Answered step by step

Verified Expert Solution

Question

1 Approved Answer

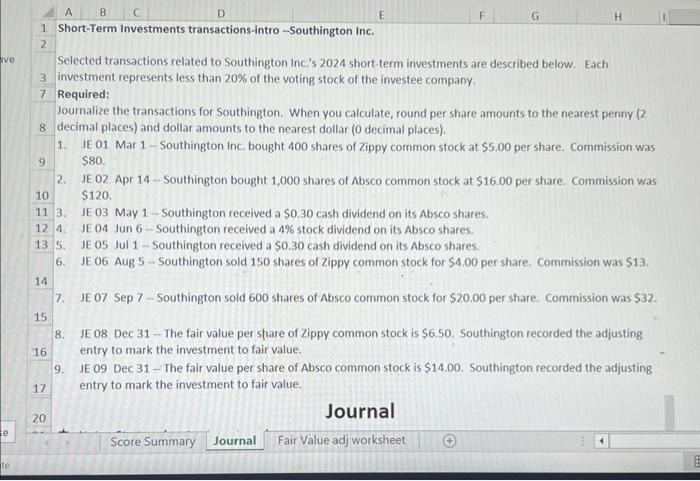

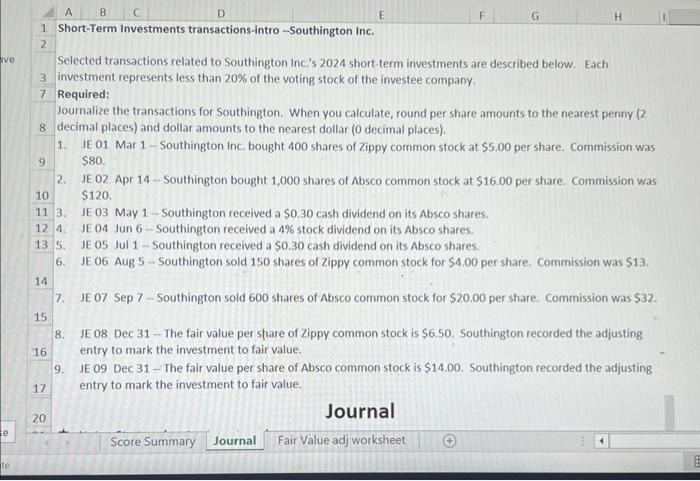

Submitted this already but the answers in red are wrong Selected transactions related to Southington Inc.'s 2024 short-term investments are described below. Each 3 investment

