Answered step by step

Verified Expert Solution

Question

1 Approved Answer

subject is Cost Accounting That is the complete question that was given. Santana manufacturing company has two production departments, A and B, and two services

subject is Cost Accounting

subject is Cost Accounting That is the complete question that was given.

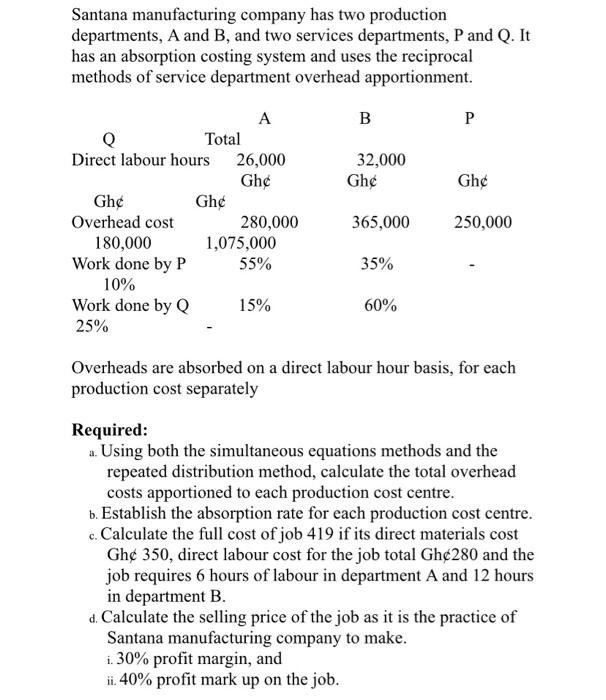

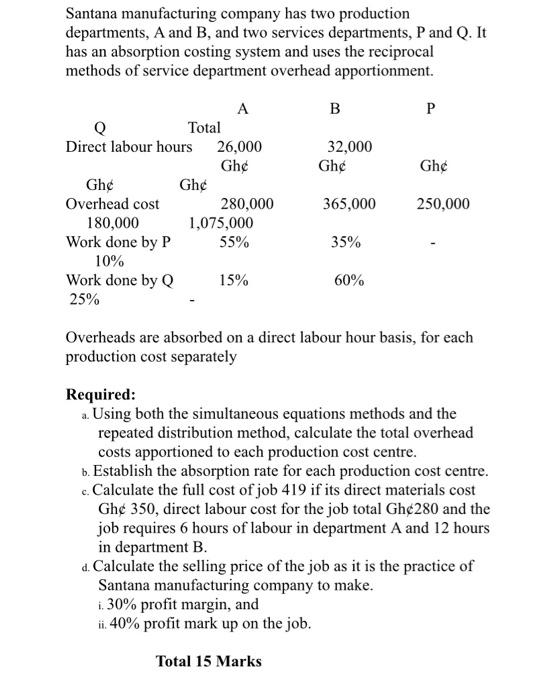

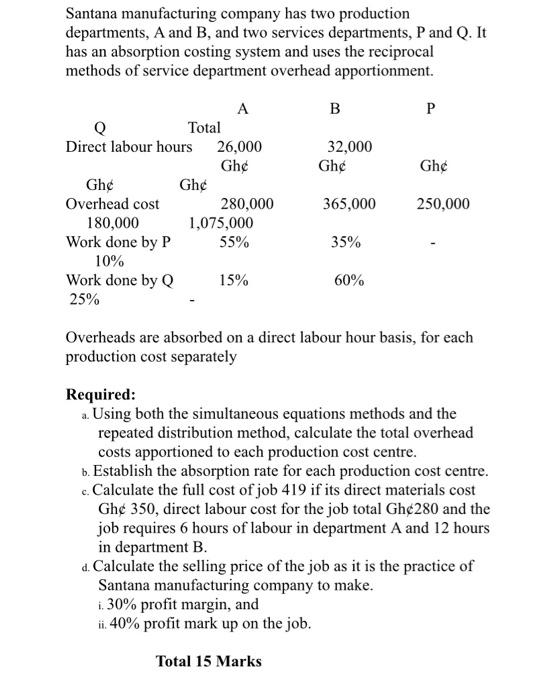

Santana manufacturing company has two production departments, A and B, and two services departments, P and Q. It has an absorption costing system and uses the reciprocal methods of service department overhead apportionment. B P 32,000 Gh Ghe A Total Direct labour hours 26,000 Gh Ghe Gh Overhead cost 280,000 180,000 1,075,000 Work done by P 55% 10% Work done by Q 15% 25% 365,000 250,000 35% 60% Overheads are absorbed on a direct labour hour basis, for each production cost separately Required: 1. Using both the simultaneous equations methods and the repeated distribution method, calculate the total overhead costs apportioned to each production cost centre. b. Establish the absorption rate for each production cost centre. c. Calculate the full cost of job 419 if its direct materials cost Gh 350, direct labour cost for the job total Gh280 and the job requires 6 hours of labour in department A and 12 hours in department B. d. Calculate the selling price of the job as it is the practice of Santana manufacturing company to make. i. 30% profit margin, and ii. 40% profit mark up on the job. i. Santana manufacturing company has two production departments, A and B, and two services departments, P and Q. It has an absorption costing system and uses the reciprocal methods of service department overhead apportionment. B P 32,000 Gh Ghe A Total Direct labour hours 26,000 Ghe Ghe Ghe Overhead cost 280,000 180,000 1,075,000 Work done by P 55% 10% Work done by Q 15% 25% 365,000 250,000 35% 60% Overheads are absorbed on a direct labour hour basis, for each production cost separately Required: ..Using both the simultaneous equations methods and the repeated distribution method, calculate the total overhead costs apportioned to each production cost centre. b. Establish the absorption rate for each production cost centre. c. Calculate the full cost of job 419 if its direct materials cost Gh 350, direct labour cost for the job total Gh280 and the job requires 6 hours of labour in department A and 