Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Subj: income tax Daemon Yu, a multi talented accountant, is a public practitioner at the same time is hired in on a school as an

Subj: income tax

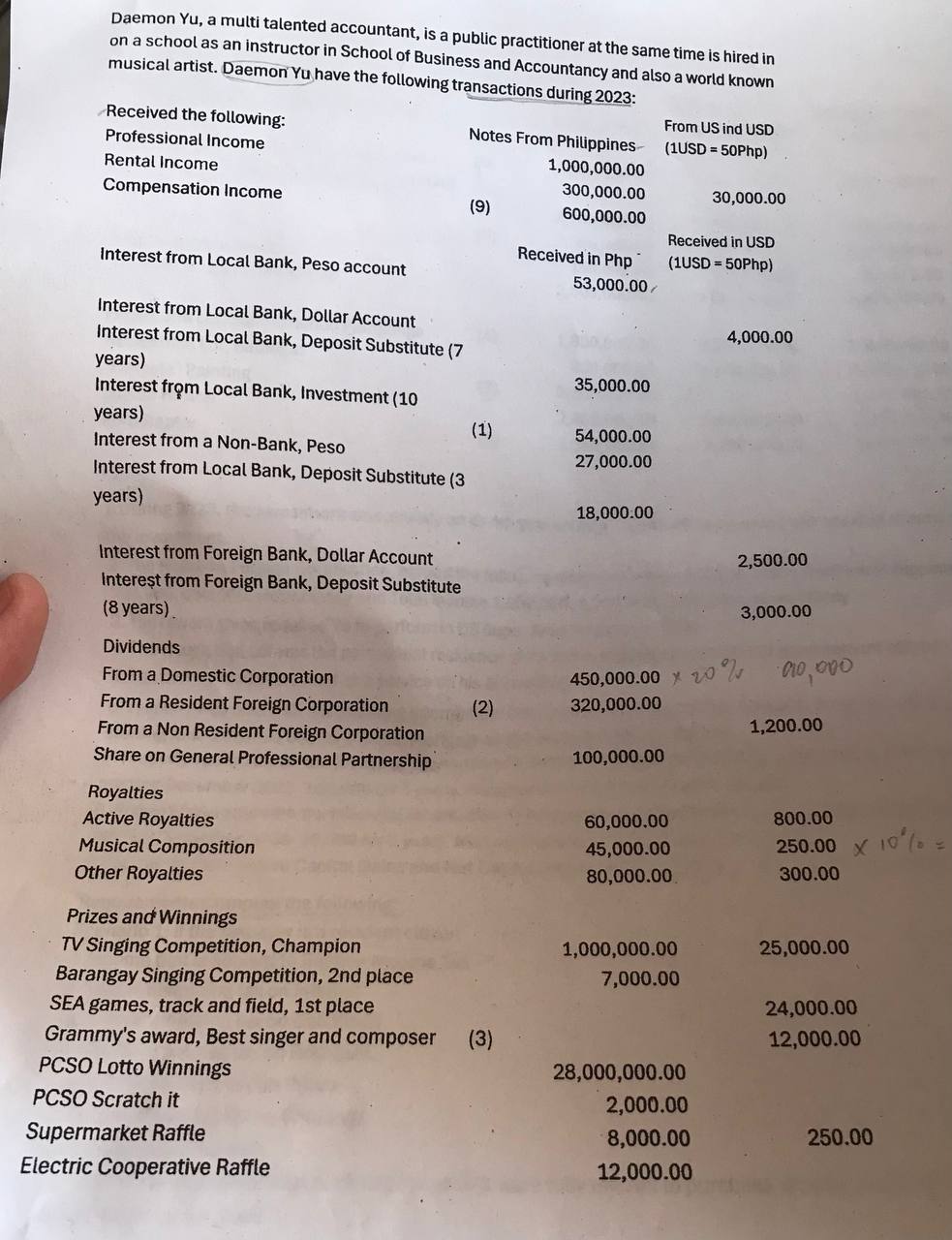

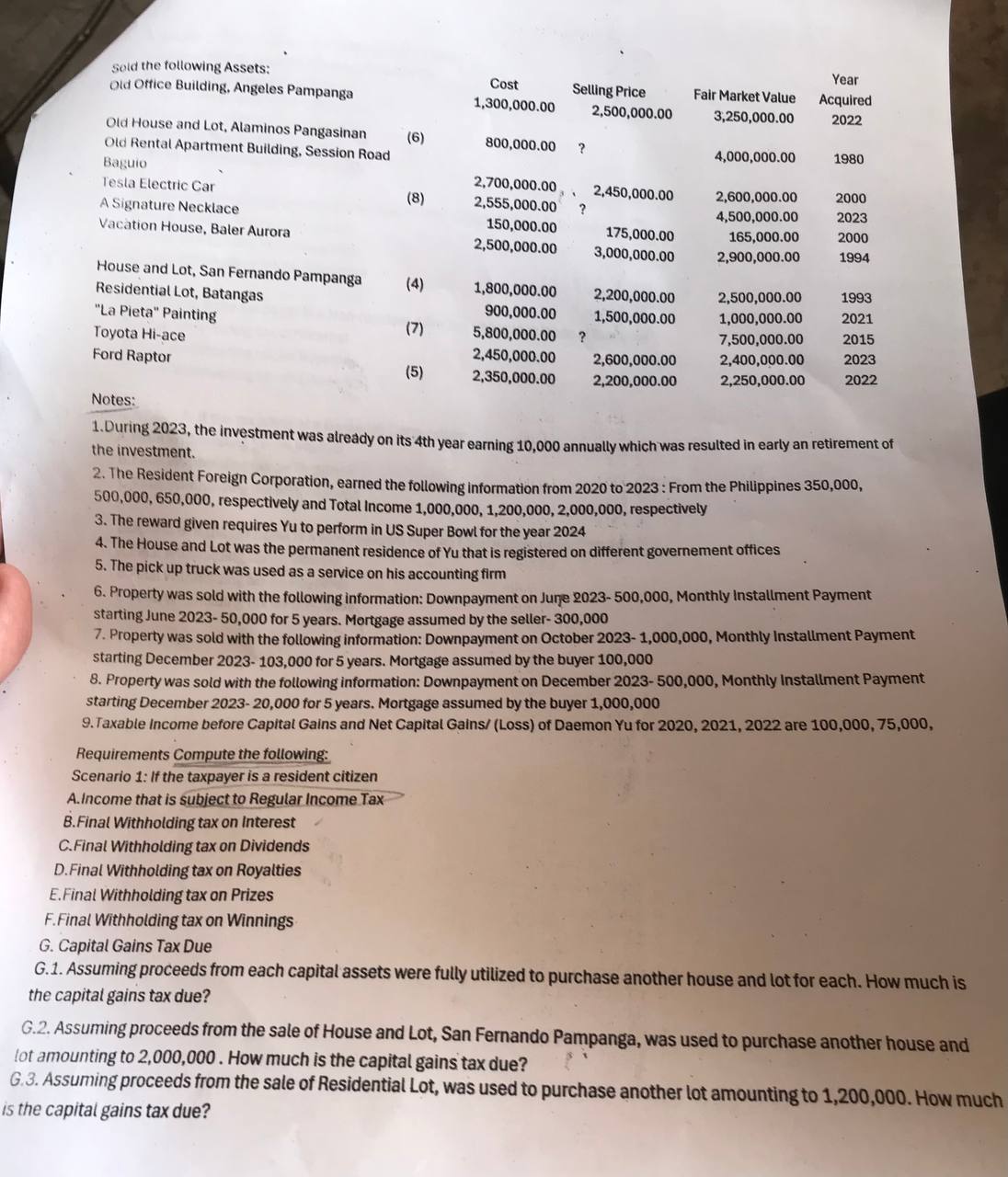

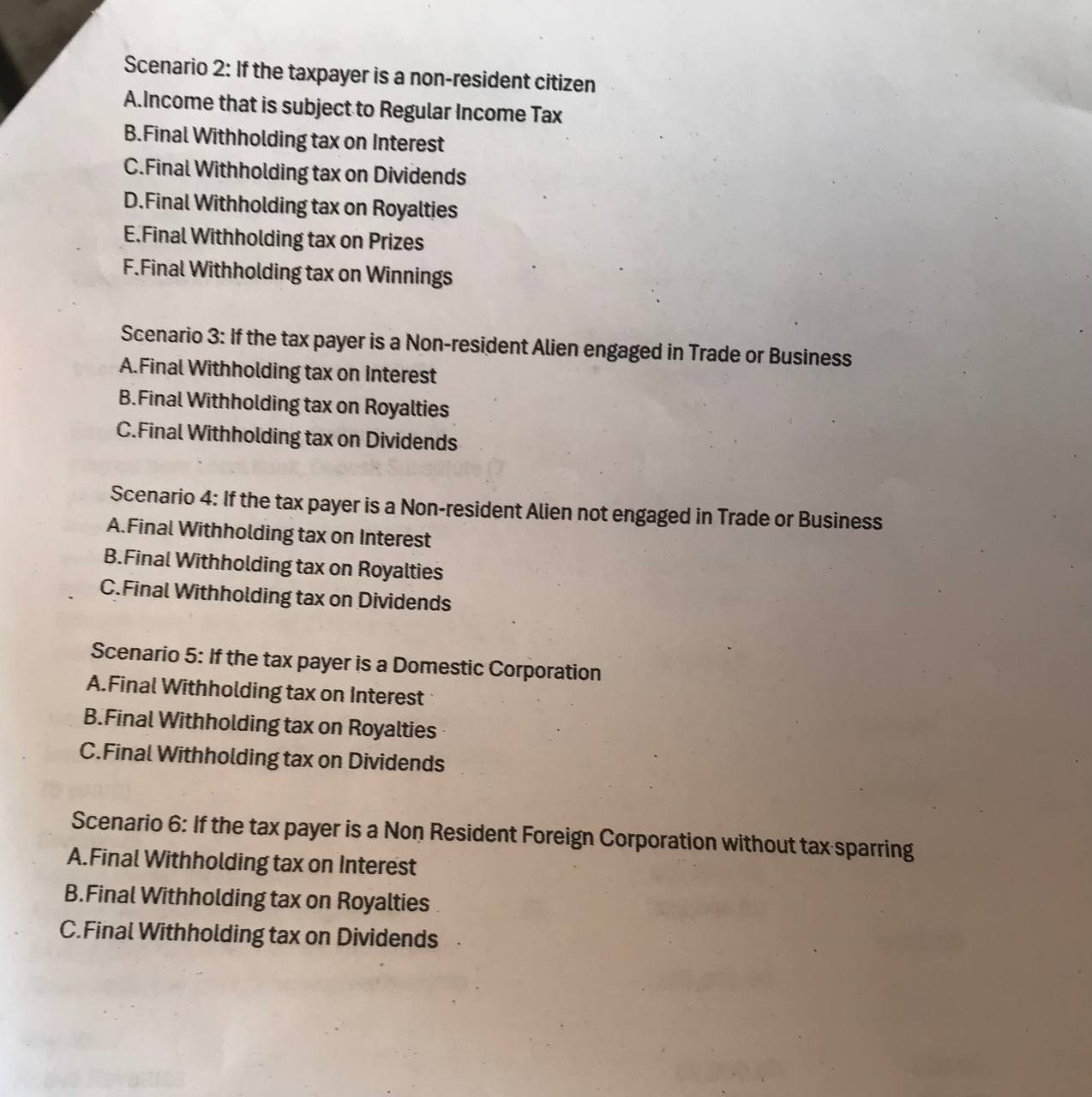

Daemon Yu, a multi talented accountant, is a public practitioner at the same time is hired in on a school as an instructor in School of Business and Accountancy and also a world known musical artist. Daemon Yu have the following transactions during 2023: Received the following: Professional Income Rental Income From US ind USD (1USD = 50Php) 