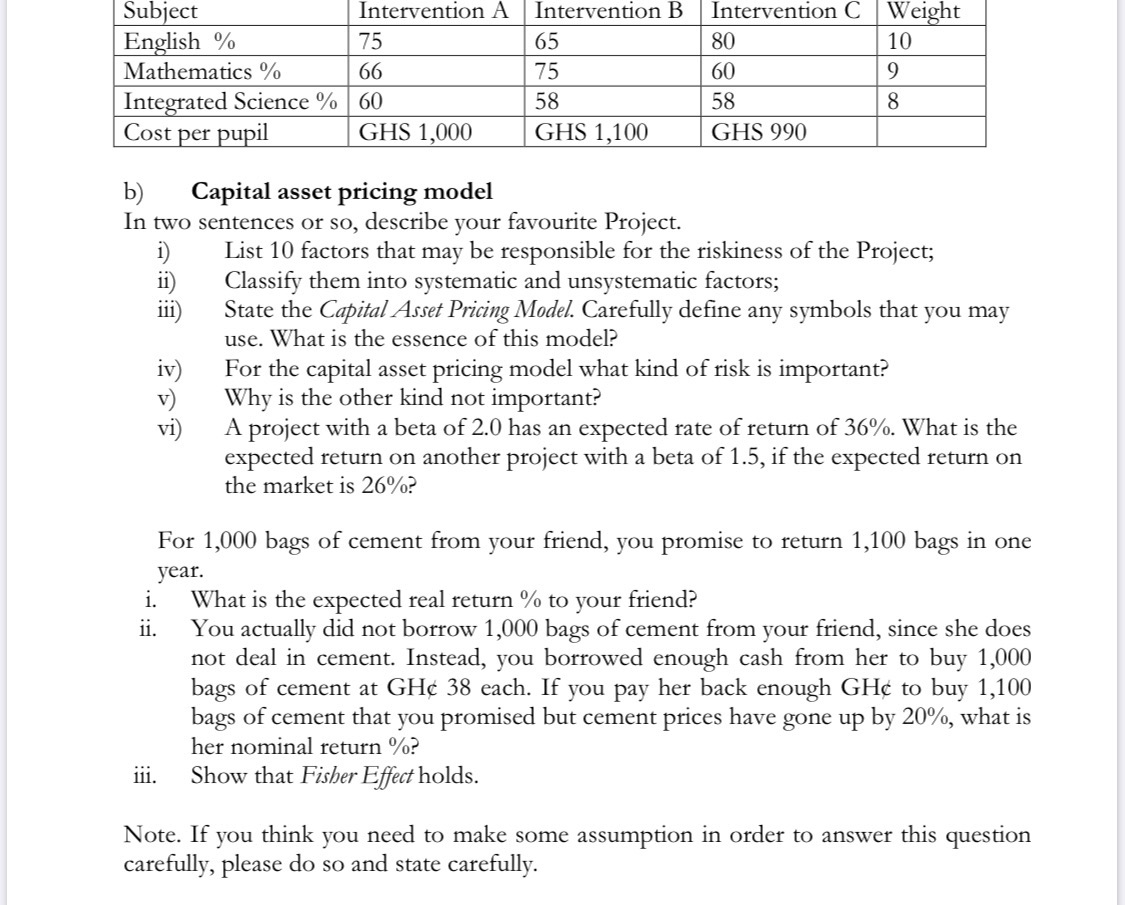

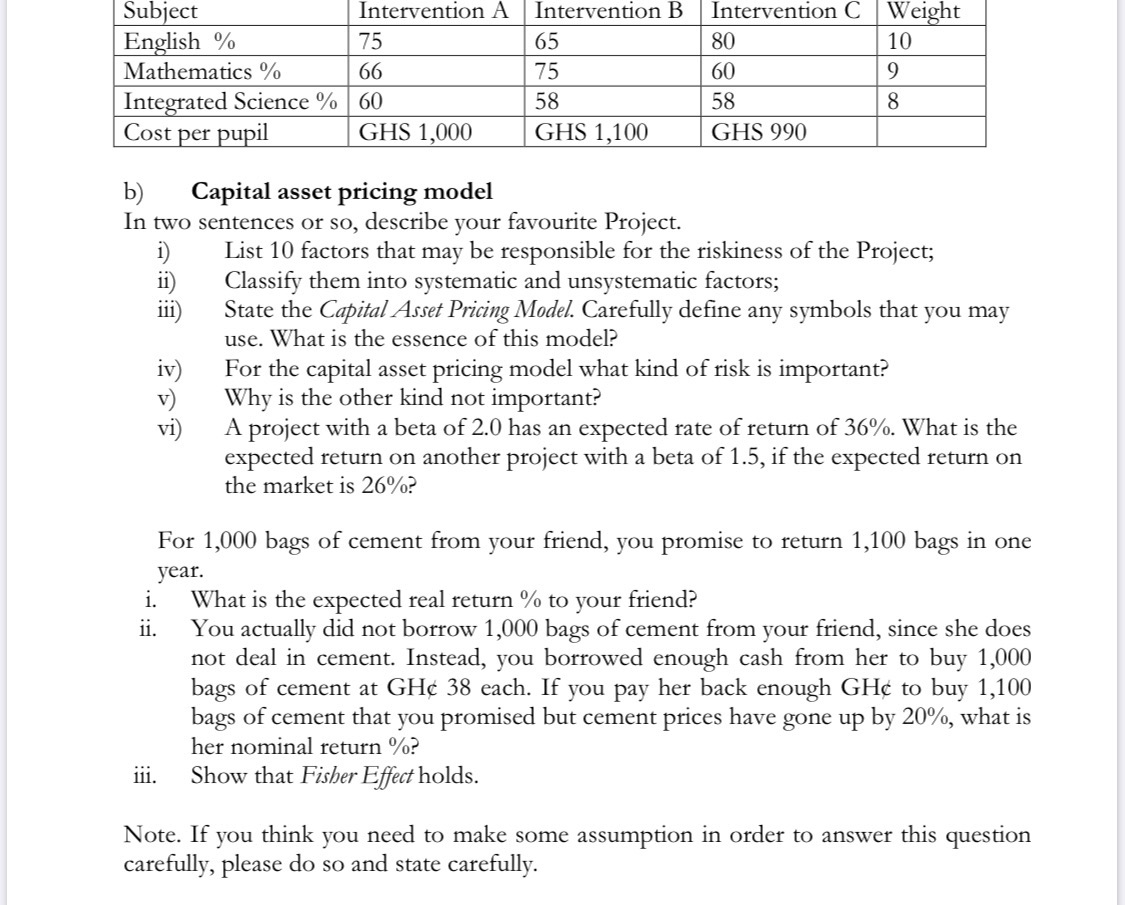

Subject Intervention A English % 75 Mathematics % 66 Integrated Science % 60 Cost per pupil GHS 1,000 Intervention B 65 75 58 GHS 1,100 Intervention C Weight 80 10 60 9 58 8 GHS 990 i) .. b) Capital asset pricing model In two sentences or so, describe your favourite Project. List 10 factors that may be responsible for the riskiness of the Project; ii) Classify them into systematic and unsystematic factors; 111 State the Capital Asset Pricing Model. Carefully define any symbols that you may use. What is the essence of this model? iv) For the capital asset pricing model what kind of risk is important? v) Why is the other kind not important? vi) A project with a beta of 2.0 has an expected rate of return of 36%. What is the expected return on another project with a beta of 1.5, if the expected return on the market is 26%? For 1,000 bags of cement from your friend, you promise to return 1,100 bags in one year. i. What is the expected real return % to your friend? ii. You actually did not borrow 1,000 bags of cement from your friend, since she does not deal in cement. Instead, you borrowed enough cash from her to buy 1,000 bags of cement at GH 38 each. If you pay her back enough GH to buy 1,100 bags of cement that you promised but cement prices have gone up by 20%, what is her nominal return %? Show that Fisher Effect holds. 