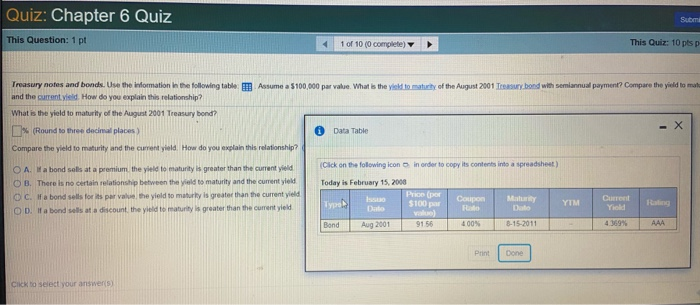

Subm Quiz: Chapter 6 Quiz This Question: 1 pt 1 of 10 (0 complete) This Quiz: 10 pls p Treasury notes and bonds. Use the information in the following table Assume a $100,000 par value. What is the yield to maturity of the August 2001 Tas bond with semiannual payment? Compare the yield to mall and the current yield. How do you explain this relationship? What is the yield to maturity of the August 2001 Treasury bond? % (Round to three decimal places Data Table Compare the yield to maturity and the current yield. How do you explain this relationship? O A Wabond sols at a premium the yield to maturity is greater than the current yield Click on the following icon in order to copy its contents into a spreadsheet) OB. There is no certain relationship between the yield to maturity and the current yield Today is February 15, 2008 OC. a bond sells for its par value the yield to matury is greater than the current yield Prio (per Coupon OD. abond sells at a discount the yield te maturity is greater than the current yield $100 per Do Yield Bond Aug 2001 91 56 400% 8-15-2011 4369% AAA Truhl May Cla YUM Dato Print Done Click to select your answers) Subm Quiz: Chapter 6 Quiz This Question: 1 pt 1 of 10 (0 complete) This Quiz: 10 pls p Treasury notes and bonds. Use the information in the following table Assume a $100,000 par value. What is the yield to maturity of the August 2001 Tas bond with semiannual payment? Compare the yield to mall and the current yield. How do you explain this relationship? What is the yield to maturity of the August 2001 Treasury bond? % (Round to three decimal places Data Table Compare the yield to maturity and the current yield. How do you explain this relationship? O A Wabond sols at a premium the yield to maturity is greater than the current yield Click on the following icon in order to copy its contents into a spreadsheet) OB. There is no certain relationship between the yield to maturity and the current yield Today is February 15, 2008 OC. a bond sells for its par value the yield to matury is greater than the current yield Prio (per Coupon OD. abond sells at a discount the yield te maturity is greater than the current yield $100 per Do Yield Bond Aug 2001 91 56 400% 8-15-2011 4369% AAA Truhl May Cla YUM Dato Print Done Click to select your answers)