Subject: Aspects of Contract and Negligence for Business ?

Case Study -Exclusion of Liability Clauses

Ahmed finds his usual parking place on an empty piece of land has been blocked off. Instead, he goes for the first time to a car parking building. A notice just inside the entrance to the carpark states:

'The company will not be responsible for death, personal injury, damage to vehicles, or theft from them, due to any act or default of its employees or any other cause whatsoever.'

Ahmed receives a ticket when he enters the carpark which refers him to the contents of this notice.

When Ahmed returns to collect his car, he finds it has been stolen. He goes to report this to the carpark attendant and is injured when the attendant negligently allows the barrier to fall on Ahmed's head.

Advise Ahmed as to the following:

Question 01: What kind of contract term is the notice?

Question 02: Has the notice been incorporated into the contract?

Question 03: What meaning will be given to the words used in the notice? What is rules does it cover its damage caused by negligence?

Question 04: What is the effect on the notice of the Consumer Rights Act 2015? What are the specific sections of the CRA 2015 which protect Ahmed?

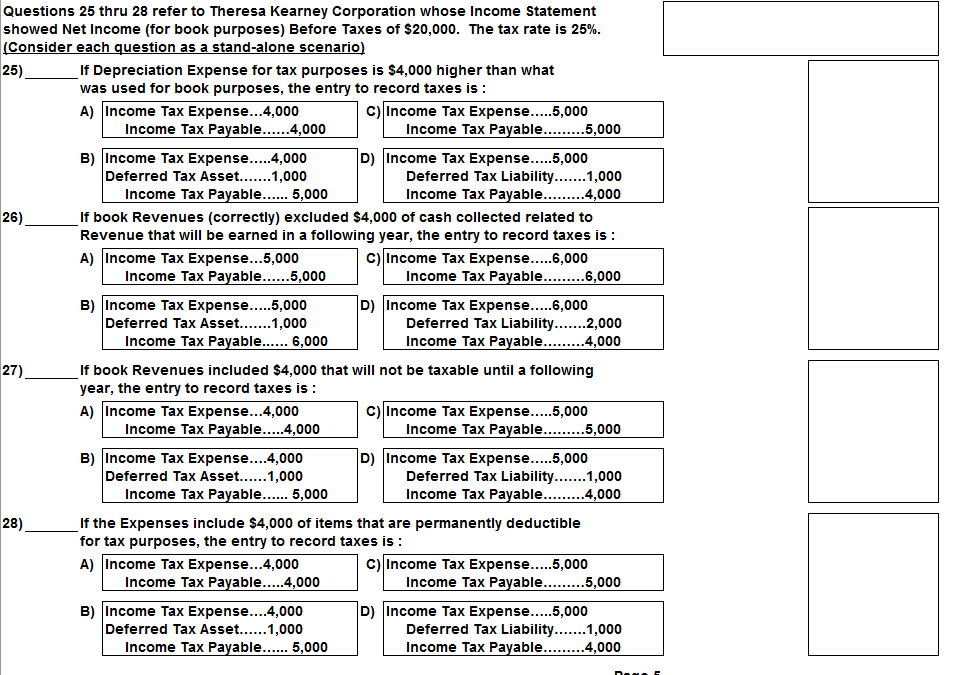

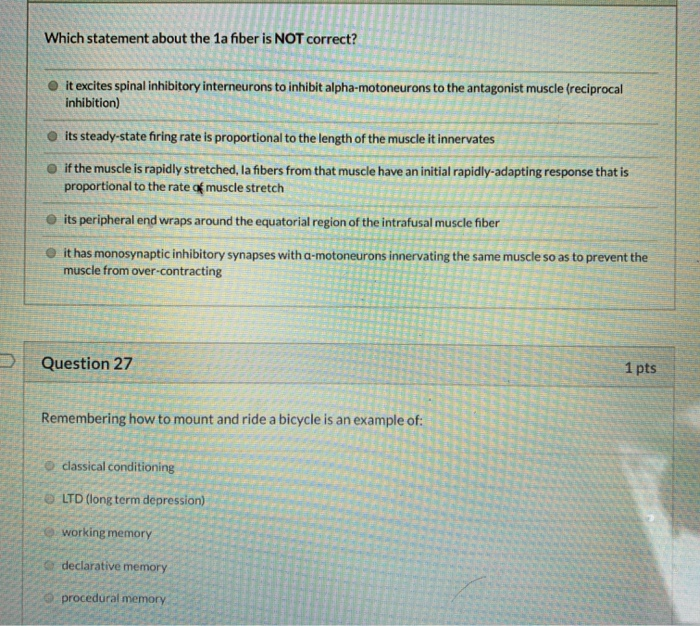

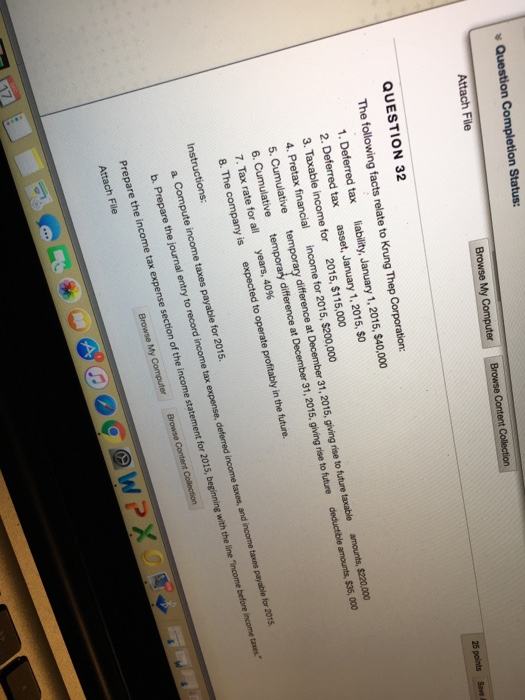

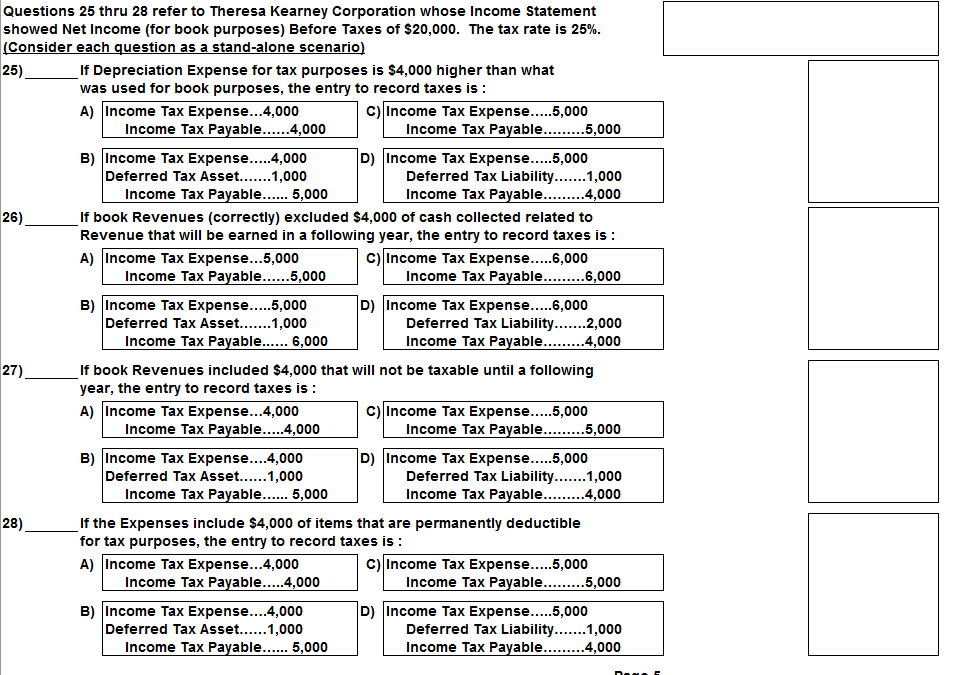

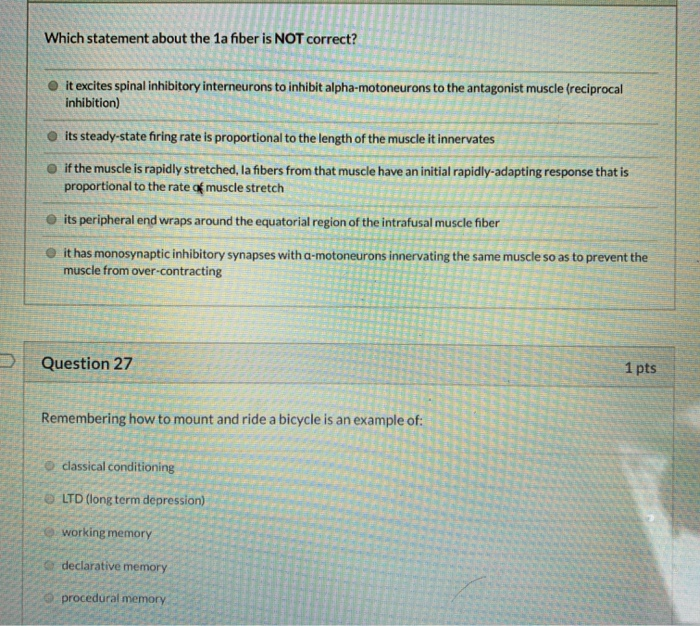

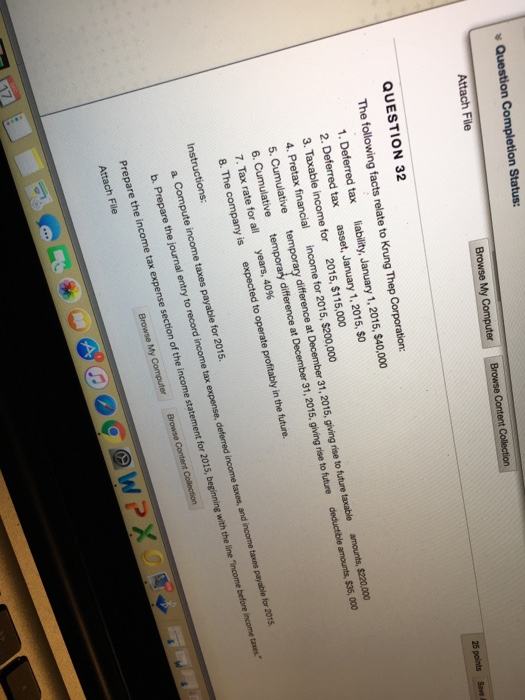

Questions 25 thru 20 refer to Theresa Kearney Corporation whose Income Statement showed Net Income [for book purposes] Before Taxes of $20,000. The tax rate is 25%. [Consider each question as a stand-alone scenario] 25] 25] 27] 29] If Depreciation Expense for tax purposes is $4,000 higher than what was used for book purposes, the entry to record taxes is : A] Income Tax Expense...4,000 Income Tax Payable......4,000 B] Income Tax Expense ..... 