Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Subject: personal taxation please help me outh with this question. X Ltd is Canadian controlied private corporation operating a franchised retall and mail order business

Subject: personal taxation

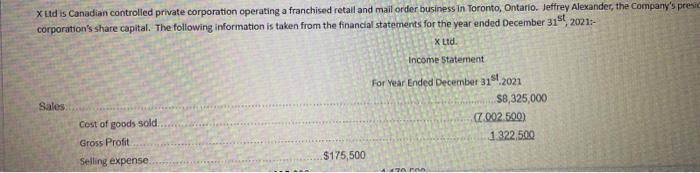

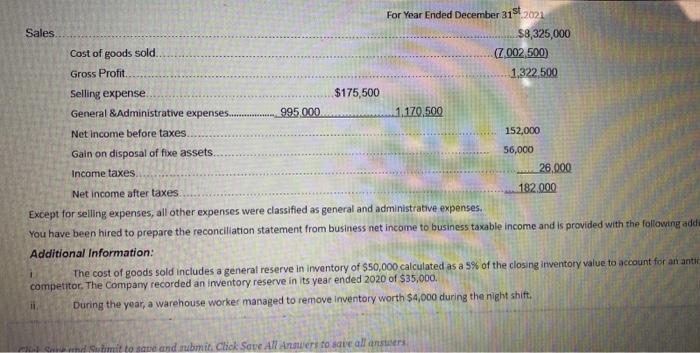

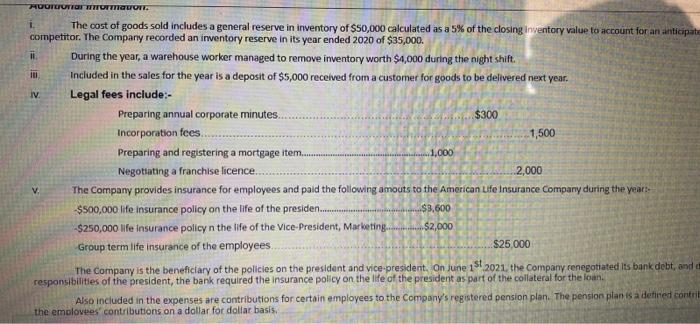

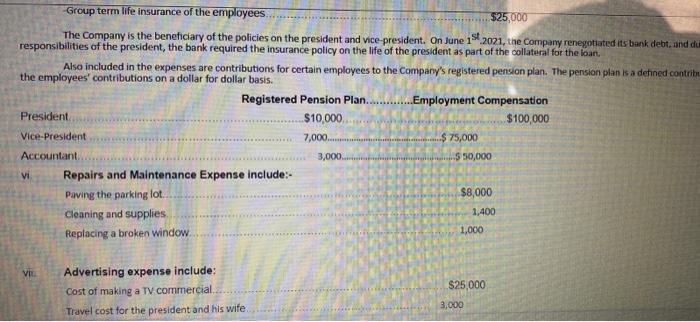

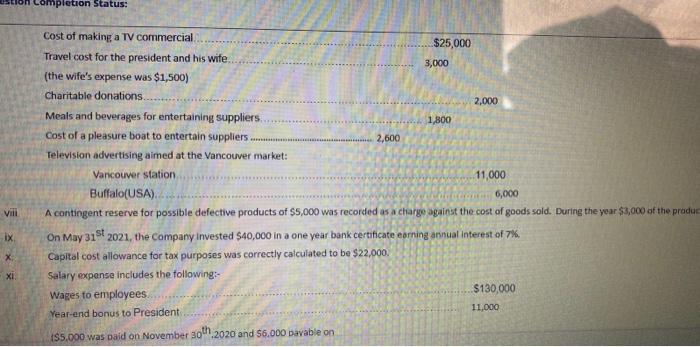

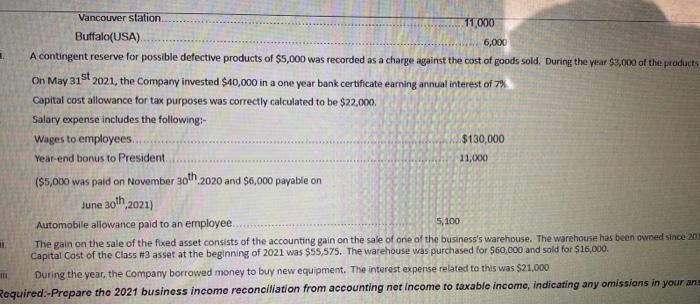

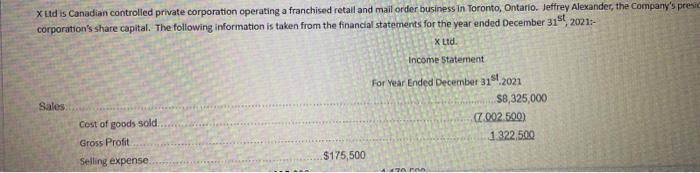

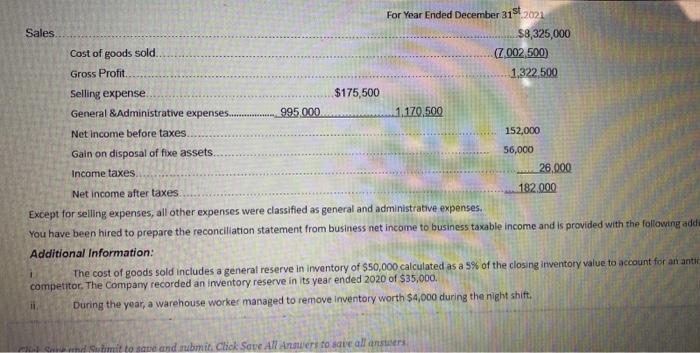

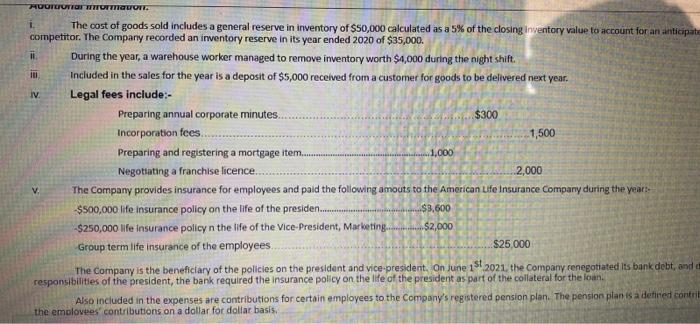

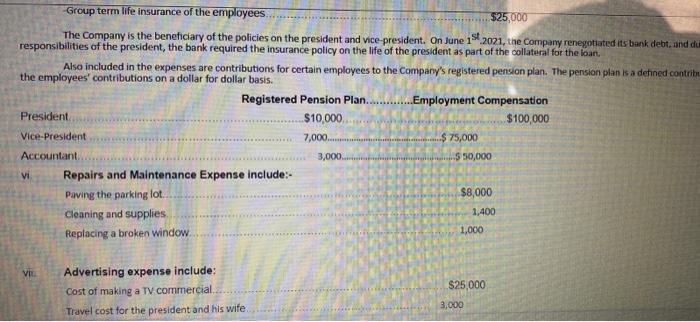

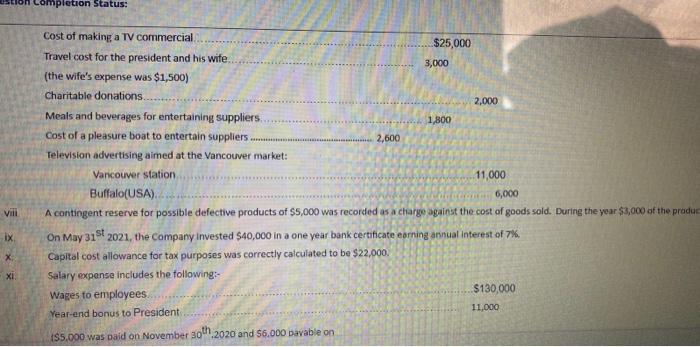

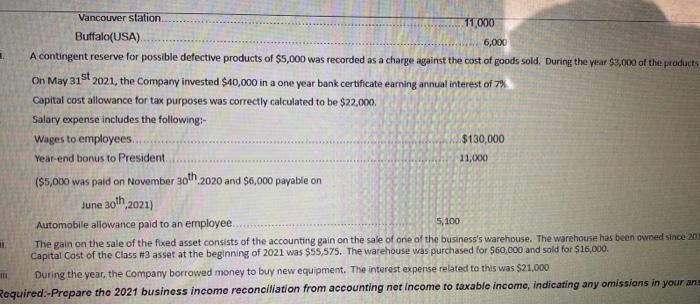

X Ltd is Canadian controlied private corporation operating a franchised retall and mail order business in Toronto, Ontario. Jeffrey Alexander, the Company's pres comoration's share capital. The following information is taken from the financial statements for the year ended December 31 'st 2021 :- Except for selling expenses, all other expenses were classified as general and administrative expenses. You have been hired to prepare the reconciliation statement from business net income to business taxable income and is provided with the following ade Additional information: 1. The cost of goods sold includes a general reserve in inventory of $50,000 calculated as a 5% of the closing inventory value fo account for an inticipat competitor. The Company recorded an inventory reserve in its year ended 2020 of $35,000. iI. During the year, a warehouse worker managed to remove inventory worth $4,000 during the night shift. iii. Included in the sales for the year is a deposit of $5,000 received from a customer for goods to be delivered next year. N. Legal fees include:- Preparing annual corporate minutes. $300 Incorporation fees. 1,500 Preparing and registering a mortgage item. 1,000 Negotiating a franchise licence. 2,000 V. The Company provides insurance for employees and paid the following amouts to the American Lfe Insurance Company during the yeart$S00,000 life insurance policy on the life of the presiden - $250,000 life insurance policy n the life of the Vice-President, Marketing Group term life insurance of the employees. $25,000 The Company is the beneficiary of the policies on the president and vice-president. On june 1 st 2021 , the company renegotiated its bank debt, and responsibilities of the president, the bark