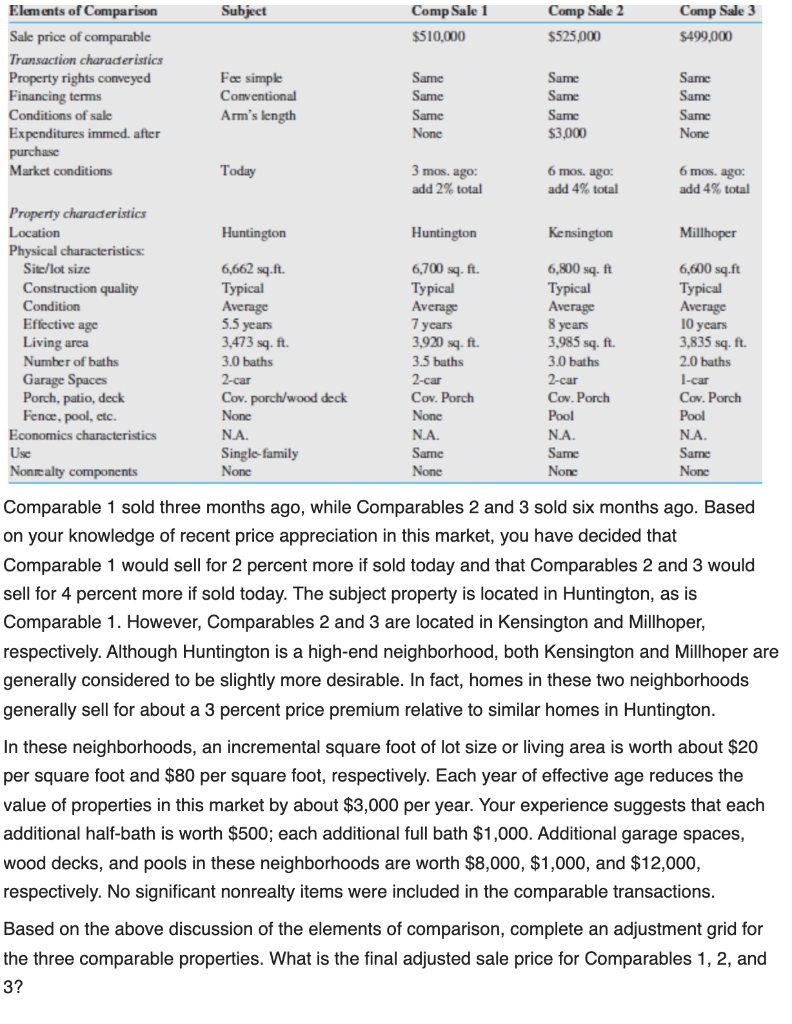

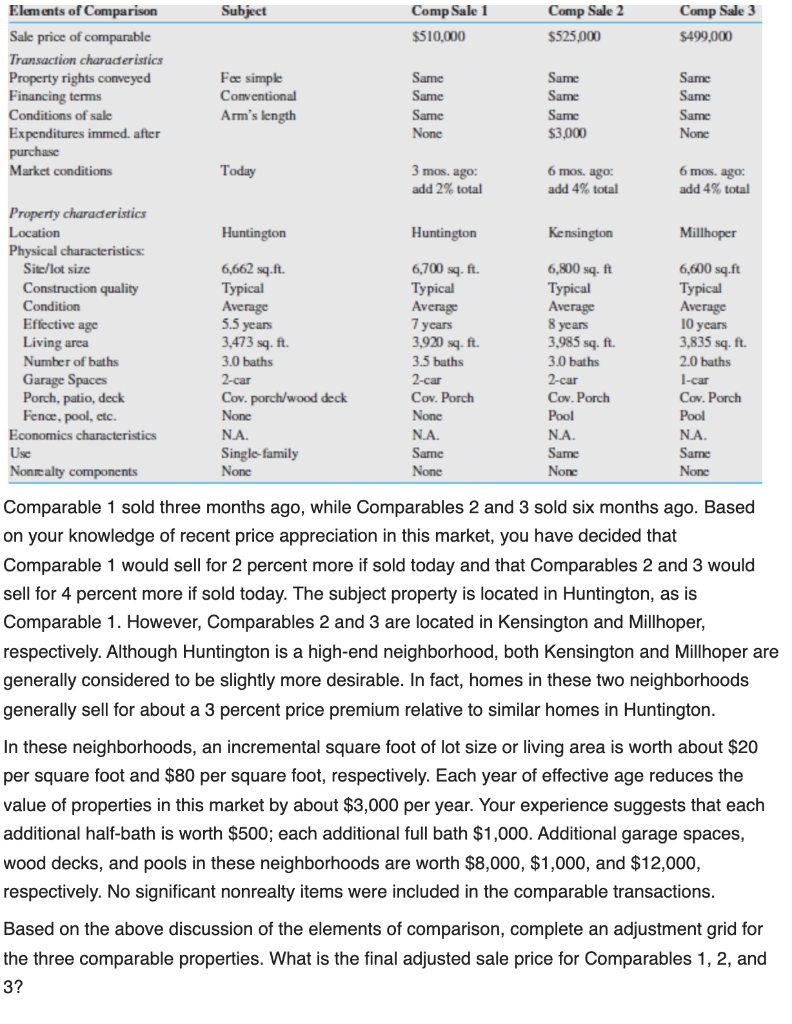

Subject Comp Sale 1 $510,000 Comp Sale 2 $525.000 Comp Sale 3 $499,000 Elements of Comparison Sale price of comparable Transaction characteristics Property rights conveyed Financing terms Conditions of sale Expenditures immed, after purchase Market conditions Fee simple Conventional Arm's length Same Same Same None Same Same Same $3,000 Same Same Same None Today 3 mos, ago: 6 mos ago 6 mos, ago: add 4% total add 2% total add 4% total Huntington Huntington Kensington Millhoper Property characteristics Location Physical characteristics: Site/lot size Construction quality Condition Effective age Living area Number of baths Garage Spaces Porch, patio, deck Fence, pool, etc. Economics characteristics Use Nonrealty components 6,662 sq.ft. Typical Average 5.5 years 3,473 sq. ft. 3.0 baths 2-car Cov. porch/wood deck None NA Single-family None 6,700 sq. ft. Typical Average 7 years 3,920 sq. ft. 3.5 baths 2-car Cov. Porch None N.A. Same None 6,800 sq.ft Typical Average 8 years 3.985 sq. ft. 3.0 baths 2-car Cov. Porch Pool NA Same None 6,600 sq.ft Typical Average 10 years 3,835 sq. ft. 2.0 baths l-car Cov. Porch Pool NA Same Nonc Comparable 1 sold three months ago, while comparables 2 and 3 sold six months ago. Based on your knowledge of recent price appreciation in this market, you have decided that Comparable 1 would sell for 2 percent more if sold today and that comparables 2 and 3 would sell for 4 percent more if sold today. The subject property is located in Huntington, as is Comparable 1. However, Comparables 2 and 3 are located in Kensington and Millhoper, respectively. Although Huntington is a high-end neighborhood, both Kensington and Millhoper are generally considered to be slightly more desirable. In fact, homes in these two neighborhoods generally sell for about a 3 percent price premium relative to similar homes in Huntington. In these neighborhoods, an incremental square foot of lot size or living area is worth about $20 per square foot and $80 per square foot, respectively. Each year of effective age reduces the value of properties in this market by about $3,000 per year. Your experience suggests that each additional half-bath is worth $500; each additional full bath $1,000. Additional garage spaces, wood decks, and pools in these neighborhoods are worth $8,000, $1,000, and $12,000, respectively. No significant nonrealty items were included in the comparable transactions. Based on the above discussion of the elements of comparison, complete an adjustment grid for the three comparable properties. What is the final adjusted