Answered step by step

Verified Expert Solution

Question

1 Approved Answer

subject: analysis of financial statements Note: plz explain with working Part B) Following are the financial information for Welmark Coporation. Year 2018 Year 2019 Sales

subject: analysis of financial statements Note: plz explain with working

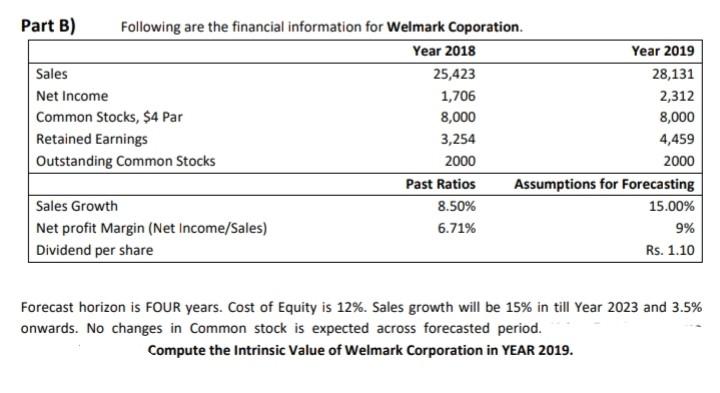

Part B) Following are the financial information for Welmark Coporation. Year 2018 Year 2019 Sales 25,423 28,131 Net Income 1,706 2,312 Common Stocks, $4 Par 8,000 8,000 Retained Earnings 3,254 4,459 Outstanding Common Stocks 2000 2000 Past Ratios Assumptions for Forecasting Sales Growth 8.50% 15.00% Net profit Margin (Net Income/Sales) 6.71% 9% Dividend per share Rs. 1.10 Forecast horizon is FOUR years. Cost of Equity is 12%. Sales growth will be 15% in till Year 2023 and 3.5% onwards. No changes in Common stock is expected across forecasted period. Compute the Intrinsic Value of Welmark Corporation in YEAR 2019Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started