Question

Subject:Government Accounting REQUIREMENTS: 1. What is the compound journal entry to record the PS transaction for the year? 2. What is the indicated compound journal

Subject:Government Accounting

REQUIREMENTS: 1. What is the compound journal entry to record the PS transaction for the year? 2. What is the indicated compound journal entry to record the incurrence of expenses under MOOE? 3. What are the indicated journal entries to record the under acquisition of assets under CO?? 4. What are the indicated entries to record the remittance of withholding tax? (MOOE and CO) 5. What are the indicated entries for the transfer of Service Vehicle to Region 10 6. What are the indicated entries for the transfer of Service Vehicle to Department ABC?

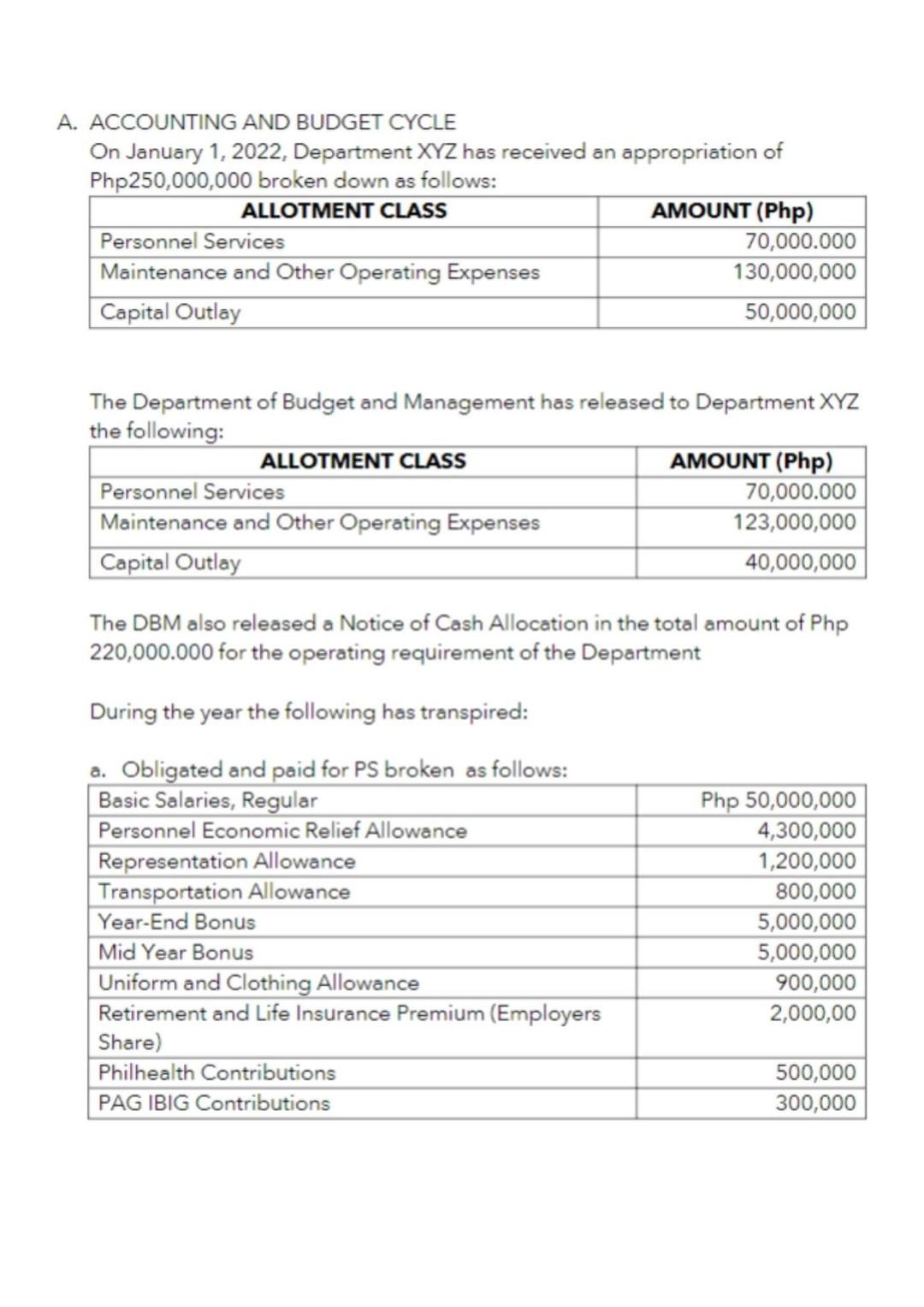

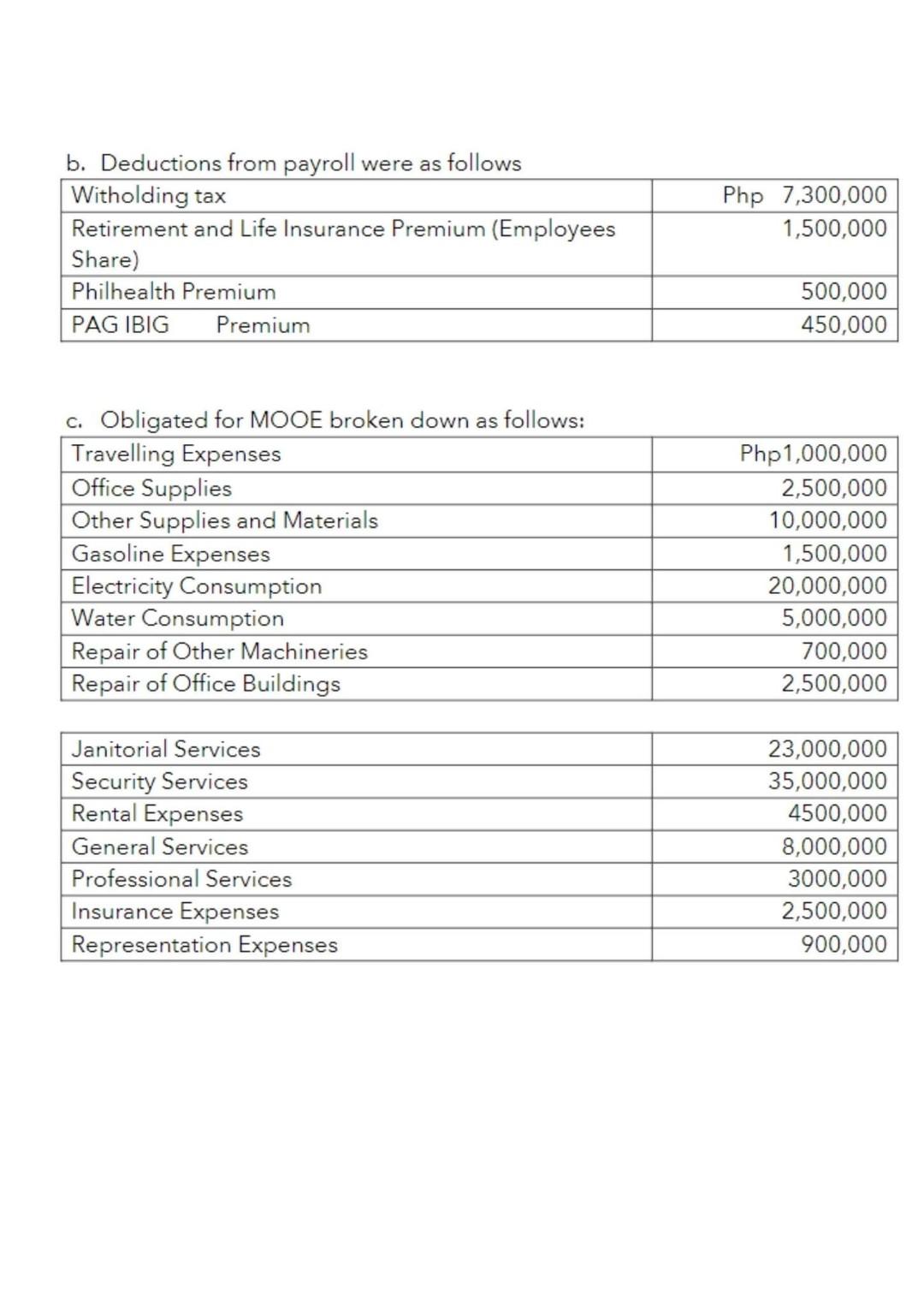

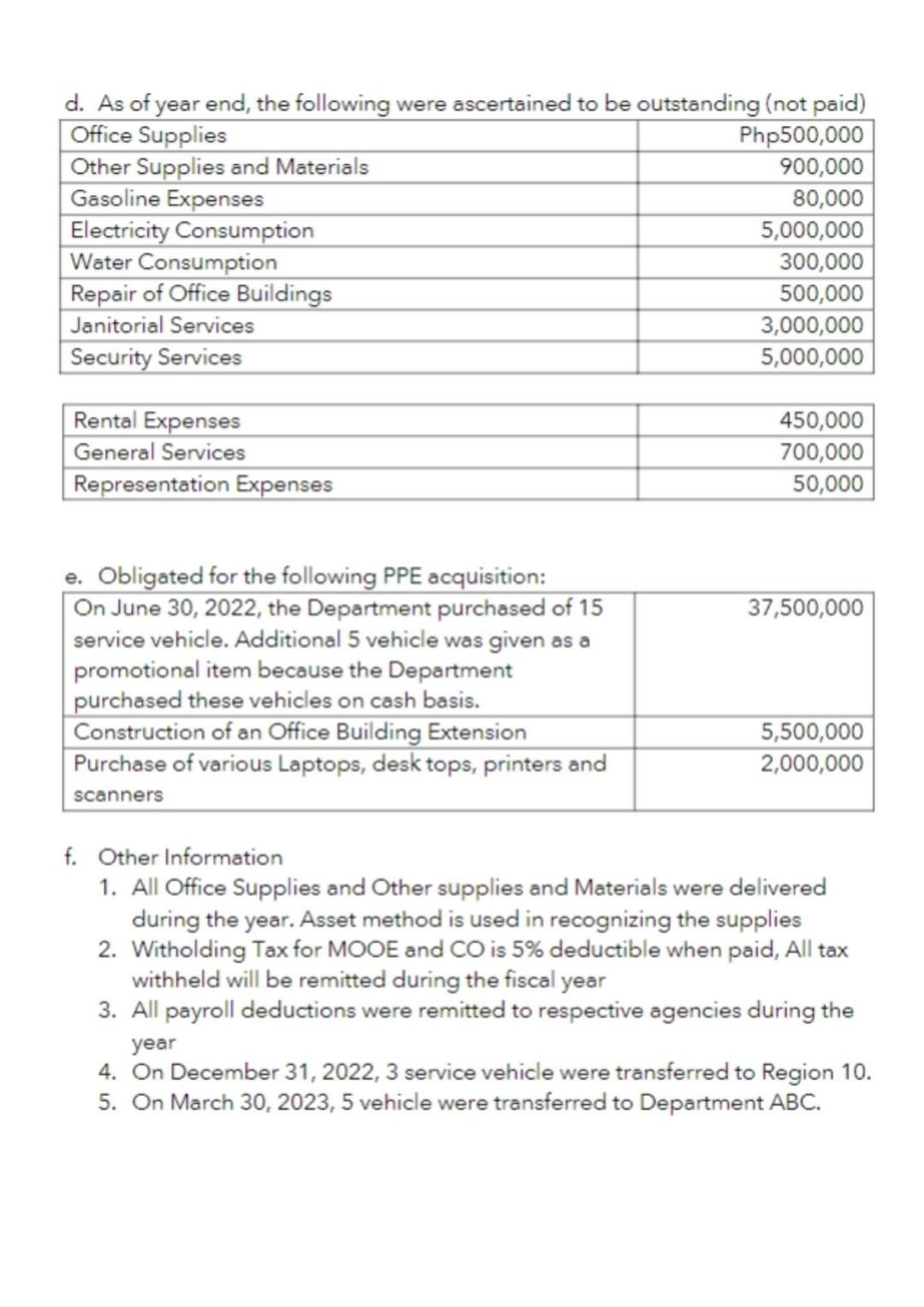

A. ACCOUNTING AND BUDGET CYCLE On January 1, 2022, Department XYZ has received an appropriation of Php250,000,000 broken down as follows: ALLOTMENT CLASS AMOUNT (Php) Personnel Services 70,000.000 Maintenance and Other Operating Expenses 130,000,000 Capital Outlay 50,000,000 The Department of Budget and Management has released to Department XYZ the following: ALLOTMENT CLASS AMOUNT (Php) Personnel Services 70,000.000 Maintenance and Other Operating Expenses 123,000,000 Capital Outlay 40,000,000 The DBM also released a Notice of Cash Allocation in the total amount of Php 220,000.000 for the operating requirement of the Department During the year the following has transpired: a. Obligated and paid for PS broken as follows: Basic Salaries, Regular Personnel Economic Relief Allowance Representation Allowance Transportation Allowance Year-End Bonus Mid Year Bonus Uniform and