Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Submissions: Submit a summary of the following information in table form (not the software print-out): The net income for John & Ann (10 marks). Briefly

Submissions:

- Submit a summary of the following information in table form (not the software print-out):

- The net income for John & Ann (10 marks).

- Briefly explain the CRAs rules with respect to the deductions from total income to arrive at net income. In your explanation, refer to the specific calculation for John & Ann. (5 marks).

- The non-refundable tax credits for John & Ann (10 marks).

- Briefly explain the concept of non-refundable tax credits. In your explanation, refer to the specific calculation for John & Ann. (5 marks).

- Summary the 2020 Tax Return (5 marks).

- Briefly explain the benefit to the couple of filing a joint return. In your explanation, refer to an example specific the tax returns of John & Ann. (5 marks).

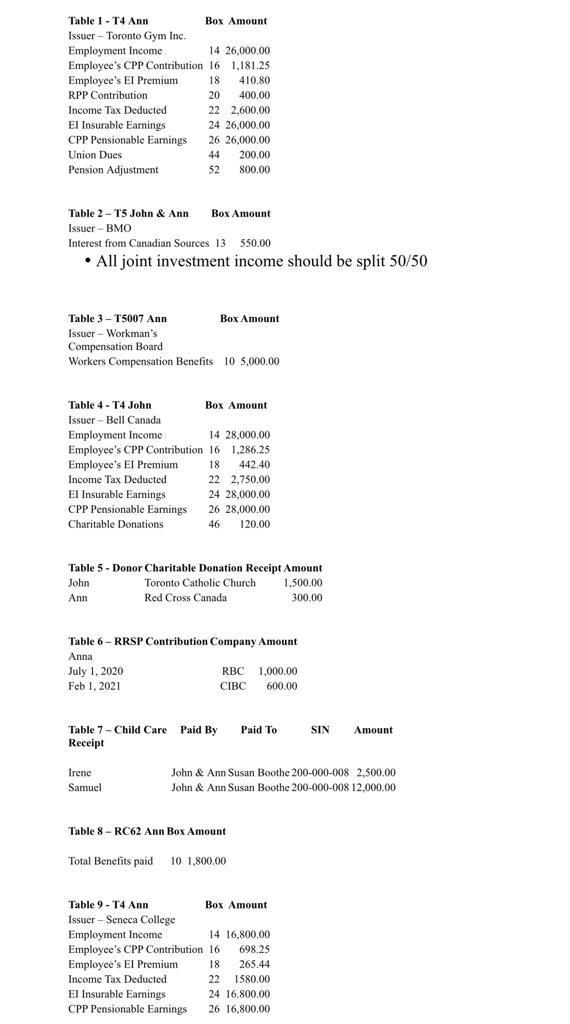

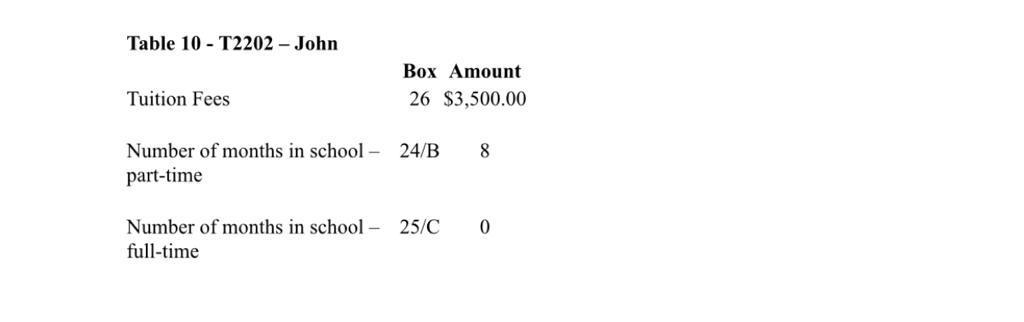

410.80 Table 1 - T4 Ann Box Amount Issuer - Toronto Gym Inc. Employment Income 14 26,000.00 Employee's CPP Contribution 16 1,181.25 Employee's El Premium 18 RPP Contribution 20 400.00 Income Tax Deducted 22 2.600.00 El Insurable Earnings 24 26,000.00 CPP Pensionable Earnings 26 26,000.00 Union Dues 44 200,00 Pension Adjustment 52 800,00 Box Amount Table 2 - T5 John & Ann Issuer - BMO Interest from Canadian Sources 13 550.00 All joint investment income should be split 50/50 Table 3-T5007 Ann Box Amount Issuer - Workman's Compensation Board Workers Compensation Benefits 10 5,000.00 Table 4 - T4 John Box Amount Issuer-Bell Canada Employment Income 14 28,000.00 Employee's CPP Contribution 16 1,286,25 Employee's El Premium 18 442.40 Income Tax Deducted 22 2,750,00 El Insurable Earnings 24 28,000.00 CPP Pensionable Earings 26 28,000.00 Charitable Donations 46 120.00 Table 5 - Donor Charitable Donation Receipt Amount - John Toronto Catholic Church 1,500.00 Ann Red Cross Canada 300.00 Table 6-RRSP Contribution Company Amount Anna July 1, 2020 RBC 1,000.00 Feb 1, 2021 CIBC 600.00 Table 7 - Child Care Paid By Receipt Paid To SIN Amount Irene Samuel John & Ann Susan Boothe 200-000-008 2,500.00 John & Ann Susan Boothe 