SUBJECT : FINANCIAL MANAGEMENT

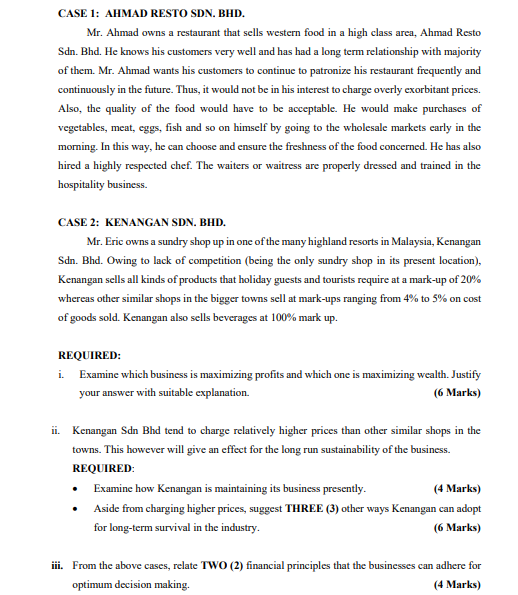

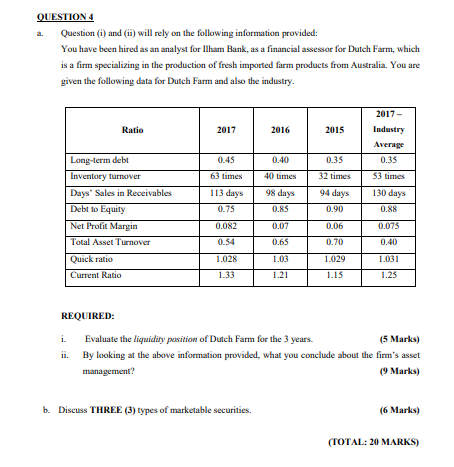

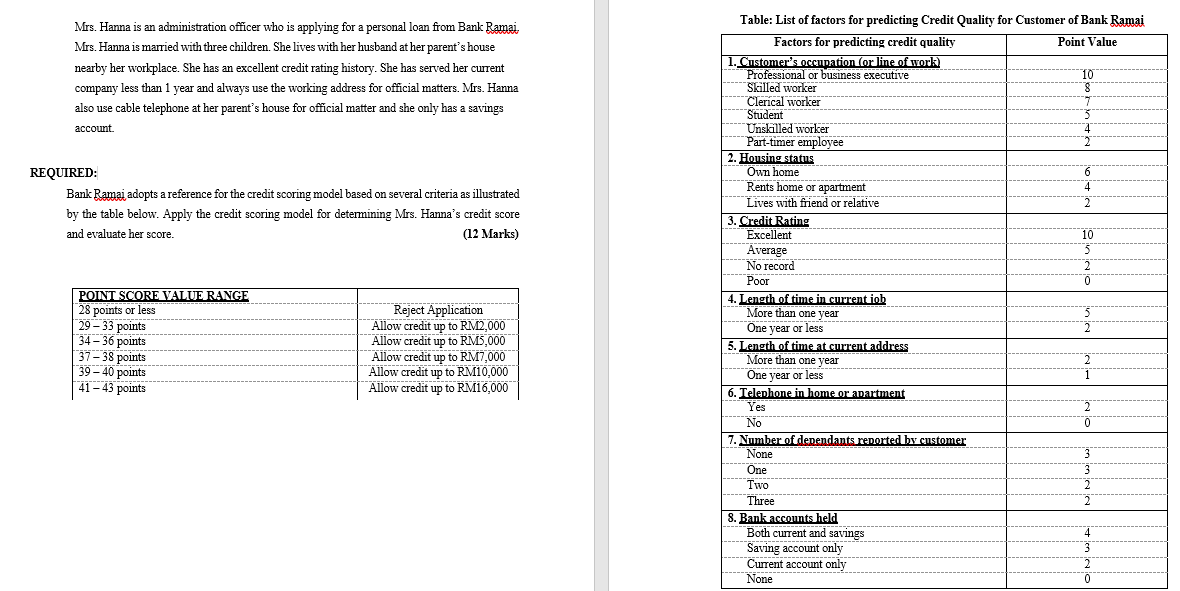

CASE 1: AHMAD RESTO SDN. BHD. Mr. Ahmad owns a restaurant that sells western food in a high class area, Ahmad Resto Sdn. Bhd. He knows his customers very well and has had a long term relationship with majority of them. Mr. Ahmad wants his customers to continue to patronize his restaurant frequently and continuously in the future. Thus, it would not be in his interest to charge overly exorbitant prices. Also, the quality of the food would have to be acceptable. He would make purchases of vegetables, meat, eggs, fish and so on himself by going to the wholesale markets early in the morning. In this way, he can choose and ensure the freshness of the food concerned. He has also hired a highly respected chef. The waiters or waitress are properly dressed and trained in the hospitality business. CASE 2: KENANGAN SDN. BHD. Mr. Eric owns a sundry shop up in one of the many highland resorts in Malaysia, Kenangan San. Bhd. Owing to lack of competition (being the only sundry shop in its present location), Kenangan sells all kinds of products that holiday guests and tourists require at a mark-up of 20% whereas other similar shops in the bigger towns sell at mark-ups ranging from 4% to 5% on cost of goods sold. Kenangan also sells beverages at 100% mark up. REQUIRED: i. Examine which business is maximizing profits and which one is maximizing wealth. Justify your answer with suitable explanation. (6 Marks) ii. Kenangan Sdn Bhd tend to charge relatively higher prices than other similar shops in the towns. This however will give an effect for the long run sustainability of the business. REQUIRED: Examine how Kenangan is maintaining its business presently. (4 Marks) Aside from charging higher prices, suggest THREE (3) other ways Kenangan can adopt for long-term survival in the industry. (6 Marks) ili. From the above cases, relate TWO (2) financial principles that the businesses can adhere for optimum decision making. (4 Marks)QUESTION 4 a. Question (i) and (ii) will rely on the following information provided: You have been hired as an analyst for Ilham Bank, as a financial assessor for Dutch Farm, which is a firm specializing in the production of fresh imported farm products from Australia. You are given the following data for Dutch Farm and also the industry. 