Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Success Bhd was incorporated in Malaysia with an authorized capital of RM100 million consisting of 80 million units of ordinary shares of RM 1.00 each

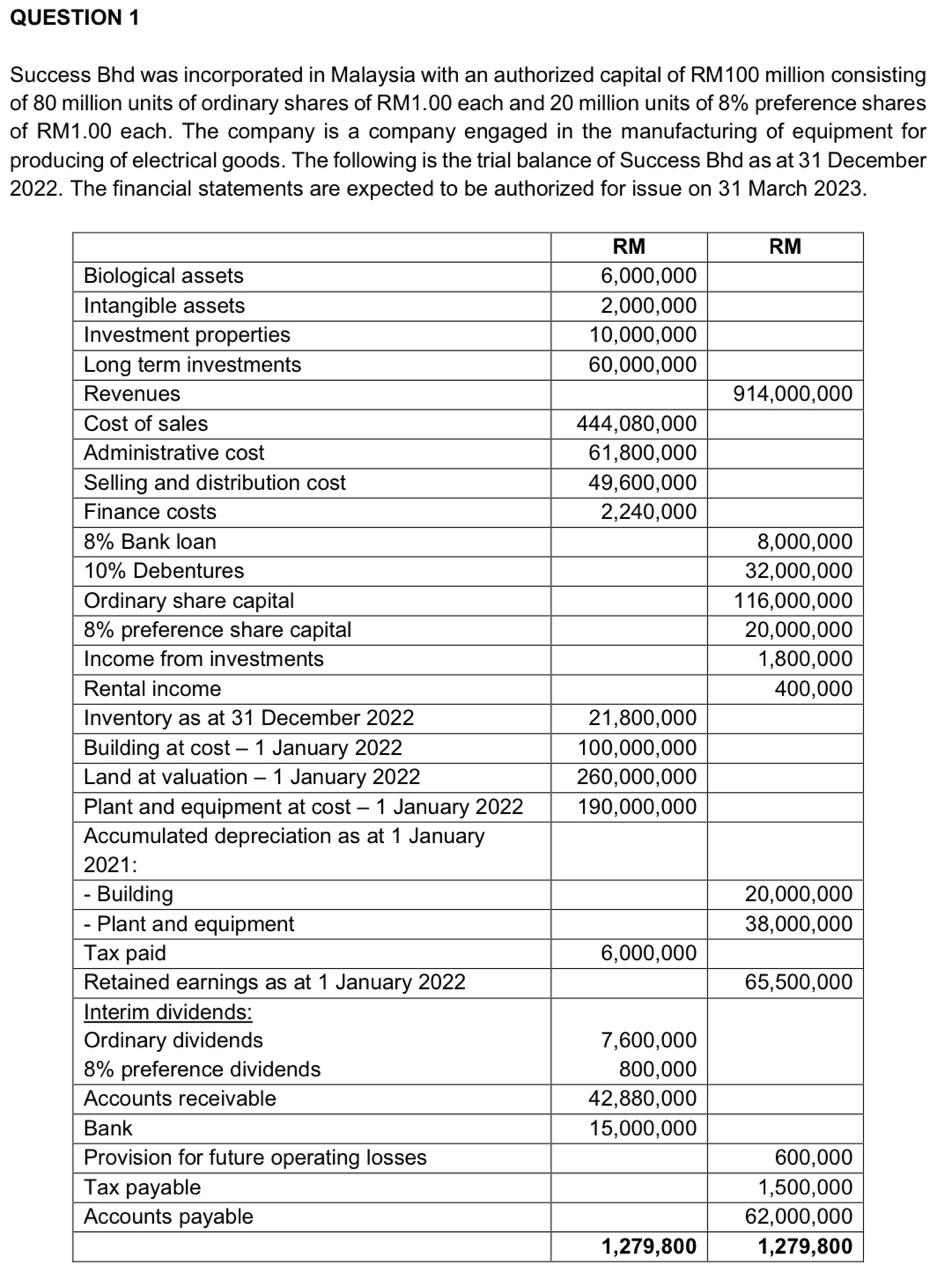

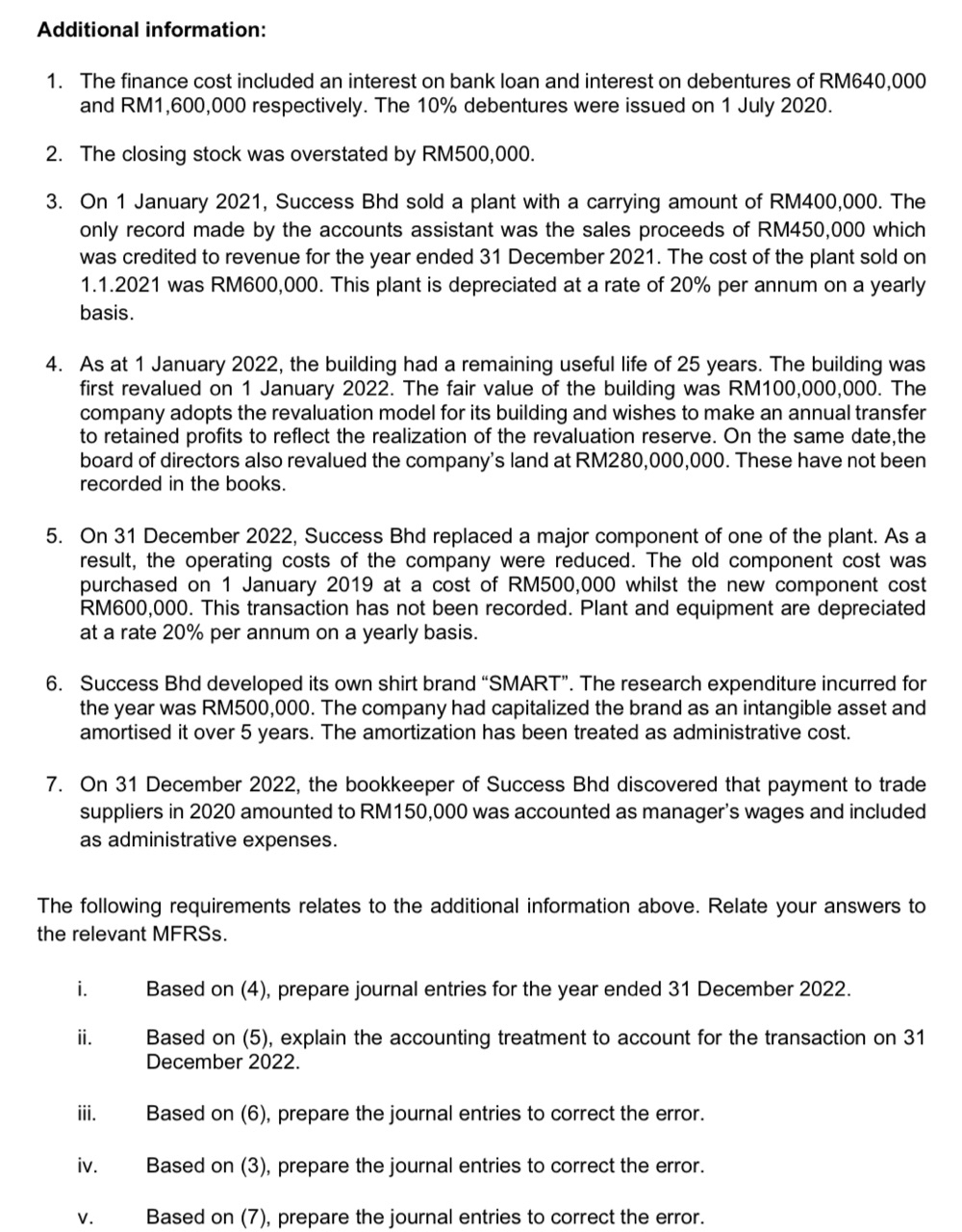

Success Bhd was incorporated in Malaysia with an authorized capital of RM100 million consisting of 80 million units of ordinary shares of RM 1.00 each and 20 million units of 8% preference shares of RM1.00 each. The company is a company engaged in the manufacturing of equipment for producing of electrical goods. The following is the trial balance of Success Bhd as at 31 December Additional information: 1. The finance cost included an interest on bank loan and interest on debentures of RM640,000 and RM1,600,000 respectively. The 10% debentures were issued on 1 July 2020. 2. The closing stock was overstated by RM500,000. 3. On 1 January 2021, Success Bhd sold a plant with a carrying amount of RM400,000. The only record made by the accounts assistant was the sales proceeds of RM450,000 which was credited to revenue for the year ended 31 December 2021. The cost of the plant sold on 1.1.2021 was RM600,000. This plant is depreciated at a rate of 20% per annum on a yearly basis. 4. As at 1 January 2022, the building had a remaining useful life of 25 years. The building was first revalued on 1 January 2022. The fair value of the building was RM100,000,000. The company adopts the revaluation model for its building and wishes to make an annual transfer to retained profits to reflect the realization of the revaluation reserve. On the same date,the board of directors also revalued the company's land at RM280,000,000. These have not been recorded in the books. 5. On 31 December 2022, Success Bhd replaced a major component of one of the plant. As a result, the operating costs of the company were reduced. The old component cost was purchased on 1 January 2019 at a cost of RM500,000 whilst the new component cost RM600,000. This transaction has not been recorded. Plant and equipment are depreciated at a rate 20% per annum on a yearly basis. 