4,000 Deferred Tax Asset.......1,000 Income Tax Payable ...... 5,000 C] Di Income Tax Expense ..... 5,000 Income Tax Payable.........5,000 Income Tax Expense ..... 5,000 Deferred Tax Liability.......1,000 Income Tax Payable.........4,000 If book Revenues [correctly] excluded $4,000 of cash collected related to ng year, the entry to record taxes is: Revenue that will be earned in a followi A] Income Tax Expense...5,000 Income Tax Payable......5,000 0] Income Tax Expense ..... 5,000 Income Tax Payable.........6,000 B] Income Tax Expense ..... 5,000 Deferred Tax Asset.......1,000 Income Tax Payable ...... B, 000 Di Income Tax Expense ..... 5,000 Deferred Tax Liability.......2,000 Income Tax Payable.........4,000 If book Revenues included 84,000 that will not be taxable until a following year, the entry to record taxes is: A] Income Tax Expense...4,000 Income Tax Payable ..... 4,000 0] Income Tax Expense ..... 5,000 Income Tax Payable.........5,000 B] Income Tax Expense....4,000 Deferred Tax Asset......1,000 Income Tax Payable ...... 5,000 D] Income Tax Expense ..... 5,000 Deferred Tax Liability.......1,000 Income Tax Payable.........4,000 If the Expenses include 54,000 of items that are permanently deductible for tax purposes, the entry to record taxes Is : A] Income Tax Expense...4,000 0] Income Tax Expense ..... 5,000 Income Tax Payable ..... 4,000 Income Tax Payable.........5,000 B] Income Tax Expense....4,000 D] Income Tax Expense ..... 5,000 Deferred Tax Asset......1,000 Income Tax Payable ...... 5,000 Deferred Tax Liability ..... 