Answered step by step

Verified Expert Solution

Question

1 Approved Answer

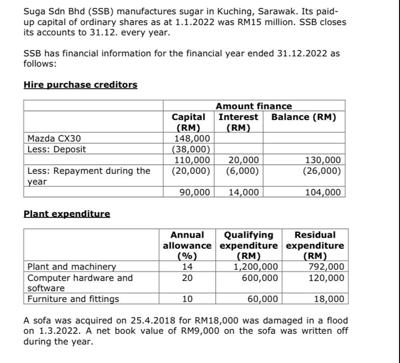

Suga Sdn Bhd (SSB) manufactures sugar in Kuching, Sarawak. Its paid- up capital of ordinary shares as at 1.1.2022 was RM15 million. SSB closes

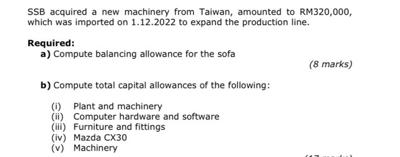

Suga Sdn Bhd (SSB) manufactures sugar in Kuching, Sarawak. Its paid- up capital of ordinary shares as at 1.1.2022 was RM15 million. SSB closes its accounts to 31.12. every year. SSB has financial information for the financial year ended 31.12.2022 as follows: Hire purchase creditors Mazda CX30 Less: Deposit Less: Repayment during the year Plant expenditure Plant and machinery Computer hardware and software Furniture and fittings Amount finance Capital Interest Balance (RM) (RM) (RM) 148,000 (38,000) 110,000 20,000 (20,000) (6,000) 90,000 14,000 130,000 (26,000) 104,000 Annual Qualifying Residual allowance expenditure expenditure (%) (RM) (RM) 14 1,200,000 20 600,000 10 60,000 792,000 120,000 18,000 A sofa was acquired on 25.4.2018 for RM18,000 was damaged in a flood on 1.3.2022. A net book value of RM9,000 on the sofa was written off during the year. SSB acquired a new machinery from Taiwan, amounted to RM320,000, which was imported on 1.12.2022 to expand the production line. Required: a) Compute balancing allowance for the sofa b) Compute total capital allowances of the following: (i) Plant and machinery (ii) Computer hardware and software (iii) Furniture and fittings (iv) Mazda CX30 (v) Machinery (8 marks) 07

Step by Step Solution

★★★★★

3.48 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

a Balancing Allowance for the Sofa Net Book Value before Flood Damage RM18000 RM9000 written off RM9...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started