30,000.00 Notes From Philippines 1,000,000.00 300,000.00 Compensation Income (9) 600,000.00 Received in USD Received in Php (1USD = 50Php) Interest from Local Bank, Peso account 53,000.00/ Interest from Local Bank, Dollar Account Interest from Local Bank, Deposit Substitute (7 4,000.00 years) Interest from Local Bank, Investment (10 years) 35,000.00 (1) Interest from a Non-Bank, Peso 54,000.00 Interest from Local Bank, Deposit Substitute (3 27,000.00 years) 18,000.00 Interest from Foreign Bank, Dollar Account 2,500.00 Interest from Foreign Bank, Deposit Substitute (8 years). Dividends 3,000.00 From a Domestic Corporation 450,000.00 20% 10,000 From a Resident Foreign Corporation (2) 320,000.00 From a Non Resident Foreign Corporation 1,200.00 Share on General Professional Partnership 100,000.00 Royalties Active Royalties Musical Composition 60,000.00 800.00 45,000.00 250.00 10 X 80,000.00 300.00 Other Royalties Prizes and Winnings TV Singing Competition, Champion Barangay Singing Competition, 2nd place 1,000,000.00 25,000.00 7,000.00 SEA games, track and field, 1st place 24,000.00 Grammy's award, Best singer and composer (3) 12,000.00 PCSO Lotto Winnings 28,000,000.00 PCSO Scratch it 2,000.00 Supermarket Raffle 8,000.00 250.00 Electric Cooperative Raffle 12,000.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started