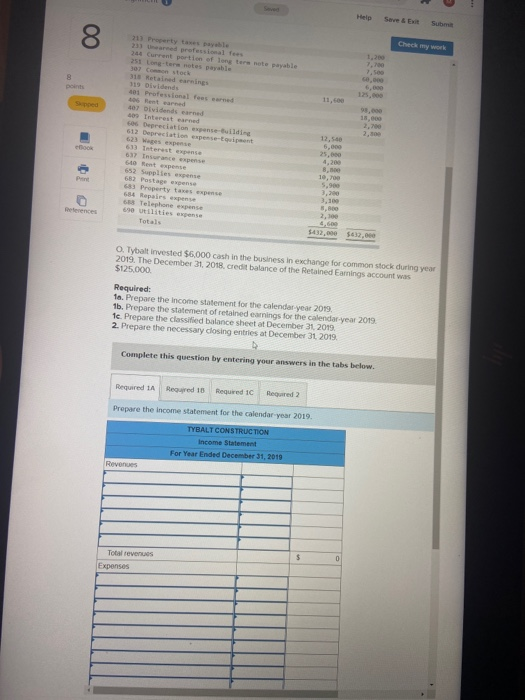

Sub 8 7.100 8 points 6.000 220 Current portion of long tera note payable 3a Common stock 11 119 Dividende Professional fees earned 07 Dividends earned 42 Interest earned os Depreciation we wilding 612 Depreciation pense qui est Tnterest expense 11,00 18.00 2,500 enook Waves 6) pense 637 Insurance 640 Rotace expense Rent expense 682 Postage 683 Property taxes expense 54 Repairs 68 Telephone expense 12,500 5.000 25,000 4,200 8,000 10,700 5.900 3,100 3,000 2,100 4.600 $42.000 References Totals 5612.00 O. Tybalt invested $6,000 cash in the business in exchange for common stock during year 2019. The December 31, 2018. credit balance of the Retained Earnings account was $125.000 Required: 10. Prepare the income statement for the calendar year 2019 1b. Prepare the statement of retained earnings for the calendar year 2019 te. Prepare the classified balance sheet at December 31, 2019 2. Prepare the necessary closing entries at December 31, 2013 Complete this question by entering your answers in the tabs below Required 1A Rewired 15 Required 1C Required 2 Prepare the income statement for the calendar year 2019 TYBALT CONSTRUCTION Income Statement For Year Ended December 31, 2019 Revenues Total revenus Expenses $ 0 Sub 8 7.100 8 points 6.000 220 Current portion of long tera note payable 3a Common stock 11 119 Dividende Professional fees earned 07 Dividends earned 42 Interest earned os Depreciation we wilding 612 Depreciation pense qui est Tnterest expense 11,00 18.00 2,500 enook Waves 6) pense 637 Insurance 640 Rotace expense Rent expense 682 Postage 683 Property taxes expense 54 Repairs 68 Telephone expense 12,500 5.000 25,000 4,200 8,000 10,700 5.900 3,100 3,000 2,100 4.600 $42.000 References Totals 5612.00 O. Tybalt invested $6,000 cash in the business in exchange for common stock during year 2019. The December 31, 2018. credit balance of the Retained Earnings account was $125.000 Required: 10. Prepare the income statement for the calendar year 2019 1b. Prepare the statement of retained earnings for the calendar year 2019 te. Prepare the classified balance sheet at December 31, 2019 2. Prepare the necessary closing entries at December 31, 2013 Complete this question by entering your answers in the tabs below Required 1A Rewired 15 Required 1C Required 2 Prepare the income statement for the calendar year 2019 TYBALT CONSTRUCTION Income Statement For Year Ended December 31, 2019 Revenues Total revenus Expenses $ 0