Answered step by step

Verified Expert Solution

Question

1 Approved Answer

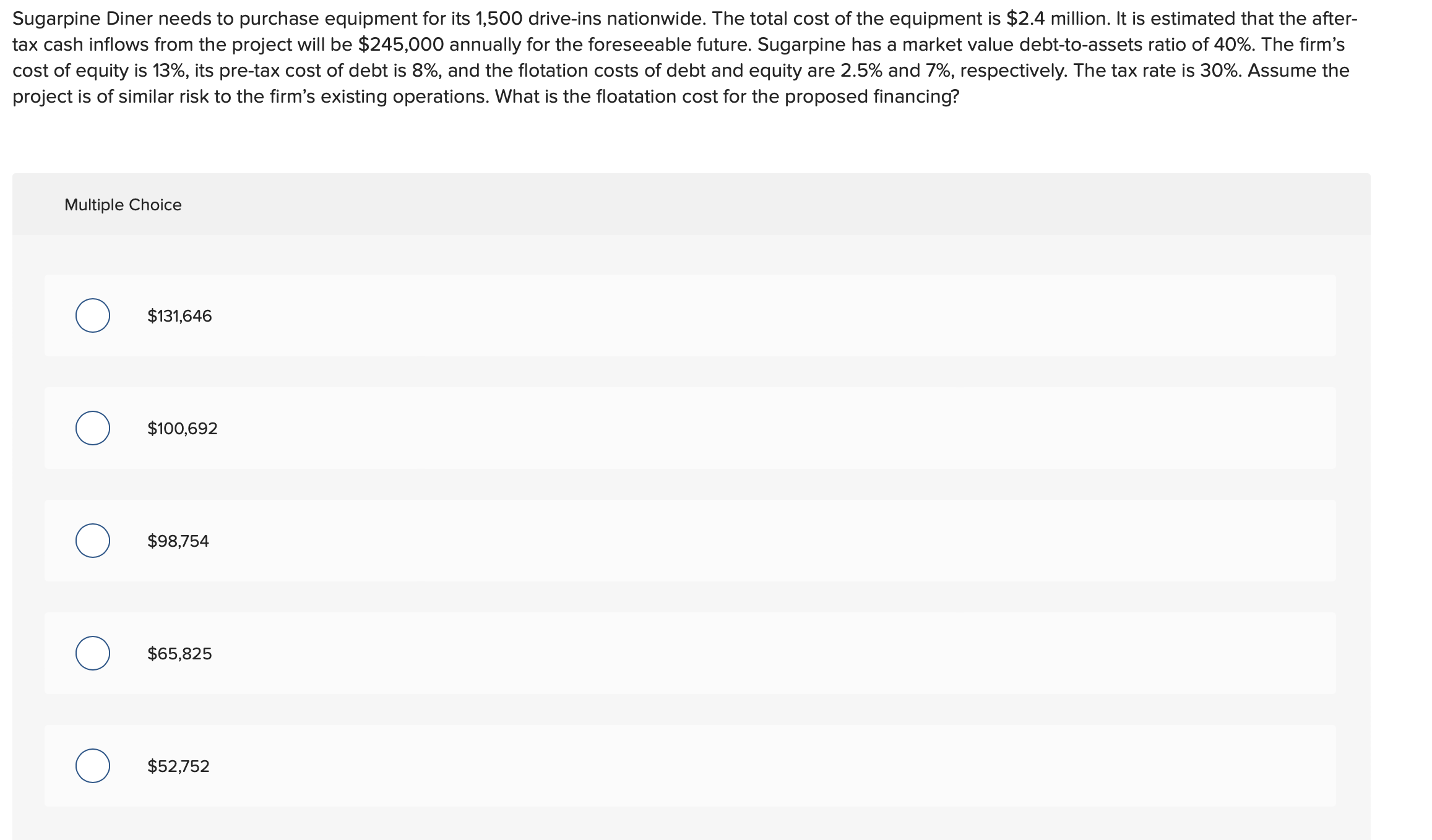

Sugarpine Diner needs to purchase equipment for its 1 , 5 0 0 drive - ins nationwide. The total cost of the equipment is $

Sugarpine Diner needs to purchase equipment for its driveins nationwide. The total cost of the equipment is $ million. It is estimated that the after

tax cash inflows from the project will be $ annually for the foreseeable future. Sugarpine has a market value debttoassets ratio of The firm's

cost of equity is its pretax cost of debt is and the flotation costs of debt and equity are and respectively. The tax rate is Assume the

project is of similar risk to the firm's existing operations. What is the floatation cost for the proposed financing?

Multiple Choice

$

$

$

$

$

can someone please help me with this managerial finance question thank you

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started