Clothing Allowance Retirement and Life Insurance Premium (Employers Share) Philhealth Contributions PAG IBIG Contributions Php 50,000,000 4,300,000 1,200,000 800,000 5,000,000 5,000,000 900,000 2,000,00 500,000 300,000 Php 7,300,000 1,500,000 b. Deductions from payroll were as follows Witholding tax Retirement and Life Insurance Premium (Employees Share) Philhealth Premium PAG IBIG Premium 500,000 450,000 c. Obligated for MOOE broken down as follows: Travelling Expenses Office Supplies Other Supplies and Materials Gasoline Expenses Electricity Consumption Water Consumption Repair of Other Machineries Repair of Office Buildings Php 1,000,000 2,500,000 10,000,000 1,500,000 20,000,000 5,000,000 700,000 2,500,000 Janitorial Services Security Services Rental Expenses General Services Professional Services Insurance Expenses Representation Expenses 23,000,000 35,000,000 4500,000 8,000,000 3000,000 2,500,000 900,000 d. As of year end, the following were ascertained to be outstanding (not paid) Office Supplies Php500,000 Other Supplies and Materials 900,000 Gasoline Expenses 80,000 Electricity Consumption 5,000,000 Water Consumption 300,000 Repair of Office Buildings 500,000 Janitorial Services 3,000,000 Security Services 5,000,000 Rental Expenses General Services Representation Expenses 450,000 700,000 50,000 37,500,000 e. Obligated for the following PPE acquisition: On June 30, 2022, the Department purchased of 15 service vehicle. Additional 5 vehicle was given as a promotional item because the Department purchased these vehicles on cash basis. Construction of an Office Building Extension Purchase of various Laptops, desk tops, printers and scanners 5,500,000 2,000,000 f. Other Information 1. All Office Supplies and Other supplies and Materials were