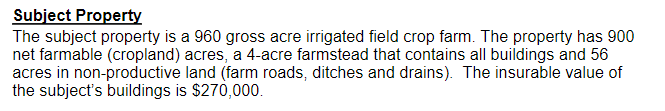

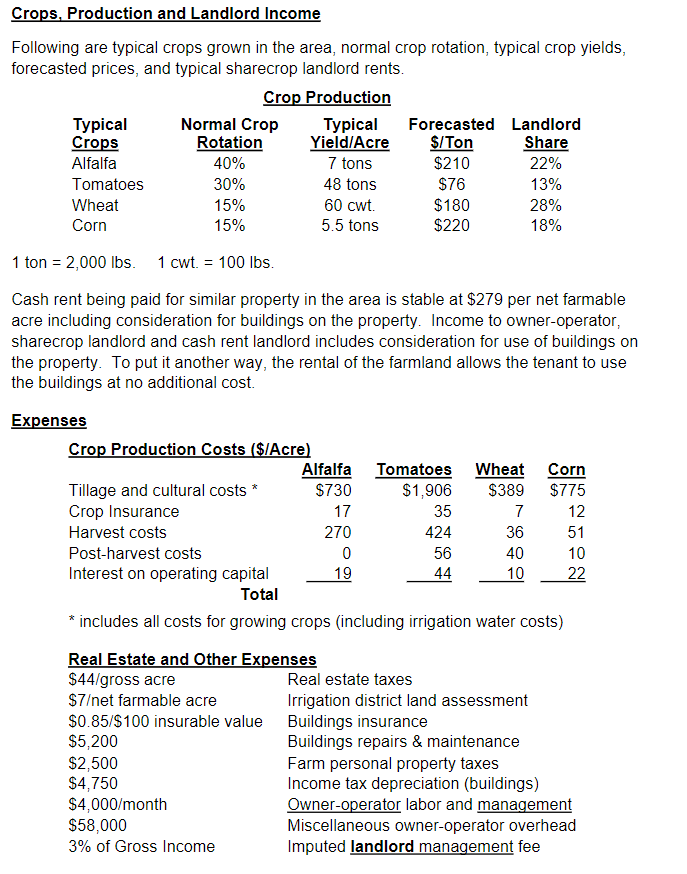

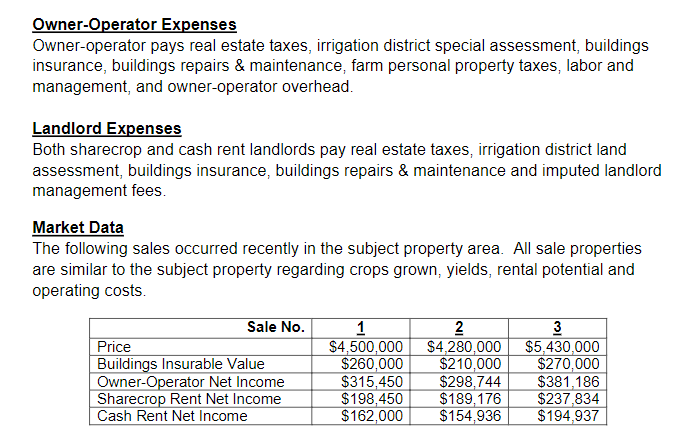

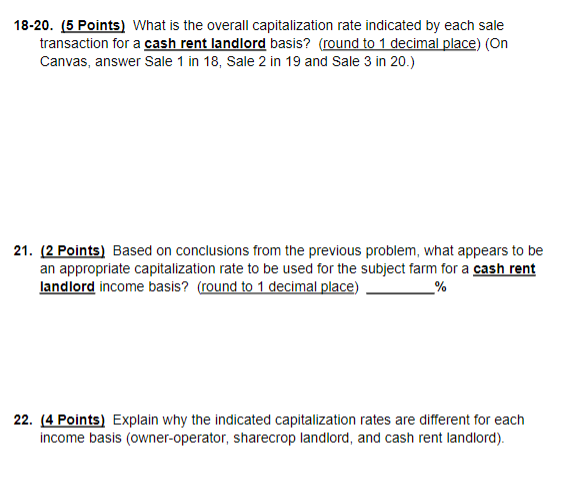

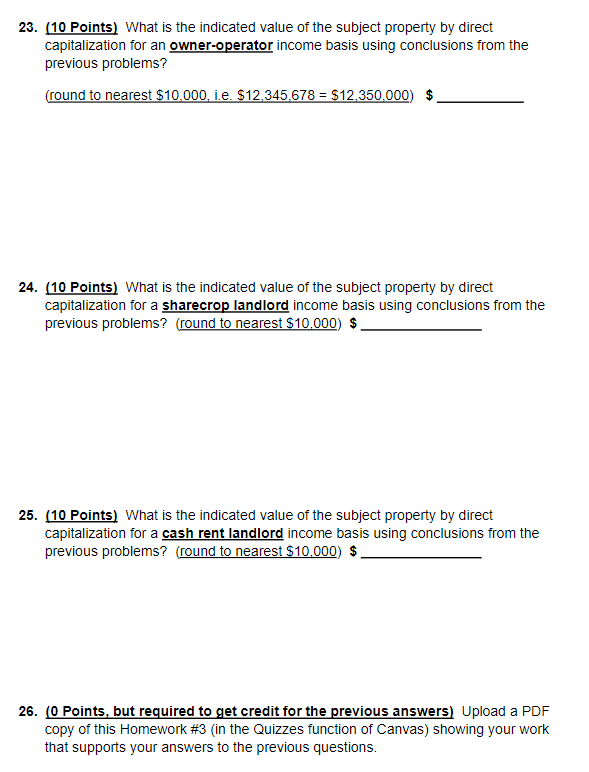

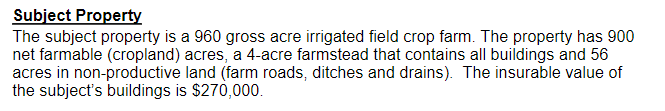

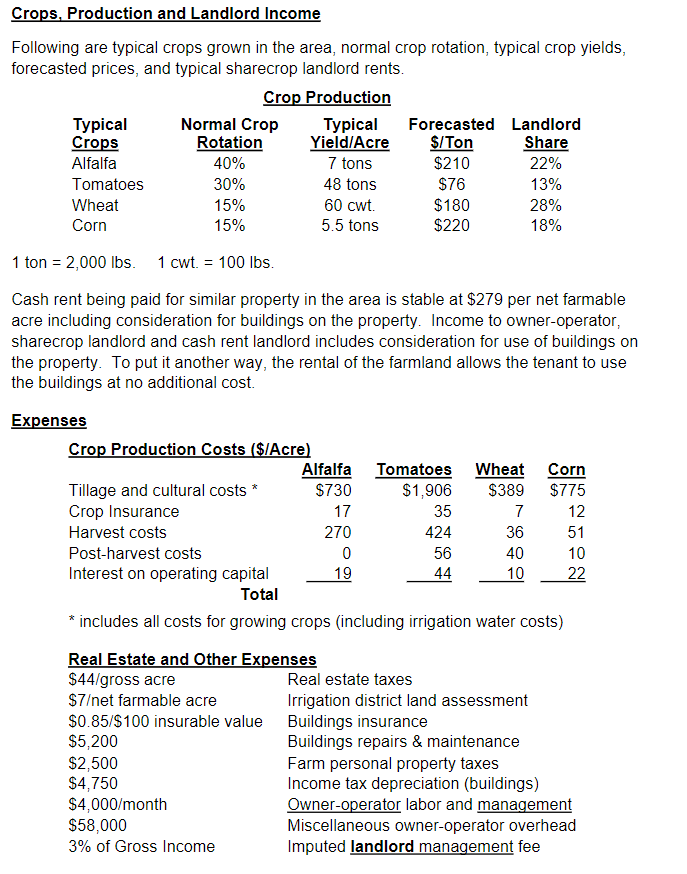

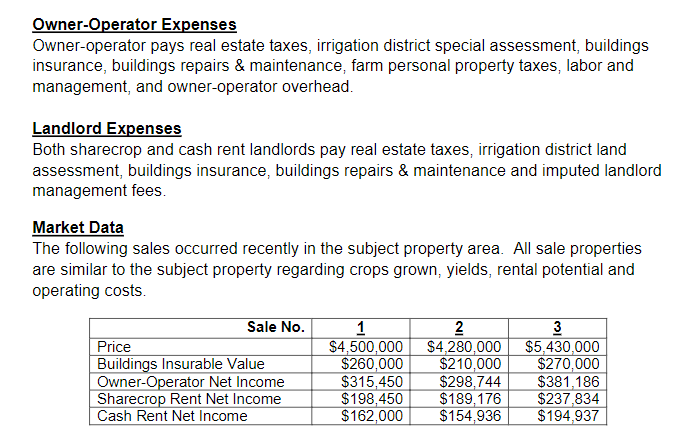

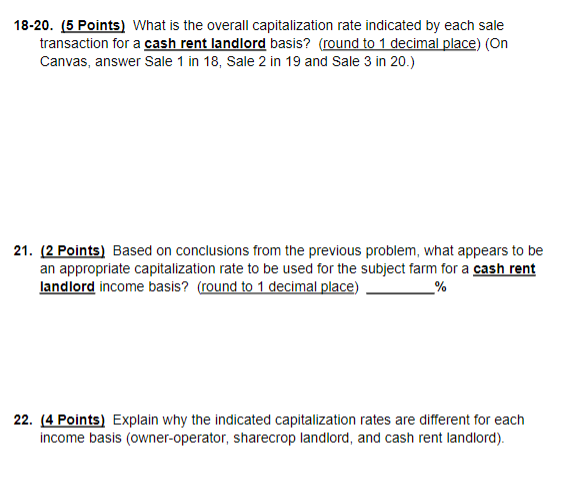

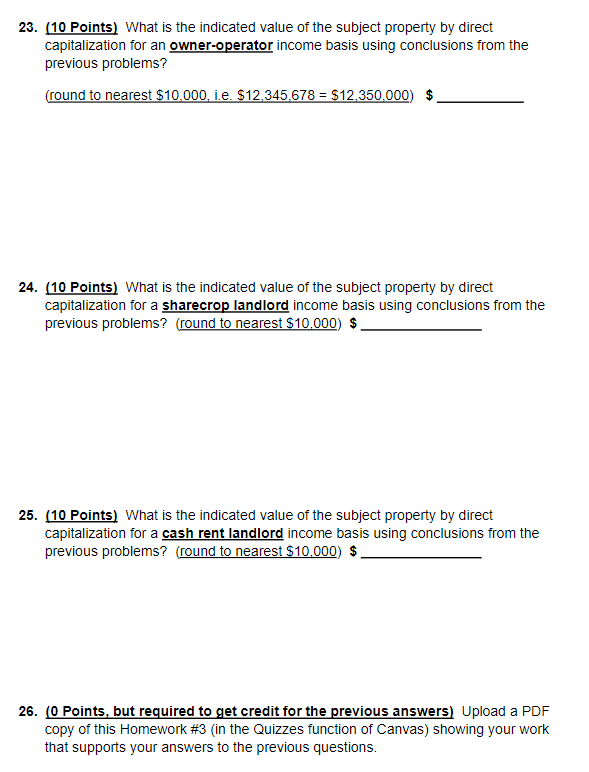

Subject Property The subject property is a 960 gross acre irrigated field crop farm. The property has 900 net farmable (cropland) acres, a 4-acre farmstead that contains all buildings and 56 acres in non-productive land (farm roads, ditches and drains). The insurable value of the subject's buildings is $270,000. Crops, Production and Landlord Income Following are typical crops grown in the area, normal crop rotation, typical crop yields, forecasted prices, and typical sharecrop landlord rents. Crop Production Typical Normal Crop Typical Forecasted Landlord Crops Rotation Yield/Acre $/Ton Share Alfalfa 40% 7 tons $210 22% Tomatoes 30% 48 tons $76 13% Wheat 15% 60 cwt. $180 28% Corn 15% 5.5 tons $220 18% 1 ton = 2,000 lbs. 1 cwt = 100 lbs. Cash