6. Success Bhd developed its own shirt brand "SMART". The research expenditure incurred for the year was RM500,000. The company had capitalized the brand as an intangible asset and amortised it over 5 years. The amortization has been treated as administrative cost. 7. On 31 December 2022, the bookkeeper of Success Bhd discovered that payment to trade suppliers in 2020 amounted to RM150,000 was accounted as manager's wages and included as administrative expenses. The following requirements relates to the additional information above. Relate your answers to the relevant MFRSs. i. Based on (4), prepare journal entries for the year ended 31 December 2022. ii. Based on (5), explain the accounting treatment to account for the transaction on 31 December 2022. iii. Based on (6), prepare the journal entries to correct the error. iv. Based on (3), prepare the journal entries to correct the error. v. Based on (7), prepare the journal entries to correct the error

Success Bhd was incorporated in Malaysia with an authorized capital of RM100 million consisting of 80 million units of ordinary shares of RM 1.00 each and 20 million units of 8% preference shares of RM1.00 each. The company is a company engaged in the manufacturing of equipment for producing of electrical goods. The following is the trial balance of Success Bhd as at 31 December Additional information: 1. The finance cost included an interest on bank loan and interest on debentures of RM640,000 and RM1,600,000 respectively. The 10% debentures were issued on 1 July 2020. 2. The closing stock was overstated by RM500,000. 3. On 1 January 2021, Success Bhd sold a plant with a carrying amount of RM400,000. The only record made by the accounts assistant was the sales proceeds of RM450,000 which was credited to revenue for the year ended 31 December 2021. The cost of the plant sold on 1.1.2021 was RM600,000. This plant is depreciated at a rate of 20% per annum on a yearly basis. 