sale price for comparables 1, 2, and 3? Subject Comp Sale 1 $510,000 Comp Sale 2 $525.000 Comp Sale 3 $499,000 Elements of Comparison Sale price of comparable Transaction characteristics Property rights conveyed Financing terms Conditions of sale Expenditures immed, after purchase Market conditions Fee simple Conventional Arm's length Same Same Same None Same Same Same $3,000 Same Same Same None Today 3 mos, ago: 6 mos ago 6 mos, ago: add 4% total add 2% total add 4% total Huntington Huntington Kensington Millhoper Property characteristics Location Physical characteristics: Site/lot size Construction quality Condition Effective age Living area Number of baths Garage Spaces Porch, patio, deck Fence, pool, etc. Economics characteristics Use Nonrealty components 6,662 sq.ft. Typical Average 5.5 years 3,473 sq. ft. 3.0 baths 2-car Cov. porch/wood deck None NA Single-family None 6,700 sq. ft. Typical Average 7 years 3,920 sq. ft. 3.5 baths 2-car Cov. Porch None N.A. Same None 6,800 sq.ft Typical Average 8 years 3.985 sq. ft. 3.0 baths 2-car Cov. Porch Pool NA Same None 6,600 sq.ft Typical Average 10 years 3,835 sq. ft. 2.0 baths l-car Cov. Porch Pool NA Same Nonc Comparable 1 sold three months ago, while comparables 2 and 3 sold six months ago. Based on your knowledge of recent price appreciation in this market, you have decided that Comparable 1 would sell for 2 percent more if sold today and that comparables 2 and 3 would sell for 4 percent more if sold today. The subject property is located in Huntington, as is Comparable 1. However, Comparables 2 and 3 are located in Kensington and Millhoper, respectively. Although Huntington is a high-end neighborhood, both Kensington and Millhoper are generally considered to be slightly more desirable. In fact, homes in these two neighborhoods generally sell for about a 3 percent price premium relative to similar homes in Huntington. In these neighborhoods, an incremental square foot of lot size or living area is worth about $20 per square foot and $80 per square foot, respectively. Each year of effective age reduces the value of properties in this market by about $3,000 per year. Your experience suggests that each additional half-bath is worth $500; each additional full bath $1,000. Additional garage spaces, wood decks, and pools in these neighborhoods are worth $8,000, $1,000, and $12,000, respectively. No significant nonrealty items were included in the comparable transactions. Based on the above discussion of the elements of comparison, complete an adjustment grid for the three comparable properties. What is the final adjusted sale price for comparables 1, 2, and 3