Answered step by step

Verified Expert Solution

Question

1 Approved Answer

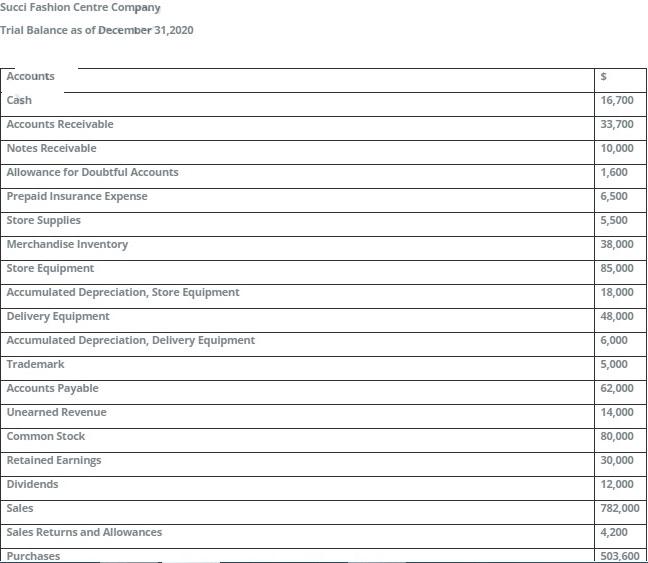

Succi Fashion Centre Company Trial Balance as of December 31,2020 Accounts Cash Accounts Receivable Notes Receivable Allowance for Doubtful Accounts Prepaid Insurance Expense Store