12 hours in department B. d. Calculate the selling price of the job as it is the practice of Santana manufacturing company to make. 1.30% profit margin, and ii. 40% profit mark up on the job. Total 15 Marks Santana manufacturing company has two production departments, A and B, and two services departments, P and Q. It has an absorption costing system and uses the reciprocal methods of service department overhead apportionment. B P 32,000 Gh Ghe A Total Direct labour hours 26,000 Gh Ghe Gh Overhead cost 280,000 180,000 1,075,000 Work done by P 55% 10% Work done by Q 15% 25% 365,000 250,000 35% 60% Overheads are absorbed on a direct labour hour basis, for each production cost separately Required: 1. Using both the simultaneous equations methods and the repeated distribution method, calculate the total overhead costs apportioned to each production cost centre. b. Establish the absorption rate for each production cost centre. c. Calculate the full cost of job 419 if its direct materials cost Gh 350, direct labour cost for the job total Gh280 and the job requires 6 hours of labour in department A and 12 hours in department B. d. Calculate the selling price of the job as it is the practice of Santana manufacturing company to make. i. 30% profit margin, and ii. 40% profit mark up on the job. i. Santana manufacturing company has two production departments, A and B, and two services departments, P and Q. It has an absorption costing system and uses the reciprocal methods of service department overhead apportionment. B P 32,000 Gh Ghe A Total Direct labour hours 26,000 Ghe Ghe Ghe Overhead cost 280,000 180,000 1,075,000 Work done by P 55% 10% Work done by Q 15% 25% 365,000 250,000 35% 60% Overheads are absorbed on a direct labour hour basis, for each production cost separately Required: ..Using both the simultaneous equations methods and the repeated distribution method, calculate the total overhead costs apportioned to each production cost centre. b. Establish the absorption rate for each production cost centre. c. Calculate the full cost of job 419 if its direct materials cost Gh 350, direct labour cost for the job total Gh280 and the job requires 6 hours of labour in department A and 12 hours in department B. d. Calculate the selling price of the job as it is the practice of Santana manufacturing company to make. 1.30% profit margin, and ii. 40% profit mark up on the job. Total 15 Marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started