Answered step by step

Verified Expert Solution

Question

1 Approved Answer

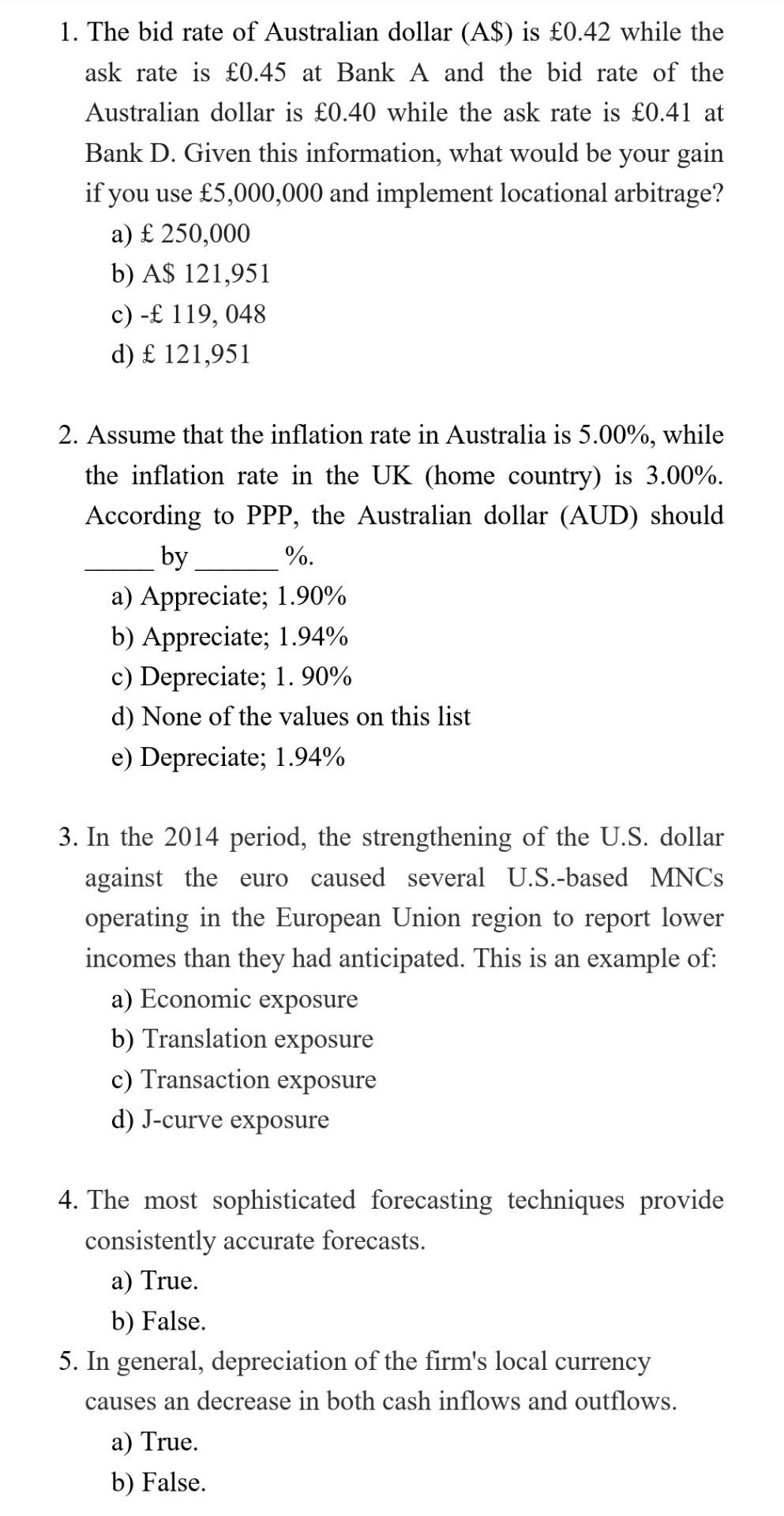

Subject: International Finance Management 1. The bid rate of Australian dollar (A$) is 0.42 while the ask rate is 0.45 at Bank A and the

Subject: International Finance Management

1. The bid rate of Australian dollar (A$) is 0.42 while the ask rate is 0.45 at Bank A and the bid rate of the Australian dollar is 0.40 while the ask rate is 0.41 at Bank D. Given this information, what would be your gain if you use 5,000,000 and implement locational arbitrage? a) 250,000 b) A$ 121,951 c) - 119, 048 d) 121,951 2. Assume that the inflation rate in Australia is 5.00%, while the inflation rate in the UK (home country) is 3.00%. According to PPP, the Australian dollar (AUD) should by %. a) Appreciate; 1.90% b) Appreciate; 1.94% c) Depreciate; 1. 90% d) None of the values on this list e) Depreciate; 1.94% 3. In the 2014 period, the strengthening of the U.S. dollar against the euro caused several U.S.-based MNCs operating in the European Union region to report lower incomes than they had anticipated. This is an example of: a) Economic exposure b) Translation exposure c) Transaction exposure d) J-curve exposure 4. The most sophisticated forecasting techniques provide consistently accurate forecasts. a) True. b) False. 5. In general, depreciation of the firm's local currency causes an decrease in both cash inflows and outflows. a) True. b) False

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started