4. As at 1 January 2022, the building had a remaining useful life of 25 years. The building was first revalued on 1 January 2022. The fair value of the building was RM100,000,000. The company adopts the revaluation model for its building and wishes to make an annual transfer to retained profits to reflect the realization of the revaluation reserve. On the same date,the board of directors also revalued the company's land at RM280,000,000. These have not been recorded in the books. 5. On 31 December 2022, Success Bhd replaced a major component of one of the plant. As a result, the operating costs of the company were reduced. The old component cost was purchased on 1 January 2019 at a cost of RM500,000 whilst the new component cost RM600,000. This transaction has not been recorded. Plant and equipment are depreciated at a rate 20% per annum on a yearly basis. 6. Success Bhd developed its own shirt brand "SMART". The research expenditure incurred for the year was RM500,000. The company had capitalized the brand as an intangible asset and amortised it over 5 years. The amortization has been treated as administrative cost. 7. On 31 December 2022, the bookkeeper of Success Bhd discovered that payment to trade suppliers in 2020 amounted to RM150,000 was accounted as manager's wages and included as administrative expenses. The following requirements relates to the additional information above. Relate your answers to the relevant MFRSs. i. Based on (4), prepare journal entries for the year ended 31 December 2022. ii. Based on (5), explain the accounting treatment to account for the transaction on 31 December 2022. iii. Based on (6), prepare the journal entries to correct the error. iv. Based on (3), prepare the journal entries to correct the error. v. Based on (7), prepare the journal entries to correct the error Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started