required the insurance policy on the ife of the president as part of the collateral for the ioan. Also included in the expenses are contributions for certain employees to the Company's registered pension plan. The pension pian is a detined Eontri the emolovees' contributions on a dollar for dollar basis. The Company is the beneficiary of the policies on the president and vice-president. On June 1 st 2021, the Cornparyy renegotiated its bank debt, ind di responsibilities of the president, the bank required the insurance policy on the life of the president as part of the collateral for the loant Also included in the expenses are contributions for certain employees to the Company's registered pension plan. The pension plan is is deined contrib the employees' contributions on a dollar for dollar basis. eatrompretion Status: Cost of making a TV commercial $25,000 Travel cost for the president and his wife. 3,000 (the wife's expense was $1,500 ) Charitable donations. 2,000 Meals and beverages for entertaining suppliers: 1,800 Cost of a pleasure boat to entertain suppliers 2,600 Television advertising aimed at the Vancouver market: Vancouver station . 11,000 viil A contingent reserve for possible defective products of $5,000 was recorded as a charge against the cost of goods sold. During the year $$3,000 of the produe IX. On May 31 St 2021, the Company invested $40,000 in a one year bank certificate eorning annual interest of 7 K. C. Capital cost allowance for tax purposes was correctly calculated to be $22,000. xi. Salary expense includes the tollowing:- Wages to employees. $130,000 Year-end bonus to President 11,000 1S5,000 was Daid on November 30th,2020 and $6,000 pavable on A contingent reserve for possible defective products of $5,000 was recorded as a charge against the cost of goods sold. During the year $,000 of the prodicts On May 31St2021, the Company invested $40,000 in a one year bank certificate earning annual interest of 7%. Capital cost allowance for tax purposes was correctly calculated to be $22,000. Salary expense includes the following:- Wages to employecs. $130,000 Year-end bonus to President. 11,000 ($5,000 was paid on November 30th.2020 and $6,000 payable on June 30th,2021) Automobile allowance paid to an employee. 