delivered during the year. Asset method is used in recognizing the supplies 2. Witholding Tax for MOOE and CO is 5% deductible when paid, All tax withheld will be remitted during the fiscal year 3. All payroll deductions were remitted to respective agencies during the year 4. On December 31, 2022, 3 service vehicle were transferred to Region 10. 5. On March 30, 2023, 5 vehicle were transferred to Department ABC. A. ACCOUNTING AND BUDGET CYCLE On January 1, 2022, Department XYZ has received an appropriation of Php250,000,000 broken down as follows: ALLOTMENT CLASS AMOUNT (Php) Personnel Services 70,000.000 Maintenance and Other Operating Expenses 130,000,000 Capital Outlay 50,000,000 The Department of Budget and Management has released to Department XYZ the following: ALLOTMENT CLASS AMOUNT (Php) Personnel Services 70,000.000 Maintenance and Other Operating Expenses 123,000,000 Capital Outlay 40,000,000 The DBM also released a Notice of Cash Allocation in the total amount of Php 220,000.000 for the operating requirement of the Department During the year the following has transpired: a. Obligated and paid for PS broken as follows: Basic Salaries, Regular Personnel Economic Relief Allowance Representation Allowance Transportation Allowance Year-End Bonus Mid Year Bonus Uniform and Clothing Allowance Retirement and Life Insurance Premium (Employers Share) Philhealth Contributions PAG IBIG Contributions Php 50,000,000 4,300,000 1,200,000 800,000 5,000,000 5,000,000 900,000 2,000,00 500,000 300,000 Php 7,300,000 1,500,000 b. Deductions from payroll were as follows Witholding tax Retirement and Life Insurance Premium (Employees Share) Philhealth Premium PAG IBIG Premium 500,000 450,000 c. Obligated for MOOE broken down as follows: Travelling Expenses