200-000-008 12,000.00 Table 8-RC62 Ann Box Amount 8 Total Benefits paid 10 1,800,00 Table 9 - T4 Ann Box Amount Issuer - Seneca College Employment Income 14 16,800.00 Employee's CPP Contribution 16 698.25 Employee's El Premium 18 265.44 Income Tax Deducted 22 1 580.00 El Insurable Earnings 24 16.800.00 CPP Pensionable Earings 26 16,800,00 Table 10 - T2202 - John Box Amount 26 $3,500.00 Tuition Fees 8 Number of months in school - 24/B part-time 0 Number of months in school - 25/C full-time 410.80 Table 1 - T4 Ann Box Amount Issuer - Toronto Gym Inc. Employment Income 14 26,000.00 Employee's CPP Contribution 16 1,181.25 Employee's El Premium 18 RPP Contribution 20 400.00 Income Tax Deducted 22 2.600.00 El Insurable Earnings 24 26,000.00 CPP Pensionable Earnings 26 26,000.00 Union Dues 44 200,00 Pension Adjustment 52 800,00 Box Amount Table 2 - T5 John & Ann Issuer - BMO Interest from Canadian Sources 13 550.00 All joint investment income should be split 50/50 Table 3-T5007 Ann Box Amount Issuer - Workman's Compensation Board Workers Compensation Benefits 10 5,000.00 Table 4 - T4 John Box Amount Issuer-Bell Canada Employment Income 14 28,000.00 Employee's CPP Contribution 16 1,286,25 Employee's El Premium 18 442.40 Income Tax Deducted 22 2,750,00 El Insurable Earnings 24 28,000.00 CPP Pensionable Earings 26 28,000.00 Charitable Donations 46 120.00 Table 5 - Donor Charitable Donation Receipt Amount - John Toronto Catholic Church 1,500.00 Ann Red Cross Canada 300.00 Table 6-RRSP Contribution Company Amount Anna July 1, 2020 RBC 1,000.00 Feb 1, 2021 CIBC 600.00 Table 7 - Child Care Paid By Receipt Paid To SIN Amount Irene Samuel John & Ann Susan Boothe 200-000-008 2,500.00 John & Ann Susan Boothe 200-000-008 12,000.00 Table 8-RC62 Ann Box Amount 8 Total Benefits paid 10 1,800,00 Table 9 - T4 Ann Box Amount Issuer - Seneca College Employment Income 14 16,800.00 Employee's CPP Contribution 16 698.25 Employee's El Premium 18 265.44 Income Tax Deducted 22 1 580.00 El Insurable Earnings 24 16.800.00 CPP Pensionable Earings 26 16,800,00 Table 10 - T2202 - John Box Amount 26 $3,500.00 Tuition Fees 8 Number of months in school - 24/B part-time 0 Number of months in school - 25/C full-time

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started