Answered step by step

Verified Expert Solution

Question

1 Approved Answer

subject -Income taxation( please do the calculation and get the correct answer for 1-3) show works. please note marked answer possibly wrong. thank you Questions

subject -Income taxation( please do the calculation and get the correct answer for 1-3) show works. please note marked answer possibly wrong. thank you

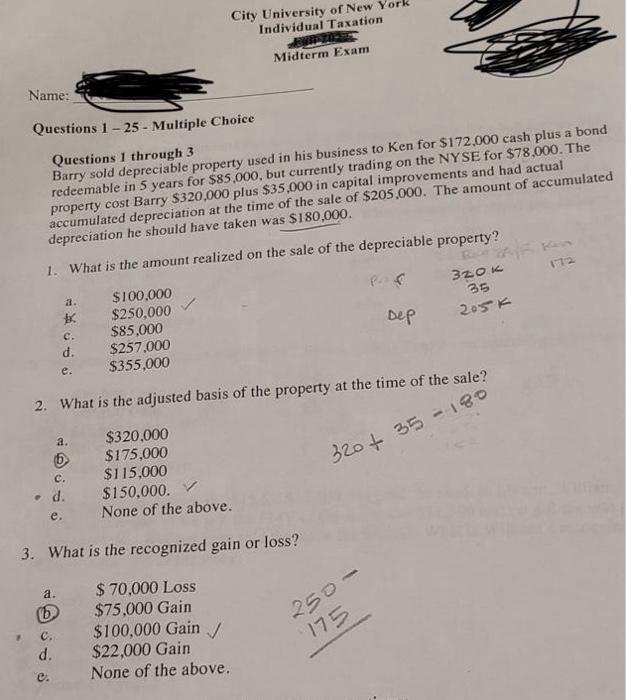

Questions 1-25-Multiple Choice Questions 1 through 3 Barry sold depreciable property used in his business to Ken for $172,000 cash plus a bond redeemable in 5 years for $85,000, but currently trading on the NYSE for $78,000. The property cost Barry $320,000 plus $35,000 in capital improvements and had actual accumulated depreciation at the time of the sale of $205,000. The amount of accumulated depreciation he should have taken was $180,000. realized on the sale of the depreciable property? 2. What is the adjusted basis of the property at the nme on un a. $320,000 (b) $175,000 320+ c. $115,000 d. $150,000. e. None of the above. 3. What is the recognized gain or loss? a. $70,000 Loss (b) $75,000 Gain c. $100,000 Gain d. $22,000 Gain c. None of the above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started