111. Note. If you think you need to make some assumption in order to answer this question carefully, please do so and state carefully. Subject Intervention A English % 75 Mathematics % 66 Integrated Science % 60 Cost per pupil GHS 1,000 Intervention B 65 75 58 GHS 1,100 Intervention C Weight 80 10 60 9 58 8 GHS 990 i) .. b) Capital asset pricing model In two sentences or so, describe your favourite Project. List 10 factors that may be responsible for the riskiness of the Project; ii) Classify them into systematic and unsystematic factors; 111 State the Capital Asset Pricing Model. Carefully define any symbols that you may use. What is the essence of this model? iv) For the capital asset pricing model what kind of risk is important? v) Why is the other kind not important? vi) A project with a beta of 2.0 has an expected rate of return of 36%. What is the expected return on another project with a beta of 1.5, if the expected return on the market is 26%? For 1,000 bags of cement from your friend, you promise to return 1,100 bags in one year. i. What is the expected real return % to your friend? ii. You actually did not borrow 1,000 bags of cement from your friend, since she does not deal in cement. Instead, you borrowed enough cash from her to buy 1,000 bags of cement at GH 38 each. If you pay her back enough GH to buy 1,100 bags of cement that you promised but cement prices have gone up by 20%, what is her nominal return %? Show that Fisher Effect holds. 111. Note. If you think you need to make some assumption in order to answer this question carefully, please do so and state carefully