1,000 Income Tax Payable.........4,000 Which statement about the la fiber is NOT correct? O it excites spinal inhibitory interneurons to inhibit alpha-motoneurons to the antagonist muscle (reciprocal inhibition) O its steady-state firing rate is proportional to the length of the muscle it innervates O if the muscle is rapidly stretched, la fibers from that muscle have an initial rapidly-adapting response that is proportional to the rate of muscle stretch its peripheral end wraps around the equatorial region of the intrafusal muscle fiber it has monosynaptic inhibitory synapses with a-motoneurons innervating the same muscle so as to prevent the muscle from over-contracting Question 27 1 pts Remembering how to mount and ride a bicycle is an example of: classical conditioning LTD (long term depression) working memory declarative memory procedural memoryQuestion Completion Status: Attach File Browse My Computer Browse Content Collection QUESTION 32 The following facts relate to Krung Thep Corporation: 15 points Save 1. Deferred tax liability, January 1, 2015, $40,000 2. Deferred tax asset, January 1, 2015, $0 3. Taxable income for 2015, $115,000 4. Pretax financial income for 2015, $200,000 5. Cumulative temporary difference at December 31, 2015, giving rise to future taxable amounts, $220,000 6. Cumulative temporary difference at December 31, 2015, giving rise to future deductible amounts, $35, 000 7. Tax rate for all years, 40% 8. The company is expected to operate profitably in the future. Instructions: a Compute income taxes payable for 2015. b. Prepare the journal entry to record income tax expense, deferred income taxes, and income taxes payable for 2015. Prepare the income tax expense section of the income statement for 2015, beginning with the line "income before income taxes." Browse My Computer Browse Content Collection Attach FileQuestion 35: {3 Points) Question 36: {3 Points} Question 37: {3 Polnts]: Question 33: {3 Points) Aiood delivery service promises customers to be compensated tor delayed delivery if the package