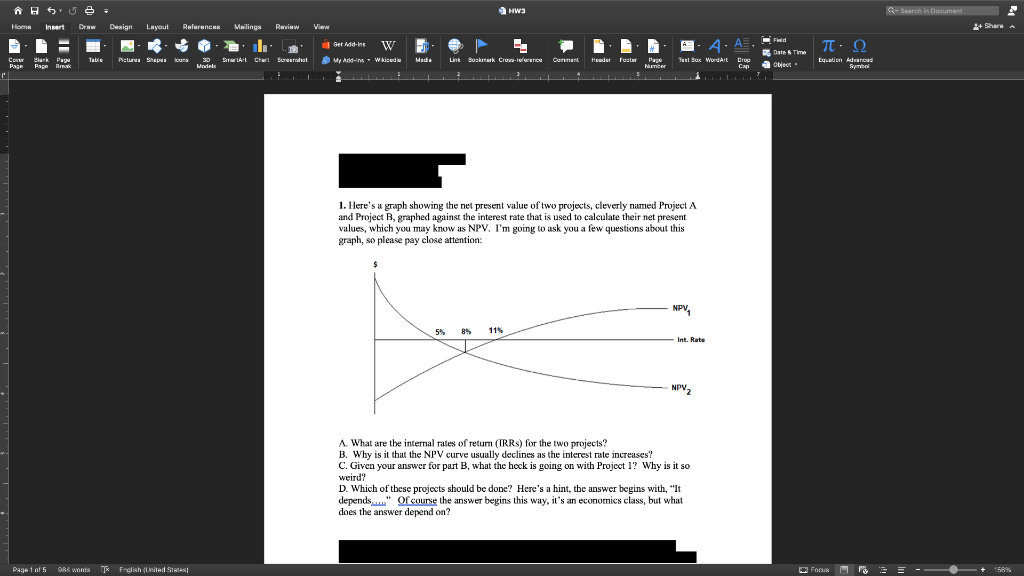

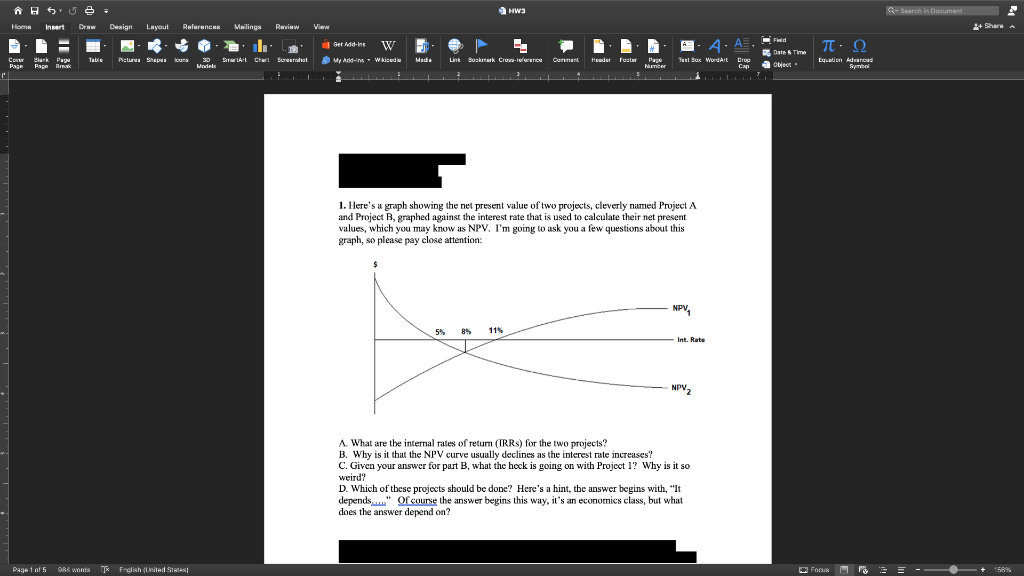

SU HW3 - Search in Document Home Insert Drew Design Layout References Mailings Review View 24 Share A Field - Get Add-ins W My Add-ins. Wkisedia T. 22 Table Cow Blank Page Page Page Ar Pictures Shapes SALAL Char! Screerde Media Link Boskrutk Crown Comment Header Post Page Meer Teel Box WordArt Model Date & Time Object Cap Equation Award - Symbol 1. Here's a graph showing the net present value of two projects, cleverly named Project A and Project B, graphed against the interest rate that is used to calculate their net present values, which you may know as NPV. I'm going to ask you a few questions about this graph, so please pay close attention: NPV, 5% 8 115 Int. Rate NPV2 1. What are the internal rates of retum (IRR) for the two projects? B. Why is it that the NPV curve usually declines as the interest rate increases? C. Given your answer for part B, what the heck is going on with Project 1? Why is it so weird? D. Which of these projects should be done? Here's a hint the answer begins with, "It depends...." Of course the answer begins this way, it's an economics class, but what does the answer depend on? Page 1 of 5 sed words x Flish (United SIRRI Focus M 56% SU HW3 - Search in Document Home Insert Drew Design Layout References Mailings Review View 24 Share A Field - Get Add-ins W My Add-ins. Wkisedia T. 22 Table Cow Blank Page Page Page Ar Pictures Shapes SALAL Char! Screerde Media Link Boskrutk Crown Comment Header Post Page Meer Teel Box WordArt Model Date & Time Object Cap Equation Award - Symbol 1. Here's a graph showing the net present value of two projects, cleverly named Project A and Project B, graphed against the interest rate that is used to calculate their net present values, which you may know as NPV. I'm going to ask you a few questions about this graph, so please pay close attention: NPV, 5% 8 115 Int. Rate NPV2 1. What are the internal rates of retum (IRR) for the two projects? B. Why is it that the NPV curve usually declines as the interest rate increases? C. Given your answer for part B, what the heck is going on with Project 1? Why is it so weird? D. Which of these projects should be done? Here's a hint the answer begins with, "It depends...." Of course the answer begins this way, it's an economics class, but what does the answer depend on? Page 1 of 5 sed words x Flish (United SIRRI Focus M 56%