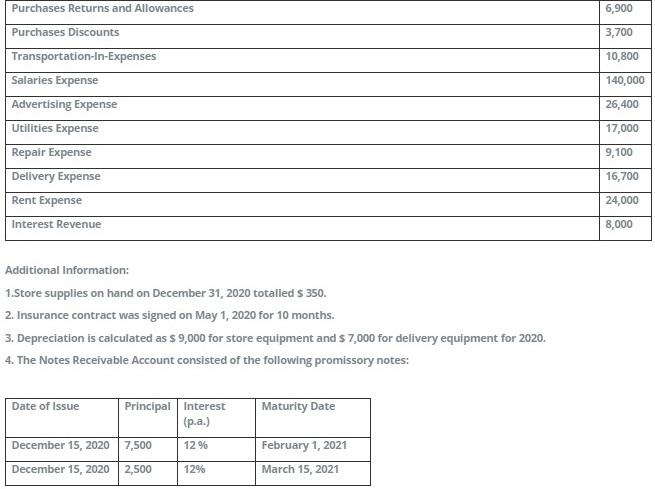

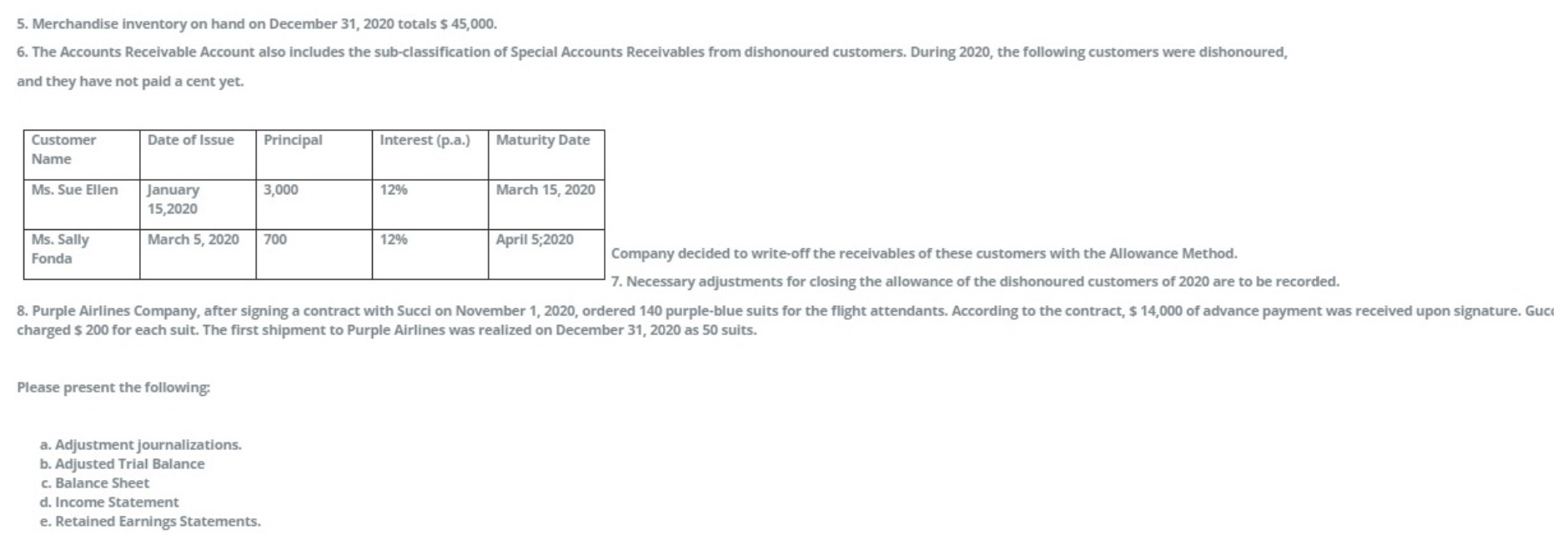

Succi Fashion Centre Company Trial Balance as of December 31,2020 Accounts Cash Accounts Receivable Notes Receivable Allowance for Doubtful Accounts Prepaid Insurance Expense Store Supplies Merchandise Inventory Store Equipment Accumulated Depreciation, Store Equipment Delivery Equipment Accumulated Depreciation, Delivery Equipment Trademark Accounts Payable Unearned Revenue Common Stock Retained Earnings Dividends Sales Sales Returns and Allowances Purchases $ 16,700 33,700 10,000 1,600 6,500 5,500 38,000 85,000 18,000 48,000 6,000 5,000 62,000 14,000 80,000 30,000 12,000 782,000 4,200 503,600 Purchases Returns and Allowances Purchases Discounts Transportation-In-Expenses Salaries Expense Advertising Expense Utilities Expense Repair Expense Delivery Expense Rent Expense Interest Revenue Additional Information: 1.Store supplies on hand on December 31, 2020 totalled $ 350. 2. Insurance contract was signed on May 1, 2020 for 10 months. 3. Depreciation is calculated as $ 9,000 for store equipment and $7,000 for delivery equipment for 2020. 4. The Notes Receivable Account consisted of the following promissory notes: Date of Issue Principal interest (p.a.) 12% December 15, 2020 7,500 December 15, 2020 2,500 12% Maturity Date February 1, 2021 March 15, 2021 6,900 3,700 10,800 140,000 26,400 17,000 9,100 16,700 24,000 8,000 5. Merchandise inventory on hand on December 31, 2020 totals $ 45,000. 6. The Accounts Receivable Account also includes the sub-classification of Special Accounts Receivables from dishonoured customers. During 2020, the following customers were dishonoured, and they have not paid a cent yet. Customer Name Ms. Sue Ellen Ms. Sally Fonda Date of Issue Principal January 15,2020 March 5, 2020 700 3,000 Please present the following: Interest (p.a.) a. Adjustment journalizations. b. Adjusted Trial Balance c. Balance Sheet d. Income Statement e. Retained Earnings Statements. 12% 12% Maturity Date March 15, 2020 Company decided to write-off the receivables of these customers with the Allowance Method. 7. Necessary adjustments for closing the allowance of the dishonoured customers of 2020 are to be recorded. 8. Purple Airlines Company, after signing a contract with Succi on November 1, 2020, ordered 140 purple-blue suits for the flight attendants. According to the contract, $ 14,000 of advance payment was received upon signature. Guc charged $ 200 for each suit. The first shipment to Purple Airlines was realized on December 31, 2020 as 50 suits. April 5;2020

Step by Step Solution

★★★★★

3.28 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

A Adjustment Journalizations Store supplies on hand on December 31 2020 totaled 350 Date Account Debit Credit Dec 31 Store Supplies 350 Dec 31 Store S...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started