2017 - Ratio 2017 2016 2015 Industry Long-term debt 1.45 0.40 0.35 0.35 Inventory lumover 63 times 40 Times 32 times $3 times Days' Sales in Receivables 113 days 98 days 94 days 130 day's Debt to Equity 1.75 D.8S 1.90 0.88 Net Profit Margin 0.082 0.075 Total Asset Turnover 0.70 0.40 Quick ratio 1.028 1.03 1.029 1.03 1 Current Ratio E I 1.21 1.15 1.25 REQUIRED: Evaluate the liquidity position of Dutch Farm for the 3 years. (5 Marks) ii. By looking at the above information provided, what you conclude about the firm's asset management? (9 Marks) b. Discuss THREE (3) types of marketable securities. (6 Marks) (TOTAL: 20 MARKS)Mrs. Hanna is an administration officer who is applying for a personal loan from Bank Rama Table: List of factors for predicting Credit Quality for Customer of Bank Ramai Mrs. Hanna is married with three children. She lives with her husband at her parent's house Factors for predicting credit quality Point Value nearby her workplace. She has an excellent credit rating history. She has served her current 1. Customer's occupation (or line of work) Professional or business executive company less than 1 year and always use the working address for official matters. Mrs. Hanna Skilled worker also use cable telephone at her parent's house for official matter and she only has a savings Clerical worker Student account Unskilled worker Part-timer employee 2. Housing status REQUIRED: Own home Bank Ramai adopts a reference for the credit scoring model based on several criteria as illustrated Rents home or apartment Lives with friend or relative by the table below. Apply the credit scoring model for determining Mrs. Hanna's credit score and evaluate her score. (12 Marks) 3. Credit Rating Excellent Average No record Poor POINT SCORE VALUE RANGE 4. Length of time in current job 28 points or less Reject Application 29 -33 points Allow credit up to RM2,000 More than one year One year or less 34 -36 points Allow credit up to RM5,000 5. Length of time at current address 37 -38 points Allow credit up to RM7,000 More than one year 39 -40 points Allow credit up to RM10,000 One year or less 41-43 points Allow credit up to RM16,000 6. Telephone in home or apartment Yes No 7. Number of dependants reported by customer None One Two Three 8. Bank accounts held Both current and savings Saving account only Current account only None