Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Subject: FIXIED INCOME INVESTMENT Kindly provide full formulae and working when there is. Thanks in advances. The Export Development Canada issued a bond on March

Subject: FIXIED INCOME INVESTMENT

Kindly provide full formulae and working when there is.

Thanks in advances.

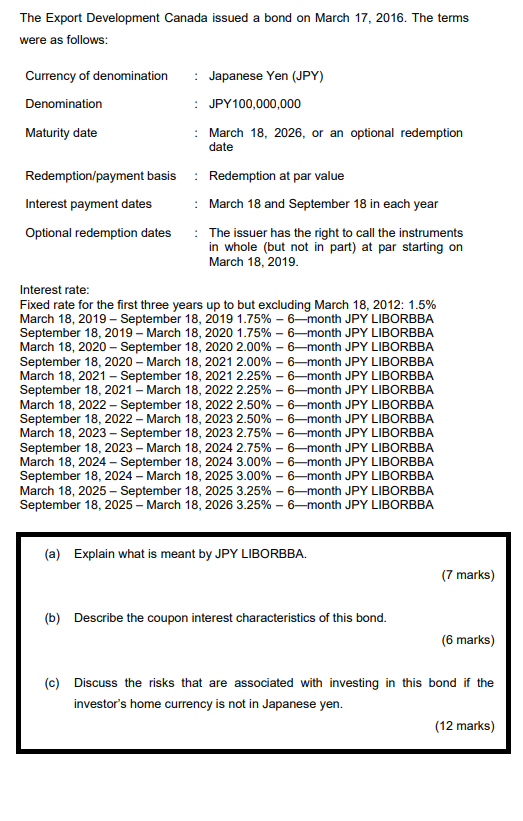

The Export Development Canada issued a bond on March 17, 2016. The terms were as follows: CurrencyofdenominationDenominationMaturitydate:JapaneseYen(JPY):JPY100,000,000:March18,2026,oranoptionalredemptiondate Redemption/paymentbasisInterestpaymentdatesOptionalredemptiondates:Redemptionatparvalue:March18andSeptember18ineachyear:Theissuerhastherighttocalltheinstrumentsinwhole(butnotinpart)atparstartingonMarch18,2019. Interest rate: Fixed rate for the first three years up to but excluding March 18, 2012: 1.5\% March 18, 2019 - September 18, 20191.75% - 6-month JPY LIBORBBA September 18, 2019 - March 18, 20201.75% - 6-month JPY LIBORBBA March 18, 2020 - September 18, 2020 2.00\% - 6-month JPY LIBORBBA September 18, 2020 - March 18, 2021 2.00\% - 6-month JPY LIBORBBA March 18, 2021 - September 18, 20212.25%6-month JPY LIBORBBA September 18, 2021 - March 18, 20222.25% - 6-month JPY LIBORBBA March 18, 2023 - September 18, 20232.75%6-month JPY LIBORBBA September 18, 2023 - March 18, 20242.75% - 6-month JPY LIBORBBA March 18, 2024 - September 18, 20243.00% - 6-month JPY LIBORBBA September 18, 2024 - March 18, 2025 3.00\% - 6-month JPY LIBORBBA March 18, 2025 - September 18, 20253.25% - 6month JPY LIBORBBA September 18, 2025 - March 18, 20263.25% - 6month JPY LIBORBBA (a) Explain what is meant by JPY LIBORBBA. (7 marks) (b) Describe the coupon interest characteristics of this bond. (6 marks) (c) Discuss the risks that are associated with investing in this bond if the investor's home currency is not in Japanese yen. (12 marks) The Export Development Canada issued a bond on March 17, 2016. The terms were as follows: CurrencyofdenominationDenominationMaturitydate:JapaneseYen(JPY):JPY100,000,000:March18,2026,oranoptionalredemptiondate Redemption/paymentbasisInterestpaymentdatesOptionalredemptiondates:Redemptionatparvalue:March18andSeptember18ineachyear:Theissuerhastherighttocalltheinstrumentsinwhole(butnotinpart)atparstartingonMarch18,2019. Interest rate: Fixed rate for the first three years up to but excluding March 18, 2012: 1.5\% March 18, 2019 - September 18, 20191.75% - 6-month JPY LIBORBBA September 18, 2019 - March 18, 20201.75% - 6-month JPY LIBORBBA March 18, 2020 - September 18, 2020 2.00\% - 6-month JPY LIBORBBA September 18, 2020 - March 18, 2021 2.00\% - 6-month JPY LIBORBBA March 18, 2021 - September 18, 20212.25%6-month JPY LIBORBBA September 18, 2021 - March 18, 20222.25% - 6-month JPY LIBORBBA March 18, 2023 - September 18, 20232.75%6-month JPY LIBORBBA September 18, 2023 - March 18, 20242.75% - 6-month JPY LIBORBBA March 18, 2024 - September 18, 20243.00% - 6-month JPY LIBORBBA September 18, 2024 - March 18, 2025 3.00\% - 6-month JPY LIBORBBA March 18, 2025 - September 18, 20253.25% - 6month JPY LIBORBBA September 18, 2025 - March 18, 20263.25% - 6month JPY LIBORBBA (a) Explain what is meant by JPY LIBORBBA. (7 marks) (b) Describe the coupon interest characteristics of this bond. (6 marks) (c) Discuss the risks that are associated with investing in this bond if the investor's home currency is not in Japanese yen. (12 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started