Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Submit your case study report here by Sunday, December 11, 2022 by 11:59PM. Absolutely no exceptions!!! Do not wait until the last moment to

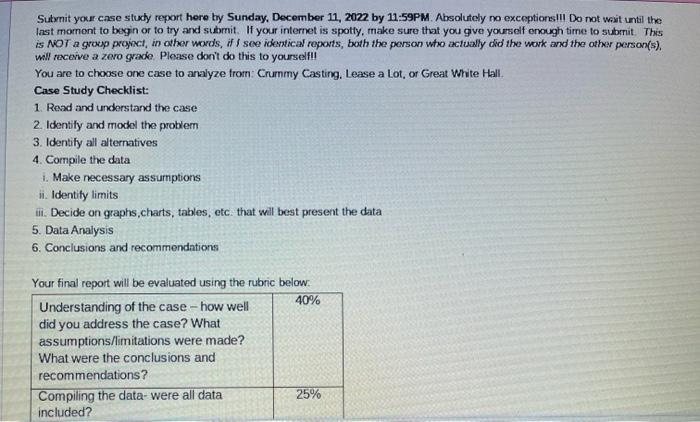

Submit your case study report here by Sunday, December 11, 2022 by 11:59PM. Absolutely no exceptions!!! Do not wait until the last moment to begin or to try and submit. If your internet is spotty, make sure that you give yourself enough time to submit. This is NOT a group project, in other words, if I see identical reports, both the person who actually did the work and the other person(s), will receive a zero grade. Please don't do this to yourself!! You are to choose one case to analyze from: Crummy Casting, Lease a Lot, or Great White Hall. Case Study Checklist: 1. Read and understand the case 2. Identify and model the problem 3. Identify all alternatives 4. Compile the data i. Make necessary assumptions ii. Identify limits iii. Decide on graphs,charts, tables, etc. that will best present the data 5. Data Analysis 6. Conclusions and recommendations Your final report will be evaluated using the rubric below: 40% Understanding of the case - how well did you address the case? What assumptions/limitations were made? What were the conclusions and recommendations? Compiling the data were all data included? 25% Round Table Rental Yards provides construction equipment, trailers, crutches, etc., on short- term rentals. Historically, Art, the owner, has purchased the items that he rents out, but his business has been expanding so rapidly that he is considering both straight leases and lease- purchase arrangements. He has decided to use the procurement of a new bulldozer with a list price of $290,000 as a test case. If he purchases the bulldozer outright, then he must also decide whether he should plan. on overhauling it or selling it after 3 years. This overhaul will cost about $150,000, but it. should double the useful life of the bulldozer. However, the bulldozer's value on the used market would drop from $180,000 after Year 3 to $135,000 after Year 6. Its annual operation and maintenance costs will start at $25,000 and increase by $7500 each year. This increase is due to increased use more than to increased age, so it is not affected by the overhaul. The manufacturer has a subsidiary that specializes in financing through leases and lease- purchases. In both cases, the subsidiary uses a term of 5 years with no option to extend it further. Art believes that other contract periods could be negotiated, but for this initial analysis he believes that their standard term is representative of the other possibilities. For the standard lease, the annual payment is $45,000. For the lease-purchase, the annual payment increases by $42,000. Although lease contracts can be written either way, for this lease Art would be responsible for the overhaul cost at Year 3. Art will insure the bulldozer for theft, catastrophic damage, and liability. This policy will cost him $9500 each year. He will spend about 5% of the rental income transporting it to and 69 from job sites. On the plus side, he expects it to bring in $175,000 the first year. Rental income should increase by $30,000 each year until it hits a maximum utilization of $300,000 per year. If secured loans are available for 9%, which financing plan do you recommend? Option Art's business can depreciate the bulldozer under a 5-year modified accelerated cost recovery system (MACRS depreciation schedule, with a combined state and federal tax rate of 41%. Do tax considerations change your recommendation?

Step by Step Solution

★★★★★

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started