Answered step by step

Verified Expert Solution

Question

1 Approved Answer

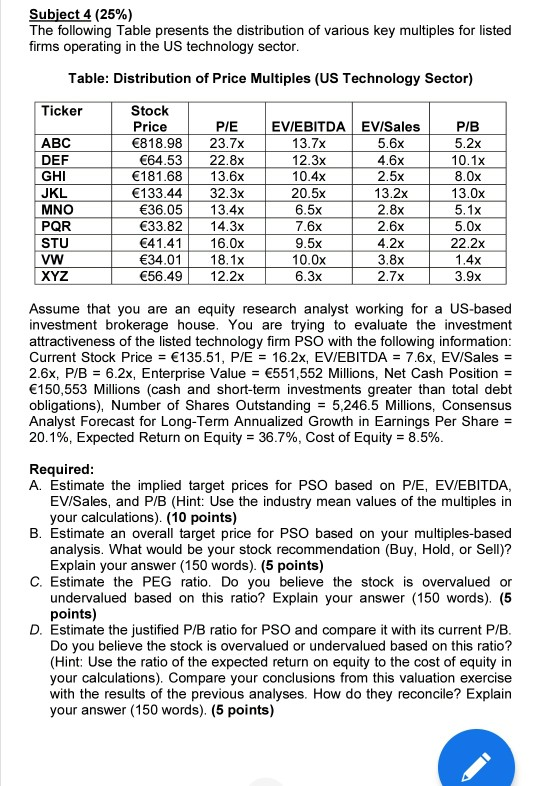

Subject 4 (25%) The following Table presents the distribution of various key multiples for listed firms operating in the US technology sector. Table: Distribution of

Subject 4 (25%) The following Table presents the distribution of various key multiples for listed firms operating in the US technology sector. Table: Distribution of Price Multiples (US Technology Sector) Ticker EV/EBITDA EV/Sales 13.7x 5.6x 12 3x 10.4x Stock Price 818.98 64.53 181.68 133.44 36.05 33.82 41.41 34.01 56.49 DEF GHI JKL MNO PQR STU VW XYZ 20 58 PIE 23.7x 22.8x 13.6x 32.3x 13.4x 14.3x 16.0x 18. 1x 12.2x 5.2x 10. 1x 8.Ox 13.0x 5.1x 5.Ox 22.2x 1.4x 3.9x 2.5x 13.2x 2.8x 2.6x 4.2x 3.8x 2.7x 6.5x 7.6x 9.5x 10.0x 6.3x Assume that you are an equity research analyst working for a US-based investment brokerage house. You are trying to evaluate the investment attractiveness of the listed technology firm PSO with the following information: Current Stock Price = 135.51, P/E = 16.2x, EV/EBITDA = 7.6x, EV/Sales = 2.6x, P/B = 6.2x, Enterprise Value = 551,552 Millions, Net Cash Position = 150,553 Millions (cash and short-term investments greater than total debt obligations), Number of Shares Outstanding = 5,246.5 Millions, Consensus Analyst Forecast for Long-Term Annualized Growth in Earnings Per Share = 20.1%, Expected Return on Equity = 36.7%, Cost of Equity = 8.5%. Required: A. Estimate the implied target prices for PSO based on P/E, EV/EBITDA, EV/Sales, and P/B (Hint: Use the industry mean values of the multiples in your calculations). (10 points) B. Estimate an overall target price for PSO based on your multiples-based analysis. What would be your stock recommendation (Buy, Hold, or Sell)? Explain your answer (150 words) (5 points) C. Estimate the PEG ratio. Do you believe the stock is overvalued or undervalued based on this ratio? Explain your answer (150 words). (5 points) D. Estimate the justified P/B ratio for PSO and compare it with its current P/B. Do you believe the stock is overvalued or undervalued based on this ratio? (Hint: Use the ratio of the expected return on equity to the cost of equity in your calculations). Compare your conclusions from this valuation exercise with the results of the previous analyses. How do they reconcile? Explain your answer (150 words) (5 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started