cannot be delivered in under an hour. Delivery time for food packages is known to follow a normal distribution with a mean of 56.5 minutes and a standard deviation cl 5 minutes. It delivery is completed as promised on time. what is the probability that the delivery took more than the expected time? Consider yourself and your competitor submitting bids on the city oi Montreal contracts. Past data indicates your competitor has submitted bids 75% of the time. The chance that you win a contract will be 25% if the competitor bids on the contract However. your chance to win a contract will increase to 70% if the competitor does not bid on the contract. What is the probability that you will win the contract? : To manage perishable Items at the storages, local grocers decide on the number of items to keep in stock on weekly basis. Suppose that the weekly demand for the item ls normally distributed with a mean of 80 units and a standard deviation of 9 units. If the grocer wants to control the probability of stock out of the item to no more than 4% In a week, now many units of the Item should be kept In the storage? : Patrons at a local restaurant are broadly classied as 90% regular and 10% as new on yearly basis. Drink preferences indicate wine was ordered by 30% of the regular customers. and by 50% of the new customers. If wine is ordered, what is the probability that the person ordering is a regular customer'? Adjustments to income (special deductions allowed to either itemizers or non-itemizers) Total Income 6 Computed Income Tax Liability for the year Income Tax Liability after Nonrefundable Credits Standard Deduction or Itemized Deductions 12 Taxable Income Income Taxes Paid and Refundable Credits 15 Taxes Due or Refund to be Received Deduction for Qualified Business Income Tax Credits (nonrefundable) Question 2 (1 point)