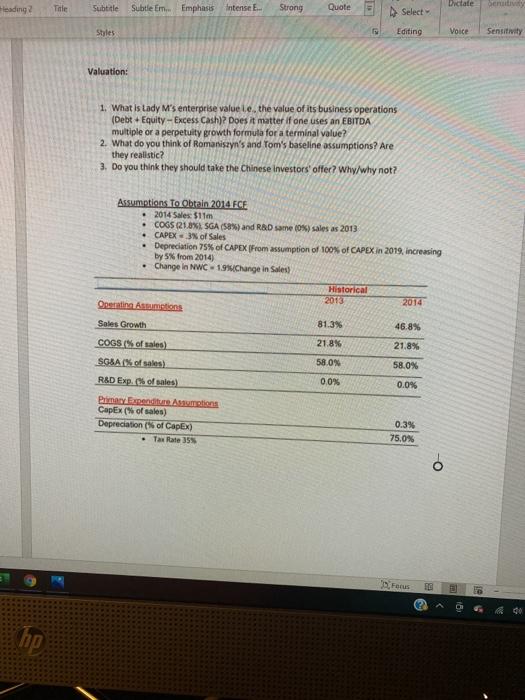

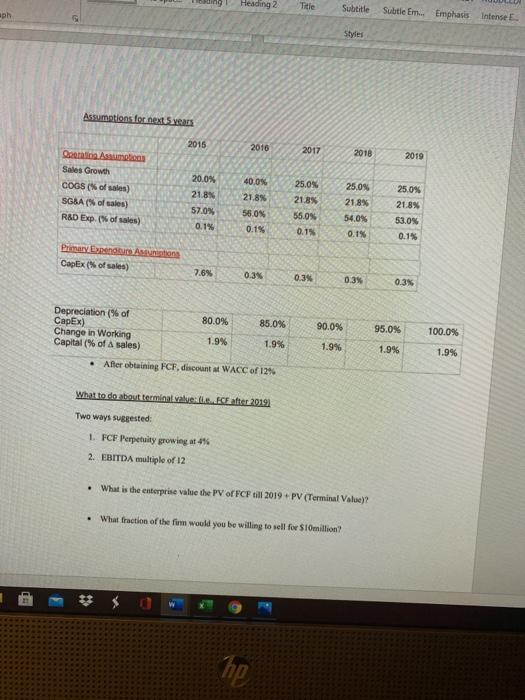

Subtitle Subtle Em Emphasis Heading? Intense E. Strong Quote Dictate Ger Select Styles Editing Voice Sensitivity Valuation: 1. What is Lady M's enterprise value Le the value of its business operations (Debt + Equity - Excess Cash)? Does it matter if one uses an EBITDA multiple or a perpetuity growth formula for a terminal value? 2. What do you think of Romaniayn's and Tom's baseline assumptions? Are they realistic? 3. Do you think they should take the Chinese investors' offer? Why/why not? Assumptions To Obtain 2014 ECE 2014 Sales: 311m COGS 21,3%: SGA (58%) and RAD samne (0) sales as 2013 CAPEX 3 of Sales Depreciation 75% of CAPEX (From assumption of 100% of CAPEX in 2019, increasing by 5% from 2014) Change in NWC 191Change in Sales Historical 2013 Operating sumtions 2014 Sales Growth 81.3% 46.8% 21.8% 21.8% 58.0% 58.0% 0.0% 0.0% COGS (5 of sales) SGSA of sales) R&D Exp. of sales) Piasendis CapEx (% of sales) Depreciation ( of Capex) Tax Rate 35 0.3% 75.0% Forus FE hp Heading 2 Title Subtitle Subtle Em Emphasis intense Styles Assumtions for next 5 years 2015 2016 2017 2018 2019 QoogAssumpcas Sales Growth COGS (of sales) SG&A (of sales) R&D Exp. [ of sales) 20.0% 21.8% 57.0% 0.1% 40.0% 21.8% 56.09 0.1% 25.0% 21.8% 55.0% 0.15 25.0 21.8% 54.0% 0.1% 25.0% 21.8% 53.0% 0.1% Primary Exped AS Capex of sales) 7.6% 0.3% 0.3% 0.3% 0.3% 90.0% 95.0% 100.0% Depreciation (% of 80.0% CapEx) 85.0% Change in Working 1.9% 1.9% Capital (% of sales) After obtaining FCF, discounts WACC of 12% 1.9% 1.9% 1.9% What to do about terminal value theater 2019) Two ways suggested: 1. FCF Perpetuity growing at 45 2. EBITDA multiple of 12 What is the enterprise value the PV of FCF till 2019 PV (Terminal Value)? What fraction of the firm would you be willing to sell for S1million? B $ hp Subtitle Subtle Em Emphasis Heading? Intense E. Strong Quote Dictate Ger Select Styles Editing Voice Sensitivity Valuation: 1. What is Lady M's enterprise value Le the value of its business operations (Debt + Equity - Excess Cash)? Does it matter if one uses an EBITDA multiple or a perpetuity growth formula for a terminal value? 2. What do you think of Romaniayn's and Tom's baseline assumptions? Are they realistic? 3. Do you think they should take the Chinese investors' offer? Why/why not? Assumptions To Obtain 2014 ECE 2014 Sales: 311m COGS 21,3%: SGA (58%) and RAD samne (0) sales as 2013 CAPEX 3 of Sales Depreciation 75% of CAPEX (From assumption of 100% of CAPEX in 2019, increasing by 5% from 2014) Change in NWC 191Change in Sales Historical 2013 Operating sumtions 2014 Sales Growth 81.3% 46.8% 21.8% 21.8% 58.0% 58.0% 0.0% 0.0% COGS (5 of sales) SGSA of sales) R&D Exp. of sales) Piasendis CapEx (% of sales) Depreciation ( of Capex) Tax Rate 35 0.3% 75.0% Forus FE hp Heading 2 Title Subtitle Subtle Em Emphasis intense Styles Assumtions for next 5 years 2015 2016 2017 2018 2019 QoogAssumpcas Sales Growth COGS (of sales) SG&A (of sales) R&D Exp. [ of sales) 20.0% 21.8% 57.0% 0.1% 40.0% 21.8% 56.09 0.1% 25.0% 21.8% 55.0% 0.15 25.0 21.8% 54.0% 0.1% 25.0% 21.8% 53.0% 0.1% Primary Exped AS Capex of sales) 7.6% 0.3% 0.3% 0.3% 0.3% 90.0% 95.0% 100.0% Depreciation (% of 80.0% CapEx) 85.0% Change in Working 1.9% 1.9% Capital (% of sales) After obtaining FCF, discounts WACC of 12% 1.9% 1.9% 1.9% What to do about terminal value theater 2019) Two ways suggested: 1. FCF Perpetuity growing at 45 2. EBITDA multiple of 12 What is the enterprise value the PV of FCF till 2019 PV (Terminal Value)? What fraction of the firm would you be willing to sell for S1million? B $ hp