5, 100 The gain on the sale of the fixed asset consists of the accounting gain on the sale of one of the business's warehouse. The warehothe has been owned since' 20 Capital Cast of the Class $3 asset at the beginning of 2021 was $55,575. The warehouse was purchased for $60,000 and sald for $16,000. During the year, the Company borrowed money to buy new equipment. The interest expense related to this was $21,000 equired:-Prcpare tho 2021 business income reconciliation from accounting net income to taxable income, indicating any omissions in your an X Ltd is Canadian controlied private corporation operating a franchised retall and mail order business in Toronto, Ontario. Jeffrey Alexander, the Company's pres comoration's share capital. The following information is taken from the financial statements for the year ended December 31 'st 2021 :- Except for selling expenses, all other expenses were classified as general and administrative expenses. You have been hired to prepare the reconciliation statement from business net income to business taxable income and is provided with the following ade Additional information: 1. The cost of goods sold includes a general reserve in inventory of $50,000 calculated as a 5% of the closing inventory value fo account for an inticipat competitor. The Company recorded an inventory reserve in its year ended 2020 of $35,000. iI. During the year, a warehouse worker managed to remove inventory worth $4,000 during the night shift. iii. Included in the sales for the year is a deposit of $5,000 received from a customer for goods to be delivered next year. N. Legal fees include:- Preparing annual corporate minutes. $300 Incorporation fees. 1,500 Preparing and registering a mortgage item. 1,000 Negotiating a franchise licence. 2,000 V. The Company provides insurance for employees and paid the following amouts to the American Lfe Insurance Company during the yeart$S00,000 life insurance policy on the life of the presiden - $250,000 life insurance policy n the life of the Vice-President, Marketing Group term life insurance of the employees. $25,000 The Company is the beneficiary of the policies on the president and vice-president. On june 1 st 2021 , the company renegotiated its bank debt, and responsibilities of the president, the bark required the insurance policy on the ife of the president as part of the collateral for the ioan. Also included in the expenses are contributions for certain employees to the Company's registered pension plan. The pension pian is a detined Eontri the emolovees' contributions on a dollar for dollar basis. The Company is the beneficiary of the policies on the president and vice-president. On June 1 st 2021, the Cornparyy