Answered step by step

Verified Expert Solution

Question

1 Approved Answer

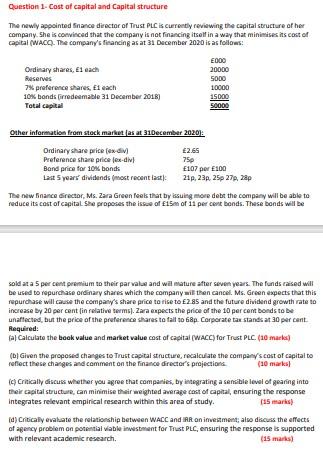

Subject: Accounting & Finance Question 1- Cost of capital and Capital structure The newly appointed finance director of Trust PLC is currently reviewing the capital

Subject: Accounting & Finance

Question 1- Cost of capital and Capital structure The newly appointed finance director of Trust PLC is currently reviewing the capital structure of her company. She is convinced that the company is not financing itself in a way that minimises its cost of capital (WACO. The company's financing as at 31 December 2020 is as follows: E000 Ordinary shares, El each 20000 Reserves 5000 7% preference shares, El cach 10000 10% bonds irredeamable 31 December 2016) 15000 Total capital 50000 750 Other information from stock market (as at 31 December 2020): Ordinary share price fex di 2.65 Preference share price lex.dll Band price for 10% bonds E107 per 100 Last 5 years' dividends most recentlast 21, 23, 25p 27, 2p The new Finance director, Ms. Zara Green Peaks that by issuing more debt the company will be able to reduce its cost of capital. She proposes the issue of E15 of it per cent bonds. These bonds will be sold at a 5 per cent premium to their par value and wil mature after seven years. The funds raised will be used to repurchase ordinary shares which the company will then cancel. Ms. Green aspects that this repurchase will cause the company's share price to rise to E2 85 and the future dividend growth rate to increase by 20 per cent in relative terms). Zara expects the price of the 10 per cent bonds to be unaffected, but the price of the preference shares to fail to 6&p. Corporate tax stands at 30 percent. Required: al Calculato the book value and market value cost of capital (WACC) for Trust PLC. (10 marks) (DI Given the proposed changes to Trust capital structure, recalculate the company's cost of capital to reflect these changes and comment on the finance director's projections (10 marks Critically discuss whether you agree that companies, by integrating a sensible level of gearing into their capital structure, Can minimise their weighted average cost of capital, ensuring the response integrates relevant empirical research within this area of study. 15 marks) Id) Critically evaluate the relationship between WACC and IRR on investment, also discuss the effects of agency problem on potential viable investment for Trust PLC, ensuring the response is supported with relevant academic research. (15 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started