rent being paid for similar property in the area is stable at $279 per net farmable acre including consideration for buildings on the property. Income to owner-operator, sharecrop landlord and cash rent landlord includes consideration for use of buildings on the property. To put it another way, the rental of the farmland allows the tenant to use the buildings at no additional cost. Expenses Crop Production Costs ($IAcre) Alfalfa Tomatoes Wheat Corn Tillage and cultural costs * $730 $1,906 $389 $775 Crop Insurance 17 35 7 12 Harvest costs 270 424 36 51 Post-harvest costs 0 56 40 10 Interest on operating capital 19 44 10 22 Total * includes all costs for growing crops (including irrigation water costs) Real Estate and Other Expenses $44/gross acre Real estate taxes $7et farmable acre Irrigation district land assessment $0.85/$100 insurable value Buildings insurance $5,200 Buildings repairs & maintenance $2,500 Farm personal property taxes $4,750 Income tax depreciation (buildings) $4,000/month Owner-operator labor and management $58,000 Miscellaneous owner-operator overhead 3% of Gross Income Imputed landlord management fee Owner-Operator Expenses Owner-operator pays real estate taxes, irrigation district special assessment, buildings insurance, buildings repairs & maintenance, farm personal property taxes, labor and management, and owner-operator overhead. Landlord Expenses Both sharecrop and cash rent landlords pay real estate taxes, irrigation district land assessment, buildings insurance, buildings repairs & maintenance and imputed landlord management fees. Market Data The following sales occurred recently in the subject property area. All sale properties are similar to the subject property regarding crops grown, yields, rental potential and operating costs. Sale No. Price Buildings Insurable Value Owner-Operator Net Income Sharecrop Rent Net Income Cash Rent Net Income 1 $4,500,000 $260,000 $315,450 $198.450 $162,000 2 $4,280,000 $210,000 $298,744 $189,176 $154,936 3 $5,430,000 $270,000 $381,186 $237,834 $194,937 18-20. (5 Points) What is the overall capitalization rate indicated by each sale transaction for a cash rent landlord basis? (round to 1 decimal place) (On Canvas, answer Sale 1 in 18, Sale 2 in 19 and Sale 3 in 20.) 21. (2 Points) Based on conclusions from the previous problem, what appears to be an appropriate capitalization rate to be used for the subject farm for a cash rent landlord income basis? (round to 1 decimal place) _% 22. (4 Points) Explain why the indicated capitalization rates are different for each income basis (owner-operator, sharecrop landlord, and cash rent landlord). 23. (10 Points) What is the indicated value of the subject property by direct capitalization for an owner-operator income basis using conclusions from the previous problems? (round to nearest $10,000, i.e. $12,345.678 = $12,350.000) $ 24. (10 Points) What is the indicated value of the subject property by direct capitalization for a sharecrop landlord income basis using conclusions from the previous problems? (round to nearest $10,000) $ 25. (10 Points) What is the indicated value of the subject property by direct capitalization for a cash rent landlord income basis using conclusions from the previous problems? (round to nearest $10.000) $. 26. (O Points, but required to get credit for the previous answers) Upload a PDF copy of this Homework #3 (in the Quizzes function of Canvas) showing your work that supports your answers to the previous questions