renegotiated its bank debt, ind di responsibilities of the president, the bank required the insurance policy on the life of the president as part of the collateral for the loant Also included in the expenses are contributions for certain employees to the Company's registered pension plan. The pension plan is is deined contrib the employees' contributions on a dollar for dollar basis. eatrompretion Status: Cost of making a TV commercial $25,000 Travel cost for the president and his wife. 3,000 (the wife's expense was $1,500 ) Charitable donations. 2,000 Meals and beverages for entertaining suppliers: 1,800 Cost of a pleasure boat to entertain suppliers 2,600 Television advertising aimed at the Vancouver market: Vancouver station . 11,000 viil A contingent reserve for possible defective products of $5,000 was recorded as a charge against the cost of goods sold. During the year $$3,000 of the produe IX. On May 31 St 2021, the Company invested $40,000 in a one year bank certificate eorning annual interest of 7 K. C. Capital cost allowance for tax purposes was correctly calculated to be $22,000. xi. Salary expense includes the tollowing:- Wages to employees. $130,000 Year-end bonus to President 11,000 1S5,000 was Daid on November 30th,2020 and $6,000 pavable on A contingent reserve for possible defective products of $5,000 was recorded as a charge against the cost of goods sold. During the year $,000 of the prodicts On May 31St2021, the Company invested $40,000 in a one year bank certificate earning annual interest of 7%. Capital cost allowance for tax purposes was correctly calculated to be $22,000. Salary expense includes the following:- Wages to employecs. $130,000 Year-end bonus to President. 11,000 ($5,000 was paid on November 30th.2020 and $6,000 payable on June 30th,2021) Automobile allowance paid to an employee. 5, 100 The gain on the sale of the fixed asset consists of the accounting gain on the sale of one of the business's warehouse. The warehothe has been owned since' 20 Capital Cast of the Class $3 asset at the beginning of 2021 was $55,575. The warehouse was purchased for $60,000 and sald for $16,000. During the year, the Company borrowed money to buy new equipment. The interest expense related to this was $21,000 equired:-Prcpare tho 2021 business income reconciliation from accounting net income to taxable income, indicating any omissions in your an please help me outh with this question.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started