Office Supplies Other Supplies and Materials Gasoline Expenses Electricity Consumption Water Consumption Repair of Other Machineries Repair of Office Buildings Php 1,000,000 2,500,000 10,000,000 1,500,000 20,000,000 5,000,000 700,000 2,500,000 Janitorial Services Security Services Rental Expenses General Services Professional Services Insurance Expenses Representation Expenses 23,000,000 35,000,000 4500,000 8,000,000 3000,000 2,500,000 900,000 d. As of year end, the following were ascertained to be outstanding (not paid) Office Supplies Php500,000 Other Supplies and Materials 900,000 Gasoline Expenses 80,000 Electricity Consumption 5,000,000 Water Consumption 300,000 Repair of Office Buildings 500,000 Janitorial Services 3,000,000 Security Services 5,000,000 Rental Expenses General Services Representation Expenses 450,000 700,000 50,000 37,500,000 e. Obligated for the following PPE acquisition: On June 30, 2022, the Department purchased of 15 service vehicle. Additional 5 vehicle was given as a promotional item because the Department purchased these vehicles on cash basis. Construction of an Office Building Extension Purchase of various Laptops, desk tops, printers and scanners 5,500,000 2,000,000 f. Other Information 1. All Office Supplies and Other supplies and Materials were delivered during the year. Asset method is used in recognizing the supplies 2. Witholding Tax for MOOE and CO is 5% deductible when paid, All tax withheld will be remitted during the fiscal year 3. All payroll deductions were remitted to respective agencies during the year 4. On December 31, 2022, 3 service vehicle were transferred to Region 10. 5. On March 30, 2023, 5 vehicle were transferred to Department ABCStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started