Submitted this already but the answers in red are wrong

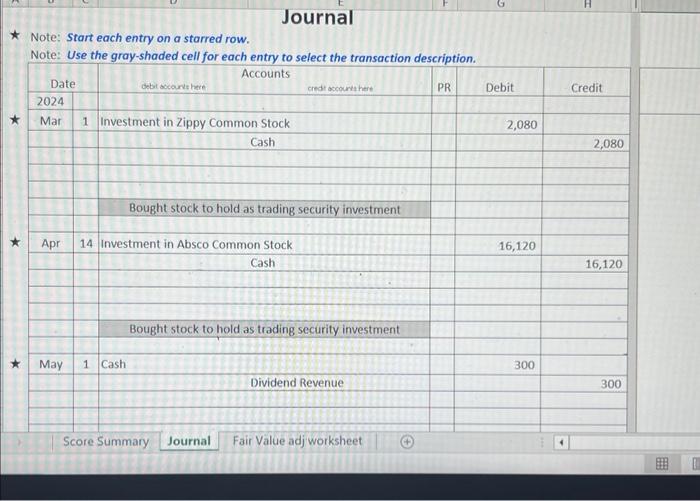

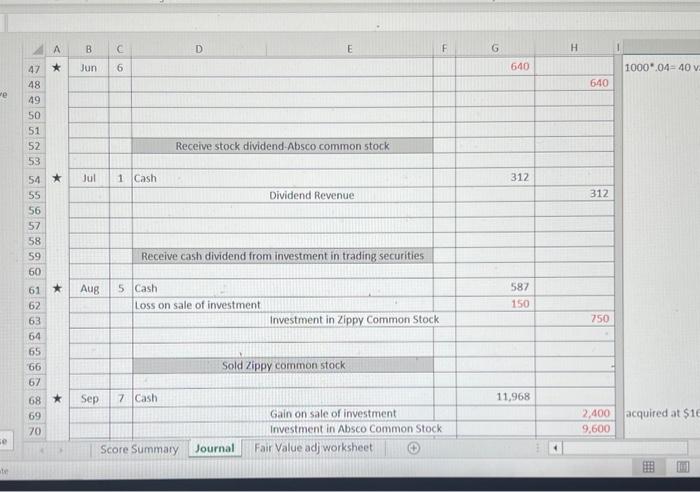

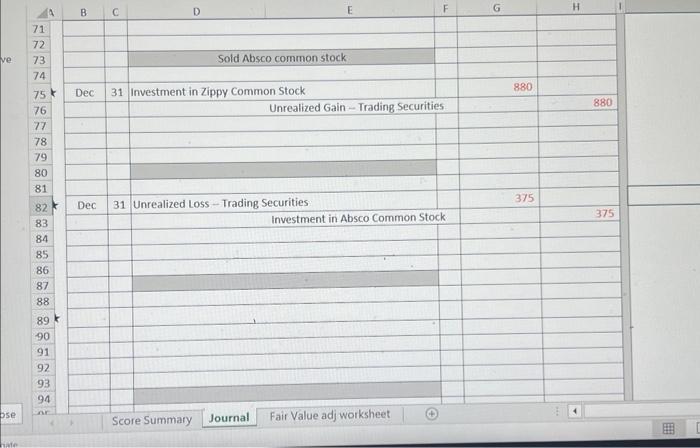

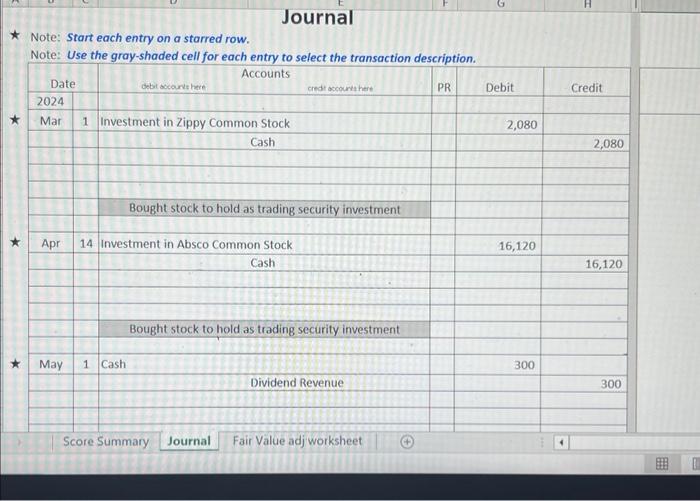

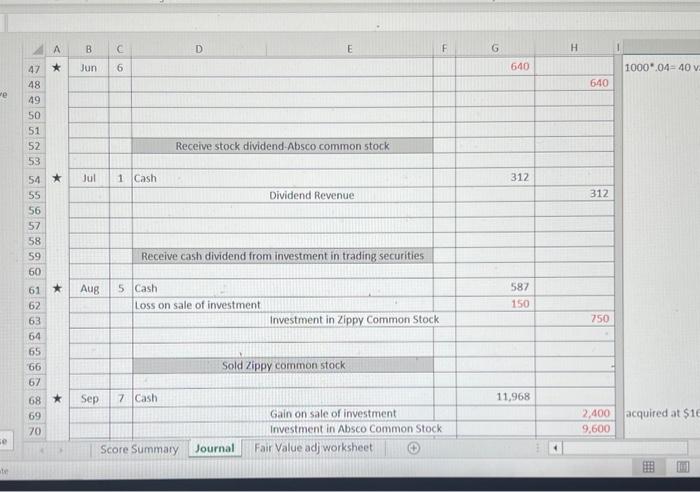

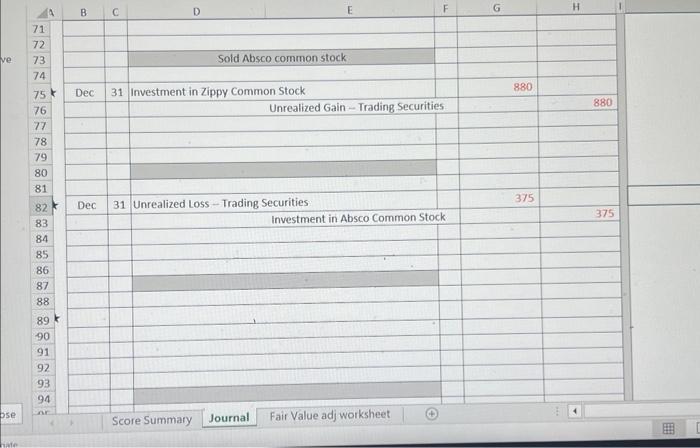

Selected transactions related to Southington Inc.'s 2024 short-term investments are described below. Each 3 investment represents less than 20% of the voting stock of the investee company. 7 Required: Journalize the transactions for Southington. When you calculate, round per share amounts to the nearest penny (2 8 decimal places) and dollar amounts to the nearest dollar ( 0 decimal places). 1. JE 01 Mar 1 - Southington Inc. bought 400 shares of Zippy common stock at $5.00 per share. Commission was $80. 2. JE 02 Apr 14 - Southington bought 1,000 shares of Absco common stock at $16.00 per share. Commission was $120. 3. JE 03 May 1 - Southington received a $0,30 cash dividend on its Absco shares. 12 4. JE 04 Jun 6 - Southington received a 4% stock dividend on its Absco shares. 13 5. JE 05 Jul 1 - Southington received a $0.30 cash dividend on its Absco shares. 6. JE 06 Aug 5 - Southington sold 150 shares of Zippy common stock for $4.00 per share. Commission was $13. 14 7. JE 07 Sep 7 - Southington sold 600 shares of Absco common stock for $20.00 per share. Commission was $32. 8. JE 08 Dec 31 - The fair value per sfare of Zippy common stock is $6.50. Southington recorded the adjusting entry to mark the investment to fair value. 9. JE 09 Dec 31 - The fair value per share of Absco common stock is $14.00. Southington recorded the adjusting entry to mark the investment to fair value. Note: Start each entry on a starred row. 1000,04=40y

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started