Answered step by step

Verified Expert Solution

Question

1 Approved Answer

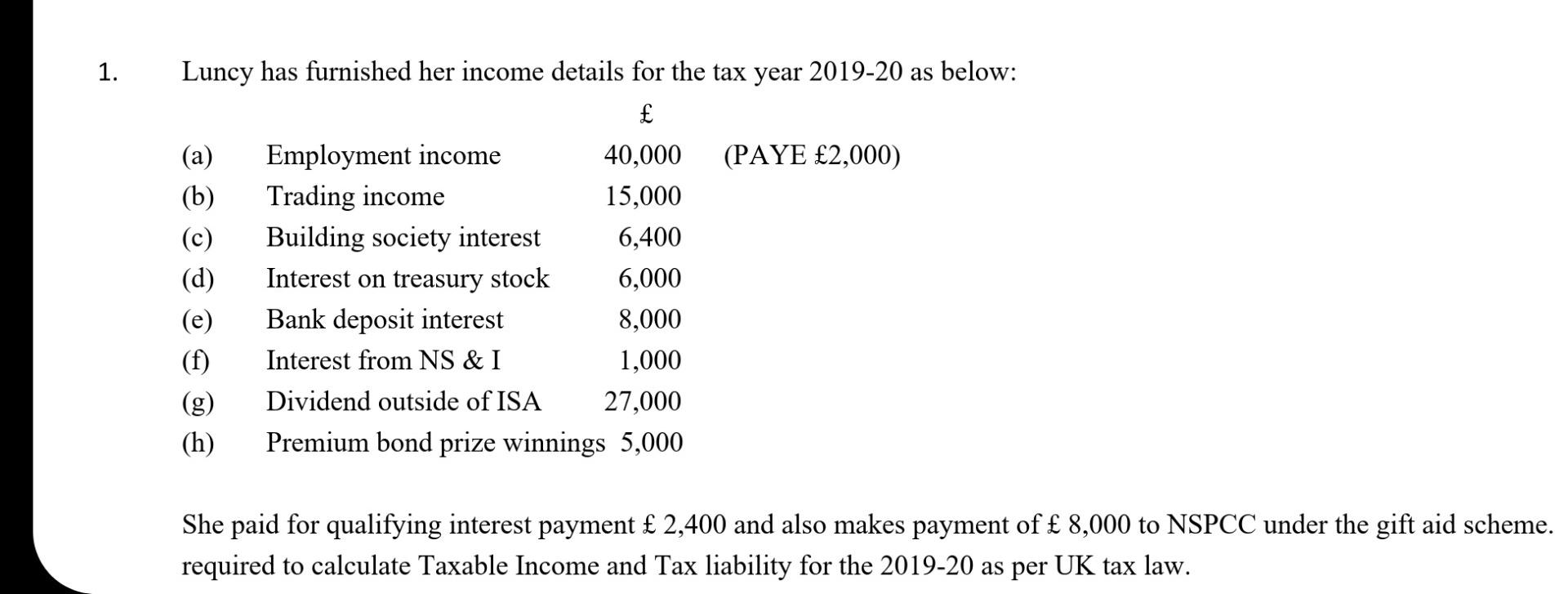

subject is Taxation accounting UK tax 1. Luncy has furnished her income details for the tax year 2019-20 as below: (a) Employment income 40,000 (PAYE

subject is Taxation accounting

UK tax

1. Luncy has furnished her income details for the tax year 2019-20 as below: (a) Employment income 40,000 (PAYE 2,000) (b) Trading income 15,000 (c) Building society interest 6,400 (d) Interest on treasury stock 6,000 Bank deposit interest 8,000 (f) Interest from NS & I 1,000 (g) Dividend outside of ISA 27,000 (h) Premium bond prize winnings 5,000 She paid for qualifying interest payment 2,400 and also makes payment of 8,000 to NSPCC under the gift aid scheme. required to calculate Taxable Income and Tax liability for the 2019-20 as per UK tax lawStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started